[Asia Economy Reporter Ji Yeon-jin] Starting next month, the designation audit system for large companies with assets exceeding 2 trillion won will be changed so that the Big Four accounting firms will be exclusively responsible for designated audits.

The Financial Services Commission announced on the 29th that the 'Supplementary Measures for the Designation Audit System,' which improves the method of designating auditors for companies and accounting firms, was finalized after being approved at the Financial Services Commission meeting held on the 28th.

The designation audit system is a system where the government designates accounting firms to conduct audits of companies' financial statements. The system has been revised to reclassify the group of companies that can be audited by accounting firms with high audit quality management levels, and to reflect the results of quality control inspections and quality control evaluations in the auditor designation scores.

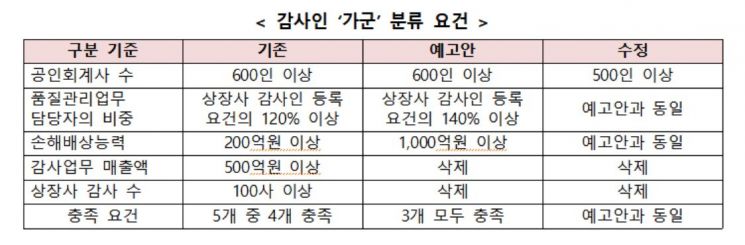

The finalized plan approved this time relaxed the entry requirements for the highest audit quality management level group, the 'Gagun,' from the previous 600 or more certified accountants to 500 or more, following opinions that the previous requirement was excessively high. Additionally, considering the difficulty of hiring quality control personnel in a short period, a six-month grace period was granted for the proportion requirements of quality control personnel in the 'Nagun' and 'Dagun' groups.

To reflect the audit quality management status of accounting firms in auditor designation, the Financial Supervisory Service adjusted the deduction rates for auditor scores according to the improvement recommendations for quality control inspection results. The previous plan had deductions of 10% for unplanned design, 5% for non-operation, and 2% for partial deficiencies, but these were revised to 2% for unplanned design, 2% for non-operation, and 1% for partial deficiencies, with a maximum deduction of up to 30% allowed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.