Prospects for WGBI Inclusion Next Year... Global Bond Fund Investment Criteria

Inclusion Weight Expected at 2~2.5%... 9th Largest Among Included Countries

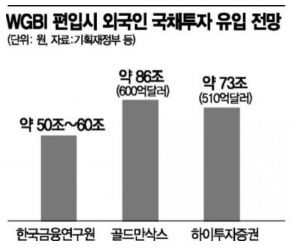

Estimated Inflow of 50 to 90 Trillion Won... Lower Issuance Rates Reduce Government Bond Interest Burden

[Asia Economy Sejong=Reporter Kwon Haeyoung, Sejong=Reporter Son Seonhee] With South Korea’s recent designation as a watchlist country for the World Government Bond Index (WGBI), it is estimated that if South Korea is officially included in the WGBI as early as next year, the inflow of foreign investment funds into government bonds could reach up to 90 trillion won. This inclusion is also expected to help resolve the 'Korea discount' on won-denominated bonds, leading to a decline in government bond issuance yields and an enhancement of the country’s stature. The market anticipates that this WGBI watchlist designation may somewhat alleviate concerns over foreign capital outflows caused by the U.S.’s aggressive monetary tightening.

According to the Ministry of Economy and Finance on the 30th, if Korean government bonds are included in the WGBI, which is composed of government bonds from 23 countries and serves as a benchmark for major global bond fund investors, the expected inclusion weight is estimated to be between 2% and 2.5%.

Based on the fact that the assets tracking the WGBI amount to 2.5 trillion dollars (approximately 3,583 trillion won), a simple calculation suggests that funds tracking Korean government bonds would be around 50 billion to 62.5 billion dollars (approximately 72 trillion to 90 trillion won). This means that foreign investment funds ranging from 72 trillion to 90 trillion won could flow into the Korean government bond market.

Previously, the Korea Institute of Finance estimated in 2020 that foreign investment funds in government bonds would amount to between 50 trillion and 60 trillion won upon Korea’s inclusion in the WGBI. Private financial firms are more optimistic. Goldman Sachs and Hi Investment & Securities forecast foreign government bond investment inflows of 60 billion dollars (about 86 trillion won) and 51 billion dollars (about 73 trillion won), respectively. However, among the top 10 countries by nominal GDP, only South Korea and India have not yet been included in the WGBI.

As the size of South Korea’s government bond market grows, the need to expand the foreign investor base through inclusion in the WGBI, known as the 'advanced country government bond club,' is increasing. The government’s issuance of government bonds surged sharply during the COVID-19 pandemic, from 101.7 trillion won in 2019 to 174.5 trillion won in 2020 and 180.5 trillion won in 2021. Foreign investors have also increased their holdings of government bonds, raising their share from 16.1% in 2019 to 16.7% in 2020 and 19.4% in 2021. For example, Malaysia saw an inflow of 2.5 billion dollars (about 3.583 trillion won) in the six months before its WGBI inclusion in July 2007, and 2.1 billion dollars (about 3.01 trillion won) in the six months after inclusion. Mexico’s foreign holdings of government bonds increased from 24% to the 30% range after its WGBI inclusion in October 2010. Additionally, increased foreign investment inflows are expected to reduce the government’s annual interest burden by around 1 trillion won due to lower bond issuance yields.

To accelerate WGBI inclusion, the government included in this year’s tax reform plan a provision to exempt foreigners (non-residents) or foreign corporations from taxes on interest and capital gains received from Korean government bonds. This measure takes into account that most countries included in the WGBI do not tax foreign investors’ government bond interest income.

A Ministry of Economy and Finance official stated, "With this WGBI watchlist designation, highly stable capital such as foreign central banks and sovereign wealth funds will enter the market, significantly stabilizing the domestic bond market. Although foreign funds are not entering immediately, we expect that confirming the fundamentals of our government bonds will lead to capital inflows and contribute considerably to exchange rate stability."

Regarding the WGBI watchlist designation, the market evaluates that it will contribute to financial market stability by driving medium- to long-term foreign investment expansion amid concerns over foreign capital outflows and sharp rises in bond yields and the won-dollar exchange rate caused by the U.S.’s aggressive tightening. However, some analysts caution that it is still too early to expect tangible financial market stabilization effects. Yoon Yeosam, head of the bond department at Meritz Securities, said, "While it is expected to psychologically help the market and reduce volatility, large-scale funds are not being deployed immediately, so it is difficult to say that bond yields will calm down right away."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.