Impact on Stock Price Following iPhone Mass Production Cancellation News

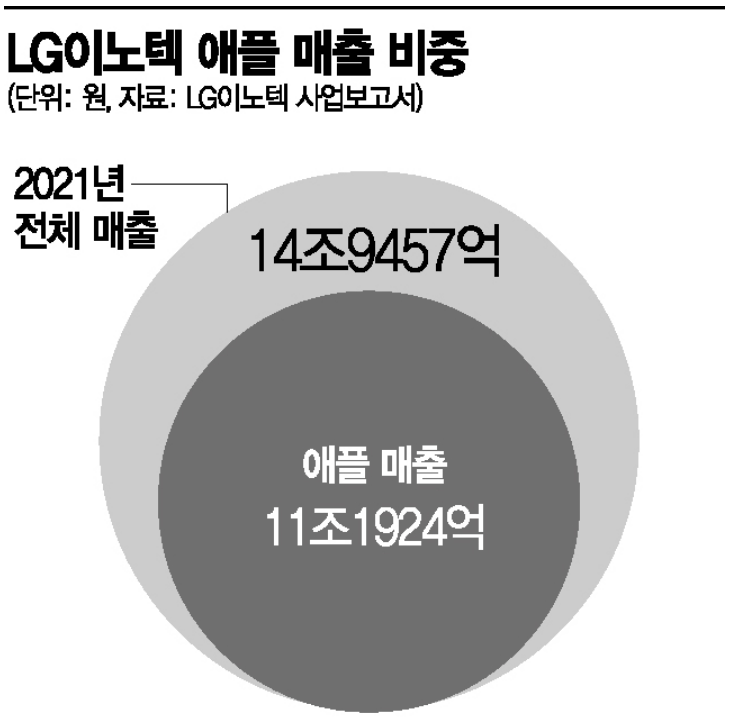

Apple Accounts for 75% of Single Sales

Challenges in Diversifying Substrate and Automotive Electronics Businesses

[Asia Economy Reporter Kim Pyeonghwa] LG Innotek, which achieved record-high performance last year thanks to Apple, is now staggering due to the 'iPhone shock.' This comes amid news that the plan to increase production of the new iPhone 14 has been canceled, raising concerns about a potential slowdown in Apple demand. The market points out that since LG Innotek's dependence on Apple reaches 75%, it must overcome its limitations through business diversification.

According to related industries and foreign media on the 30th, as Apple withdrew its plan to increase production of the new iPhone 14 series, causing fluctuations in the New York stock market, LG Innotek, a major parts supplier, has seen its stock price plunge continuously. As of 10:30 AM on the same day, LG Innotek was trading at 271,500 KRW on the KOSPI market, down 1.27% from the previous day.

LG Innotek is a representative Apple parts supplier. The proportion of Apple in LG Innotek's total sales surged to 75% (11.1924 trillion KRW) last year. In the second quarter of this year as well, the Optical Solutions division, which supplies camera modules to Apple, generated sales of 2.8035 trillion KRW, accounting for 75.72% of total sales.

LG Innotek has increased its Apple business share relying on solid iPhone demand. Apple holds a 57% market share in the premium smartphone market priced over $400 as of the second quarter this year (according to Counterpoint Research), making it the top player with a strong fan base. In a situation where smartphone technology has become standardized, Apple has competed with rivals like Samsung Electronics in camera performance over recent years, increasing demand for high-performance camera modules. As a result, LG Innotek's Apple sales ratio steadily rose from 37% in 2016 to 54% in 2017, 64% in 2019, and 68% in 2020.

The electronics industry evaluates LG Innotek's business portfolio as a double-edged sword. While LG Innotek benefits from Apple's performance, it is also vulnerable to adverse effects like this time. There are also calls for business diversification as Apple may intentionally reduce LG Innotek's share to diversify its supply chain. It is suggested that LG Innotek should strengthen its businesses in substrate materials and automotive components in addition to the Optical Solutions division.

To this end, LG Innotek is looking to expand its next-generation semiconductor substrate business, Flip Chip (FC)-Ball Grid Array (BGA). In February, it announced a 413 billion KRW investment plan for FC-BGA facilities and equipment, officially entering the market. Son Gil-dong, head of LG Innotek's Substrate Materials Division, stated at the time, "We will expand the substrate business from mobile to servers, PCs, communications, networks, digital TVs, and vehicles." Additionally, LG Innotek is focusing on the automotive sector by concretizing plans for mass production of in-vehicle radar products. Securities firms believe that if the Apple Car enters the market in the future, LG Innotek could be the biggest beneficiary.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.