[Asia Economy Reporter Minji Lee] Nike is going through difficult times due to sluggish performance in the Chinese market and concerns over declining demand. Securities experts advised a cautious approach as cost improvements have not appeared due to increased inventory.

On the 2nd, Nike's stock price stood at $83.12. Since the beginning of the year, Nike's stock price has fallen sharply by 49.52%. This is due to the impact in the China region, concerns over reduced discretionary consumer goods demand caused by inflation, and costs related to supply chain disruptions.

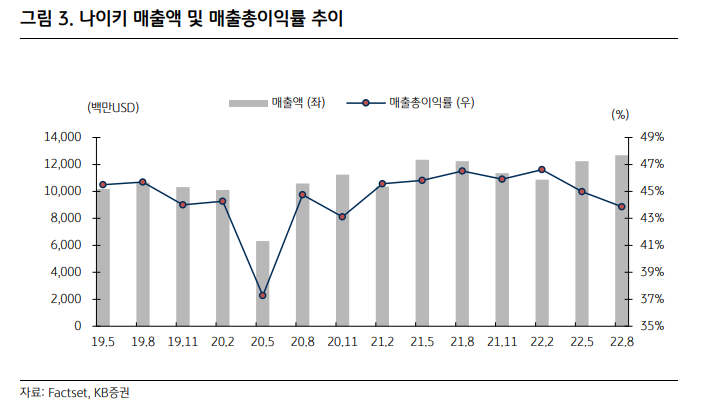

Nike recorded sales of $12.69 billion in the first quarter (June to August), a 3.6% increase compared to the same period last year. Earnings per share were $0.93, down 19.8% during the same period. Despite sales growth, margins shrank due to supply delays and high costs.

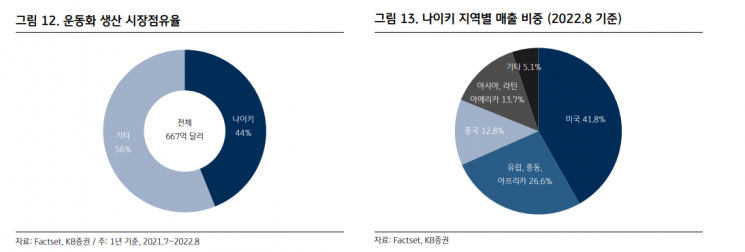

In terms of sales, Nike Direct sales grew 8% to $5.1 billion, and Nike Brand Digital grew 16%. By region, North America grew 13% during the same period, and Asia and Latin America increased by 5%. Although the China region fell by more than 16%, growth in other regions partially offset this decline.

Nike's gross profit margin for this quarter was 43.9%, down 2.64 percentage points compared to the same period last year. As the trend season passed, inventory delayed in transportation became carryover products, and additional discounts for inventory clearance had an impact. High inventory transportation management costs also contributed to the performance decline. About 65% of North America's total inventory is in transit, a characteristic following early inventory purchases made to prepare for transportation time volatility after the 15-week shutdown of the Vietnam factory last year.

KB Securities analyst Jongho Yoo said, "Inventory as of the end of the quarter was $9.7 billion, a 44% increase compared to the same period last year," adding, "Discounts for inventory clearance are expected to continue this year and will act as a margin pressure factor." The company stated that about 10% of the inventory requires rapid liquidation.

The company forecasted that second-quarter (September to November) sales would grow in the low double digits compared to the same period last year. Due to various factors causing performance deterioration, the gross profit margin is expected to decrease by about 3.5 to 4 percentage points. Annual earnings per share for this year are expected to decrease by 2.8% to $3.64 compared to last year.

Experts mentioned that for Nike's stock price to rebound, cost reduction and demand improvement must occur. Shin Ji-hyun, a researcher at Shinhan Financial Investment, said, "Compared to other apparel sectors, sportswear, which initially showed strong demand against inflation, is also not avoiding recent demand declines," adding, "The current PER level is 23.9 times, which is historically low and attractive, but in the short term, we maintain a neutral investment opinion."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.