Korea Federation of SMEs Announces 'October SME Economic Outlook Survey'

Economic Outlook at 86.2, Service Sector Rises by 2.5 Points

Beverages Show Largest Decline... Domestic Demand Slump Tops Business Difficulties

[Asia Economy Reporter Kim Bo-kyung] The business outlook for small and medium-sized enterprises (SMEs) has shown an upward trend for two consecutive months.

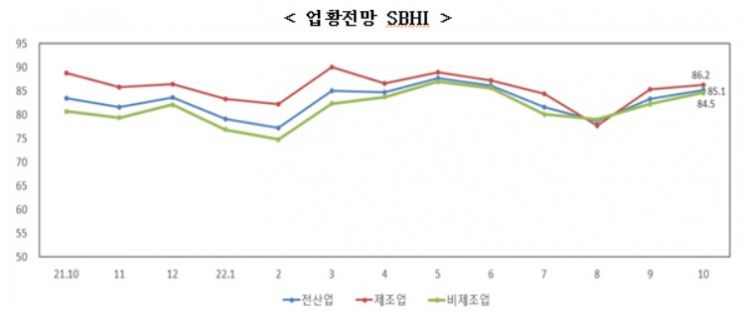

On the 29th, the Korea Federation of SMEs announced that the Small Business Health Index (SBHI) for October rose by 1.9 points from the previous month to 85.1, based on the results of the October SME Business Outlook Survey. The survey was conducted from September 15 to 22, targeting 3,150 SMEs.

The business outlook index had reached its highest point since COVID-19 at 87.6 in May, then declined for three consecutive months, but has rebounded over the past two months.

The manufacturing sector's business outlook for October was 86.2, up 1.0 point from the previous month (down 2.5 points compared to the same month last year), while the non-manufacturing sector was 84.5, up 2.3 points from the previous month (up 3.9 points year-on-year).

The construction industry (82.3) rose 2.7 points from the previous month, and the service industry (85.0) increased by 2.3 points as daily life recovery continued following the lifting of quarantine measures.

Among the 22 manufacturing industries, 14 sectors, centered on wood and wood products, textiles, and printing and recorded media reproduction, showed an increase compared to the previous month, while beverages saw the largest decline due to the end of the summer peak season.

In the service sector, six industries, including repair and other personal services, lodging, and food services, rose, whereas four industries, such as education services and arts, sports, and leisure-related services, declined.

Outlooks for domestic demand (83.0→84.9), exports (85.1→85.3), operating profit (79.3→82.7), and financial conditions (80.3→83.3) improved compared to the previous month.

The main difficulties faced by SMEs in September were domestic demand slump (56.3%), followed by rising raw material prices (48.9%), increased labor costs (45.7%), excessive competition among companies (35.7%), and rising logistics costs and transportation difficulties (27.3%).

The response rates for delayed payment collection (16.2→17.3), excessive competition among companies (35.3→35.7), and rising raw material prices (48.8→48.9) increased compared to the previous month.

The average operating rate of small and medium manufacturing firms in August 2022 was 71.8%, down 0.4 percentage points from the previous month but up 0.9 percentage points year-on-year.

A representative from the Korea Federation of SMEs stated, "Despite the expansion of uncertainties from the 'three highs' of high inflation, high interest rates, and high exchange rates, the decrease in the resurgence of COVID-19 and the recovery of consumer sentiment due to the return to daily life have positively influenced the perceived business conditions of SMEs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.