Financial Supervisory Service's '200 Financial Tips'

13,000 Bond Collection Complaints in Last 5 Years

Illegal Bond Collection Detected in Inspections

Respond to Illegal Collection by Securing Evidence

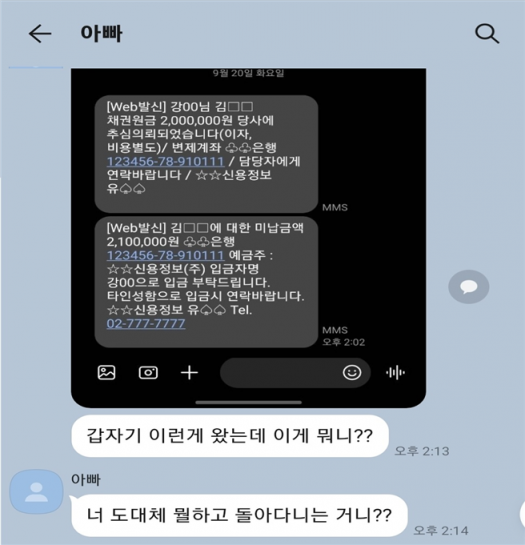

[Asia Economy Reporter Song Seung-seop] Mr. A was subjected to debt collection by a credit information company after failing to repay money to a creditor. However, the credit information company started collecting from Mr. A's father instead. As collection messages continued to be sent to his father, Mr. A found himself in a difficult situation.

Mr. B, who failed in his business after receiving liquor supplies from a liquor company, was unable to pay the amount owed. Although Mr. B barely completed the payment, two years after the full payment, he received a contact from a credit information company. At that time, the creditor sent a reminder message through the credit information company demanding payment again.

On the 29th, the Financial Supervisory Service (FSS) disclosed countermeasures against illegal acts that may occur during the debt collection process. This is because 13,542 complaints related to debt collection were filed with the FSS alone over five years since 2017, and many cases of illegal debt collection were detected during inspections.

If you have been subjected to debt collection, the first thing to do is to verify the identity of the debt collector. There are frequent cases where debt collectors impersonate courts or other government agencies, which is illegal and punishable, yet they often mislead debtors. If the debt collector does not clearly state their affiliation and name, request this information; if they do not respond or if you suspect falsehood, do not engage further and report to the FSS, police, or prosecution. It is advisable to familiarize yourself with recording and photographing functions on your mobile phone so that if illegal debt collection is suspected, you can secure evidence by recording calls and taking photos or videos.

For old debts, it is important to check whether the statute of limitations has expired. In the case of loans from financial institutions, the principal debt expires if five years have passed since the right was last exercised. If a court judgment or payment order has been finalized, an additional 10 years must pass for the statute of limitations to be completed. If the statute of limitations has expired, the debtor can refuse repayment by asserting the expiration.

Additionally, debt collectors cannot repeatedly visit or contact you at night without justifiable reasons. Repeated visits to your home or contact via phone calls or text messages without legitimate reasons can be punished as illegal collection activities. Visits or contacts between 9 p.m. and 8 a.m. are punishable regardless of frequency. Financial companies, debt collection companies, and large loan businesses under the supervision of the FSS must not contact debtors more than twice a day by phone, email, text message, or visits according to guidelines. Visits must be coordinated with the debtor in advance regarding time and date.

Securing Evidence Such as Mobile Phone Recordings and Text Message Photos Is Crucial

It is also illegal for debt collectors to visit a debtor’s workplace and inform colleagues or to notify family members of the debt, or to send mail such as postcards that reveal the debt details to third parties. If such acts occur, you should immediately request the debt collector to stop. If an incident has already occurred, record the date and details carefully, secure evidence such as statements, and then report it.

Misrepresenting legal procedures in civil or criminal matters is strictly prohibited. There have been cases where debt collectors were sanctioned for falsely indicating that legal procedures such as seizure, auction, or registration of default information had been carried out when they had not. If you receive a demand letter or text message claiming that seizure or auction has been conducted or completed, verify the facts and report with evidence if the information is inaccurate.

Debt collectors must also remember that they cannot collect debts during personal rehabilitation or bankruptcy. If debts are discharged through bankruptcy or personal rehabilitation procedures, repeated demands for repayment are prohibited. Even before discharge, if the court orders the suspension or prohibition of collection activities or if rehabilitation procedures have commenced, repeated demands for repayment are not allowed.

If the debt collector is a loan business operator, loan broker, or unregistered loan business operator (private lender), the debtor can appoint a lawyer or other representative. Once a debtor’s representative is appointed and notified in writing to the loan business operator, the operator cannot visit or contact the debtor except for justifiable reasons. Free support for debtor representatives is available through the FSS Illegal Private Finance Center.

Furthermore, when repaying debts, it is important to use corporate accounts in the creditor’s name to leave evidence, and to keep debt repayment confirmation documents, which are useful as proof in case of disputes.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.