Rising Loan Interest and Raw Material Costs Pressure SME Financing

Small Business Owners Worried About Closing Wallets, Fear of a 'Second IMF'

Bankruptcy Risk Increases by 60,000 Small Businesses if Interest Rates Rise to 3%

[Asia Economy Reporters Kim Bo-kyung, Kim Jong-hwa, Choi Dong-hyun] Kang, who runs an elevator manufacturing company, is deeply worried about the rising loan interest rates. Having expanded various facilities with bank loans to grow from a company that only produced elevator doors to one that manufactures complete products, he is now under financial pressure as interest rates, which were in the 2% range, have recently jumped to around 6-7%. Until September last year, he paid 100 million KRW in interest monthly, but a few months ago, one bank demanded partial principal repayment, so this month he must pay 180 million KRW combining interest and principal. Kang said, "These days, even low-interest policy funds are not being supported," adding, "I have to pay the interest as required by commercial banks and postpone the loan." He is also suffering from a double burden as raw material prices rise. For example, stainless steel sheets, which are the exterior materials for elevators, were priced at 4,000 KRW per kg at the end of December last year but are now trading at 5,200 KRW in mid-this month. Kang said, "We use about 20 tons of stainless steel sheets monthly, so the cost for sheets alone has increased by 24 million KRW every month," adding, "I worry about how long we can endure like this."

Small business owners running self-employed businesses are also struggling with high interest rates. Lee, who has been operating a restaurant in Geumcheon-gu, Seoul for three years, is troubled by rising loan interest. He said, "Last year, the loan interest rate was in the 3% range, but now it has risen to around 6%, nearly doubling the variable interest loan interest," lamenting. Although he hoped sales would increase as the COVID-19 situation calmed down, he is now wrestling with high interest rates and high inflation. It has become routine to talk with regular customers about whether a 'second IMF crisis' might be coming. Lee sighed, saying, "When prices rise, the first expense people cut is probably dining out."

◆"Enduring is strength," says the SME industry... Even maturity extensions cause ‘anxiety’= The worries of small and medium-sized enterprises (SMEs) and small business owners deepen day by day. Entrepreneurs who took loans for facility investments are struggling with rising interest costs, and small business owners are anxious that consumers might close their wallets amid soaring prices. Although there were expectations that the economy might recover as the COVID-19 resurgence subsided, harsher headwinds have pushed companies to their limits. Kang said, "In the industry these days, companies that endure are considered the strong ones."

In this situation, there are opinions that loan liquidity should be eased to prevent companies from suddenly facing liquidity crises. Kim Moon-sik, director of the Busan Surface Treatment Cooperative, said, "Liquidity should be provided appropriately where companies need it as interest rates rise," adding, "Making loan conditions too strict and locking up liquidity is a big problem." He continued, "Companies suffered from the THAAD issue, struggled for three years due to COVID-19, and now face adverse factors like skyrocketing raw material prices due to the Russia war," and insisted, "Loans should not be tightened but companies should be supported until they get on a stable track."

Recently, the government extended loan maturities by up to three years and deferred repayments by up to one year for self-employed and small and medium-sized enterprises. However, the industry is well aware that such measures could become a game of 'hot potato' that might explode at any time. An official from the Korea Federation of SMEs said, "The government's fifth maturity extension decision has temporarily put out the urgent fire," but expressed concern that "the number of companies pushed to their limits during the extension period is increasing, and the fuse could blow someday."

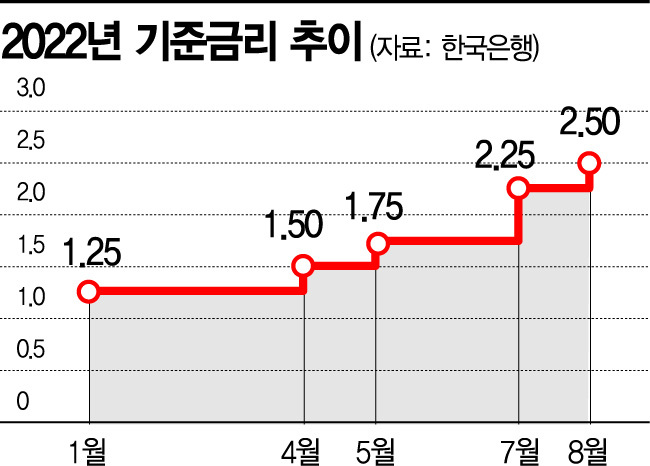

◆If interest rates rise to 3%, 60,000 small business owners face bankruptcy risk= The Bank of Korea will hold a Monetary Policy Committee meeting on the 12th to decide whether to raise the base interest rate. With the possibility of an additional rate hike increasing, a study showed that if a 'big step' to 3.0% is taken, about 60,000 small business owners could face additional bankruptcy risk.

The Small and Medium Business Research Institute released a report titled "Estimation and Implications of Insolvent Small Business Owners Due to Interest Rate Hikes" on the 28th of last month. According to the report, about 250,000 businesses experienced insolvency at least once in a quarter during the recent five years from Q2 2017 to Q1 2022, accounting for 40% of the total. In other words, 4 out of 10 small business owners experienced a state where operating profits could not even cover interest expenses at least once during their five years of operation. The problem is that they continue operating in an insolvent state by covering costs with debt. The proportion of 'marginal small business owners' who continued operating in insolvency for more than a year after entering insolvency reached 31%.

Jeong Eun-ae, a research fellow at the Small and Medium Business Research Institute who led the study, said, "Small business owners account for more than 90% of all enterprises but are more vulnerable compared to large and medium-sized companies," adding, "When insolvency occurs, its scale is very large and the ripple effect on society is also significant." She emphasized, "Since insolvency among small business owners can lead to household insolvency, it is urgent to investigate and prepare countermeasures for insolvent small business owners to proactively respond to risks." Unlike corporations, small business owners must repay all debts or have them transferred to personal debts upon closure. If small business owners burdened with debt close their businesses and fall into extreme poverty or become credit delinquents, the social burden will inevitably be large.

The report examined how the proportion of marginal small business owners changes under scenarios based on changes in two variables: interest rates and inflation. As a result, at the current base rate of 2.50%, the proportion of marginal small business owners was found to be 17.3%. If the rate is raised by a baby step to 2.75%, the proportion is estimated to increase to 17.7%, and if raised by a big step to 3%, it is expected to rise to 18.2%. Especially, at a 3% increase, about 864,000 individual businesses and 1,243,000 small business owners are estimated to face marginal situations where operating profits cannot cover debt interest for four consecutive quarters. This is an increase of about 40,000 individual businesses and 59,000 small business owners compared to when the base rate was 2.50%. Research fellow Jeong said, "It is necessary to establish a monitoring system for insolvent and marginal small business owners and prepare support criteria by type."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.