Irrational Fear, Chaotic Market Overwhelming Price and Value

Focus on Oversold Stagflation Risk Hedge Stocks

[Asia Economy Reporter Lee Seon-ae] An analysis has been raised that the KOSPI bottom in the fourth quarter could reach 2000. Samsung Securities expects the chaotic market where irrational fear overwhelms price and value to continue, and presented the expected KOSPI band for the fourth quarter as 2000 to 2400. The stability of inflation, interest rates, and exchange rates, as well as the strengthening of policy coordination among major countries, are key to stock market stability, but it is judged to be difficult in the fourth quarter. Accordingly, portfolio restructuring is necessary, and it advised paying attention to stocks that are excessively fallen during this period and alternatives related to hedging stagflation (rising prices amid economic recession) risks.

On the 2nd, Kim Yong-gu, a researcher at Samsung Securities, analyzed, "Considering the possibility of downward support near the KOSPI 12-month forward price-earnings ratio (PER) during the extreme undershooting of the domestic stock market in the 2008 US financial crisis and the KOSPI 12-month trailing price-to-book ratio (PBR) of 0.8 times (equivalent to KOSPI 2026) during the 2020 COVID-19 pandemic, the expected lower bound of the KOSPI was set at 2000."

Regarding this, he said, "The trigger for a self-resolving solution that guarantees the stabilization of domestic and foreign financial markets and a turnaround in the stock market direction is the stability of inflation, interest rates, exchange rates, and the strengthening of policy coordination among major countries, but it is unlikely that specific changes related to this will appear during the fourth quarter," adding, "This is because there is still insufficient evidence of downward stabilization of inflation, and the Federal Reserve's (Fed) additional tightening will continue until the first quarter of next year."

Accordingly, the fourth-quarter stock market is judged to have a high probability of regaining calm and reason through ▲passing the oversold peak and spreading recognition of excessive decline and rock-bottom value ▲stabilization measures in major countries' markets ▲whether domestic and foreign third-quarter earnings season performs well ▲resumption of decline in October inflation indicators.

Despite recession forecasts and the Fed's final tightening fears, it was forecasted that signs of credit risk occurrence in the global financial market will be limited to a very minimal level. Although doubts about inflation stabilization increased due to the August Consumer Price Index (CPI) shock, it was pointed out that this is only a matter of temporary or transitional speed, not a fundamental directional issue. It was expected that the US headline CPI is likely to fall below the Fed policy rate around the first half of next year.

Researcher Kim said, "The Fed rate hike cycle may come to an end around the first quarter of next year," and added, "It is highly likely that the perception of the long-term interest rate peak will be strengthened at the estimated 4% nominal growth rate for 2023 by the September Federal Open Market Committee (FOMC)." He added, "This will be a key argument to expect a gradual easing of domestic and foreign stock market value discounts due to the strengthened perception of the long-term interest rate peak around the first quarter of next year."

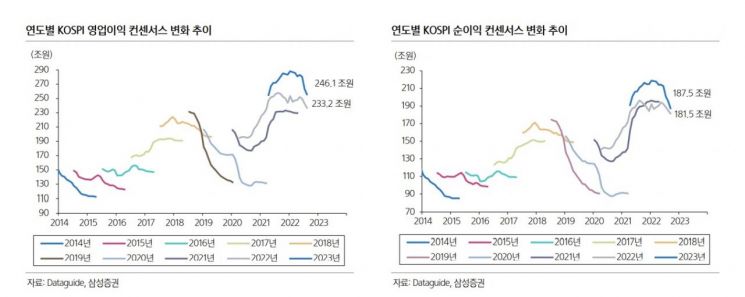

The market worries about uncontrollable earnings shocks comparable to 2008 and a return to the profit strength level before the 2021 COVID-19 special period, but it was observed that the actual extent is likely to be limited to controllable noise or risk levels. Accordingly, it was analyzed that this year's KOSPI net profit could settle in the 160 trillion won range even in the worst case.

As investment advice, it was considered more advantageous to hold rather than sell off and to buy rather than wait at the current price and value levels. In addition, it advised portfolio restructuring to counter irrational fear. This is to establish a mid- to long-term investment strategy. Researcher Kim said, "Pay attention to ▲stocks related to stagflation risk hedging with excessive decline, cyclical export sectors (electric vehicles, refining, construction), and defensive domestic sectors such as defense, media, food and beverage, distribution ▲stocks expected to surprise in third-quarter and annual earnings with excessive decline ▲high-quality stocks with excessive decline, and high-dividend stocks with excessive decline."

The top preferred stocks presented were Samsung Electronics, Samsung Biologics, SK Innovation, Hyundai Construction, KB Financial Group, Kia, LIG Nex1, LG Energy Solution, BGF Retail, and Hyundai Electric.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.