Seoul Central District Prosecutors' Office Raids Shinhan and Woori Bank Branches

Over 10 Trillion Won Transferred Overseas via Banks Using Cryptocurrency

Financial Supervisory Service, Police, Prosecutors, Customs, and National Intelligence Service Investigate

Banks Say "Structure Difficult for On-Site Staff to Detect"

[Asia Economy Reporters Seungseop Song, Eunju Lee] The controversy over 'suspicious foreign exchange remittances' that erupted in the financial sector is entering a correction phase. Following the Financial Supervisory Service (FSS), various domestic and international investigative authorities with jurisdiction have each jumped into uncovering the facts. Banks are reportedly bewildered by the unexpectedly intense investigative pressure.

According to sources from the financial and legal sectors on the 30th, the International Crime Investigation Division of the Seoul Central District Prosecutors' Office (Chief Prosecutor Nauk Jin) dispatched investigators to branches of Shinhan Bank and Woori Bank yesterday morning to conduct raids and seizures. Customs officials also participated alongside the prosecution personnel during the on-site investigation. The branches raided were those that handled the suspicious foreign exchange remittance transactions recently exposed in the financial sector. The prosecution also conducted a raid on Woori Bank's headquarters in Jung-gu, Seoul, on the 21st.

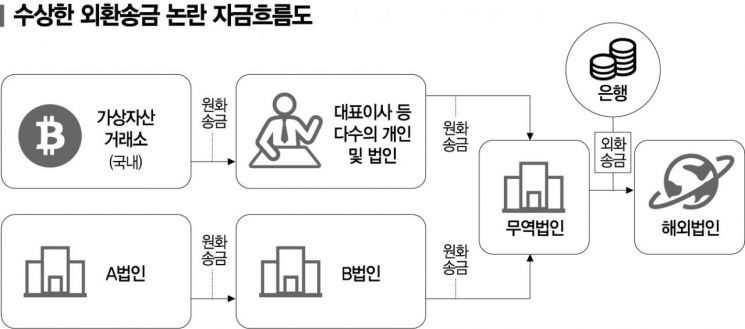

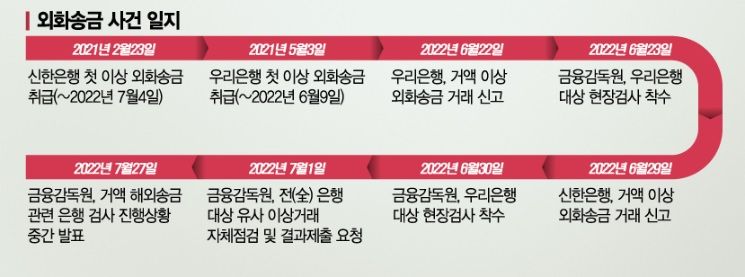

This issue came to light in June when the FSS received reports from Shinhan Bank and Woori Bank about 'large suspicious foreign exchange remittance transactions.' Funds converted into Korean won at domestic virtual asset exchanges were transferred through several banks and then moved to places like Hong Kong and Japan. The flow of funds by the companies conducting the remittances appeared suspicious, and some companies seemed to be essentially ghost companies, prompting the FSS to conduct inspections. The total foreign exchange remittance amount identified so far is $7.22 billion USD (approximately 10.1729 trillion KRW).

From Prosecution and Police to the National Intelligence Service... "Sharing Situations Closely"

This matter involves not only the FSS and financial authorities but also the police, prosecution, National Intelligence Service (NIS), Customs Service, Ministry of Justice, and the U.S. Federal Bureau of Investigation (FBI). It is rare for so many agencies to unite and simultaneously conduct inspections and investigations on a single issue. Under the common goal of uncovering the facts, investigations are being conducted according to each agency's interests.

