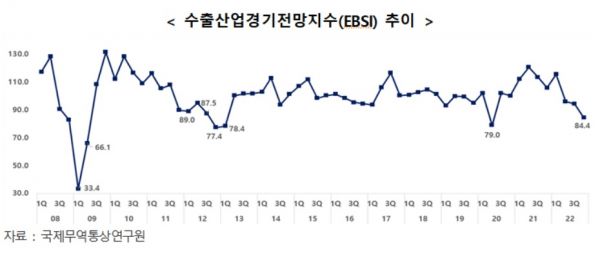

EBSI at 84.4 in Q4 This Year... Below 100 for Three Consecutive Quarters

Export Outlook Deteriorates for All Items Except Ships (149.9) and Semiconductors (112.0)

Export Industry Business Sentiment Index (EBSI) Trend. [Provided by Korea International Trade Association]

Export Industry Business Sentiment Index (EBSI) Trend. [Provided by Korea International Trade Association]

[Asia Economy Reporter Han Ye-joo] There are forecasts that the fourth-quarter exports this year will face dark clouds due to exchange rate fluctuations and economic slowdown.

The Korea International Trade Association (KITA) International Trade and Commerce Research Institute announced the '2022 4th Quarter Export Industry Business Survey Index (EBSI)' on the 5th.

EBSI is an indicator showing companies' outlook on export conditions for the next quarter. Based on 100, if companies expect improvement (deterioration) compared to the previous quarter, the value will be greater (less) than 100.

The 4th quarter EBSI was 84.4, down 10 points from the 3rd quarter (94.4). For two consecutive quarters and three consecutive quarters below 100, it shows that export companies' perceived business conditions are worsening.

KITA estimated that the decline in EBSI was contributed by rising interest rates due to intensified global inflation, increased exchange rate volatility, and worsening export profitability caused by rising raw material prices. By category, many respondents expected the export product cost (65.1), export destination countries' economy (75.2), and logistics and freight (79.3) environment to worsen further in the 4th quarter, leading to a forecasted deterioration in export profitability (85.6). By item, exports of ships (149.9) and semiconductors (112.0) were expected to improve in the 4th quarter, but export conditions for other items appeared negative.

Raw materials, oil prices, and sea freight rates by major routes showed a downward trend compared to the 3rd quarter, somewhat reducing difficulties such as rising raw material prices (25.4%) and increased logistics costs (18.0%), but these were still cited as the biggest challenges for export companies. Along with this, as inflation intensified due to the COVID-19 pandemic and the Russia-Ukraine war, the United States implemented high-intensity quantitative tightening, leading the global economy into a recession phase. Consequently, difficulties such as sluggish export destination economies (14.9%) and increased volatility in the Korean won exchange rate (14.1%) also significantly increased.

Cho Sang-hyun, head of KITA's International Trade and Commerce Research Institute, said, "The perceived business conditions of export companies are worsening due to the global economic recession," adding, "Moreover, with expanding exchange rate volatility and rising raw material import costs, and logistics difficulties not yet resolved, it will be difficult for the export economy to recover easily."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.