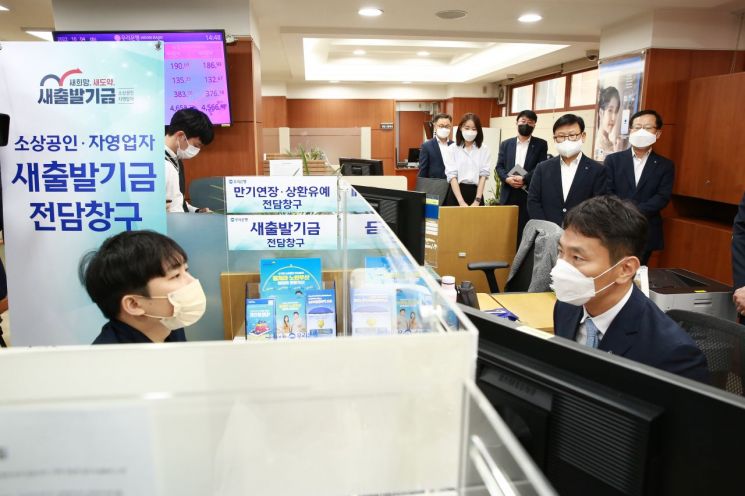

April 4 Meeting at Woori Bank Jongno 4-ga Financial Center

Director Lee: "We Also Discussed Provisions Extensively"

Lee Bok-hyun, Governor of the Financial Supervisory Service (right), is conducting financial consultations for general customers at the Woori Bank Jongno 4-ga Financial Center located in Jongno-gu, Seoul, on the 4th.

Lee Bok-hyun, Governor of the Financial Supervisory Service (right), is conducting financial consultations for general customers at the Woori Bank Jongno 4-ga Financial Center located in Jongno-gu, Seoul, on the 4th.

[Asia Economy Reporter Song Seung-seop] Lee Bok-hyun, Governor of the Financial Supervisory Service (FSS), emphasized that “there is almost no issue regarding soundness related to the maturity extension that the public is concerned about.”

Governor Lee met with reporters on the 4th after a meeting with self-employed individuals at Woori Bank Jongno 4-ga Financial Center in Jongno-gu, Seoul, and explained, “Since my inauguration, I have thoroughly and specifically examined the soundness issues in the financial sector,” adding, “We have also extensively consulted with the financial sector on the provisioning policies accordingly.” This means that although maturity extensions have been repeatedly implemented, ample provisions have been set aside to prepare for potential defaults.

This meeting was arranged for Governor Lee to encourage banks’ efforts in supporting maturity extensions and repayment deferrals and to directly listen to the difficulties faced by self-employed individuals. Previously, financial authorities decided to extend the maturity extension and interest repayment deferral measures for self-employed individuals and small and medium-sized enterprises affected by COVID-19. This extension decision marks the fifth time since it began in March 2020, raising concerns in the financial sector about increased risks due to the inability to ascertain the scale of non-performing loans.

Regarding the New Start Fund, which faced challenges such as moral hazard, he acknowledged, “We are aware of the controversies over whether to include borrowers at risk of default and the eligibility criteria,” but evaluated that “it started cautiously but smoothly by reflecting various opinions.” He added, “We are also carefully listening to detailed opinions from the financial sector and coordinating various aspects.”

Governor Lee continued, “For individuals and small business owners, the financial sector’s soft-landing plan aims to allow them to autonomously enjoy the benefits of maturity extension and repayment deferral as much as possible, and if that is not feasible, they move on to the New Start Fund as a two-track system,” and said, “Regarding the difficulties expected during the interest rate hike period until the end of this year and early next year, the government, financial authorities, financial institutions, borrowers, and companies will share the burden within their respective capacities.”

He also stated, “In any case, market principles are the most important, and we also believe that the importance of autonomous allocation through the market comes first,” but added, “Since the current situation involves abnormal simultaneous shocks of rapid changes and inflation and interest rates hitting at the same time, situation-responsive customized policies considering these factors are also necessary.”

Regarding the investigation into the actual status of solar power loans, it was confirmed that the status was compiled over the past weekend. Governor Lee said, “It is cautious to disclose numbers at this moment,” and added, “If there are signs of default risk, we will verify and, if necessary, conduct inspections in a sequential process, but at this stage, understanding the current status is the priority.”

When asked about the timing and severity of sanctions related to embezzlement at Woori Bank, he responded, “It is difficult to make a definitive statement.” He explained, “We have confirmed the details revealed during the inspection process and the related issues,” and said, “We need to make a comprehensive conclusion.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.