Within the FSS, the General Banking Inspection Bureau and the Foreign Exchange Supervision Bureau are focusing on the foreign exchange remittance process. They are examining the overall scale of foreign exchange remittances, domestic fund flows, whether banks had proper internal controls related to foreign exchange remittance operations, and whether banks and their responsible employees complied with internal control regulations. However, the FSS alone has limitations in fully grasping the flow of funds. Identifying who converted virtual assets and who received money overseas is outside their scope. Lee Junsu, Deputy Governor of the FSS, explained in July, "The FSS looks at the source of domestic funds," adding, "We cannot conduct all inspections up to the virtual asset exchanges. We do not know about the exchange or transaction stages at the exchanges."

The FSS maintains a cooperative system with the prosecution and customs authorities. Unlike before, when each agency conducted individual inspections and investigations and only shared data upon request, now they proactively share relevant data when deemed necessary. On the 5th, Lee Bokhyun, Governor of the FSS, stated, "We are sharing situations very closely with related agencies such as the prosecution and customs regarding suspicious foreign exchange transactions." The prosecution, including the Daegu District Prosecutors' Office and Seoul Central District Prosecutors' Office, is investigating how trillions of won were generated and to whom the funds were directed, aiming to uncover the reality of foreign exchange arbitrage using the kimchi premium. They are also examining whether banks were negligent during the foreign exchange remittance process and whether internal employees were involved in illegal activities.

The FSS has expressed willingness to cooperate with the U.S. FBI if necessary. It is known that Minister of Justice Han Donghoon discussed cooperation measures related to virtual assets with the FBI during his U.S. trip in June. This has led to speculation in the financial sector that the suspicious foreign exchange transactions occurring in banks will be jointly investigated with the U.S. Lee Bokhyun emphasized, "If the FSS is requested to cooperate, we will do our best to assist."

The NIS has also unusually launched its own investigation. It is reported that the NIS is collecting intelligence on where the money flowed overseas using its overseas intelligence network. This has sparked rumors about illegal money laundering, overseas asset concealment, and even North Korea-related suspicions.

Banking Sector: "Difficult to Filter All Suspicious Remittances at Branch Level"

Within the banking sector, there is significant dissatisfaction that the authorities' crackdown is proceeding excessively and unreasonably. They find it hard to accept the logic that defines this issue as a problem of internal control deficiencies within banks, akin to embezzlement, and points to banks' lack of responsibility.

The authorities believe that under the Foreign Exchange Transactions Act and related laws, banks should have verified the suitability of related companies through document checks during the foreign exchange remittance and receipt processes. Previously, on the 16th, Lee Bokhyun, Governor of the FSS, said at a press conference, "If this suspicious transaction was not the first but the second or third over a long period, shouldn't a red flag have gone off at the bank by then?" He added, "We will check whether the essential provisions of the Foreign Exchange Transactions Act were violated during the foreign exchange process." This implies that banks should have at least detected the appropriateness of companies when newly established companies requested large-scale remittances. The FSS considers transactions suspicious if no actual trade is confirmed, if transactions suddenly surge, or if funds are linked to virtual asset exchanges.

However, a representative from a commercial bank argued, "In reality, it is impossible for employees working at the counters to verify the authenticity of transactions by checking the suitability of companies based on submitted documents." He continued, "At the branch level, bank employees do not have effective means or methods to verify the suitability of companies. The process is merely a repetitive administrative procedure of approving documents once submitted." This means that when a company submits invoices and documents and requests remittance, it is structurally difficult for employees to reject the remittance based solely on the large amount or unfamiliarity of the company by detecting document falsification. Given the lack of sufficient administrative infrastructure or authority to identify company falsity, banks face limitations in proactively filtering suspicious remittances.

There are also concerns inside and outside the financial authorities that the crackdown targeting banks is excessive. A financial authority official said, "The FSS was the first to drive this foreign exchange remittance issue, and there were concerns both inside and outside that it might be overextending itself." He added, "Of course, this time the foreign exchange remittance scale is excessively large and related to virtual assets, so the issue has escalated significantly. However, it is somewhat unusual that the entire financial sector cannot be seen as actively involved, yet the problem is emerging as a banking sector issue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.