'Fear Index' Tracking ETF·ETN Records High Price Gains

'Gopbus' ETF Posts 16% Returns

Inverse Betting Product Trading Volume Also Increases

On the 29th, dealers were working in the dealing room of Hana Bank in Euljiro, Seoul. On this day, the KOSPI index opened at 2197.75, up 28.46 points (1.31%) from the previous trading day. The won-dollar exchange rate opened at 1424.5, down 15.4 won. Photo by Moon Honam munonam@

On the 29th, dealers were working in the dealing room of Hana Bank in Euljiro, Seoul. On this day, the KOSPI index opened at 2197.75, up 28.46 points (1.31%) from the previous trading day. The won-dollar exchange rate opened at 1424.5, down 15.4 won. Photo by Moon Honam munonam@

[Asia Economy Reporter Myung-Hwan Lee] Even amid a sharp market downturn, investors who put their money into exchange-traded products (ETPs) that profit from higher volatility were able to smile.

According to the Korea Exchange and the financial investment industry on the 29th, exchange-traded funds (ETFs) and exchange-traded notes (ETNs) tracking the Chicago Board Options Exchange (CBOE) Volatility Index (VIX), known as Wall Street’s “fear index,” showed significant price gains. The VIX represents the market’s expectation of volatility over the next 30 days for S&P 500 index options and typically moves inversely to the stock market trend. The VIX, which stood at 26.21 on August 29 (local time), closed at 30.18 on the 28th, rising 15.15% over the month.

As the index rose, ETFs based on the VIX also showed an upward trend. During this period, the price of the leveraged ETF ‘2X Long VIX Futures (UVIX),’ which tracks the VIX futures index at twice the rate, rose 20% on the New York Stock Exchange. Similarly, ‘ProShares Ultra VIX Short-Term Futures (UVXY)’ and ‘ProShares VIX Short-Term Futures (VIXY),’ which track the same index at 1.5 times and 1 times respectively, also posted gains of 15.91% and 11.14%.

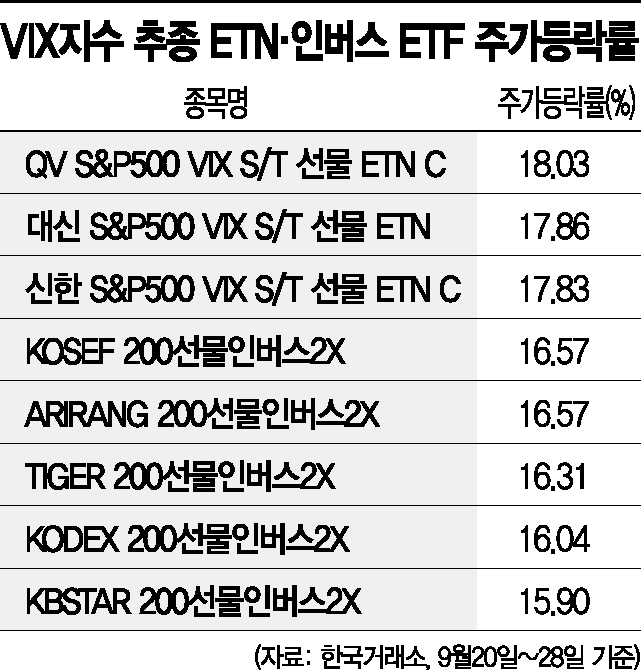

The prices of VIX-tracking ETNs listed on the domestic stock market also trended upward. Over the recent seven trading days from September 20 to 28, the average price increase of four ETNs based on the VIX futures index reached 17.03%. During the same period, the KOSPI fell by 7.91%.

Inverse ETFs, also known as ‘Gopbus (leveraged inverse)’ ETFs, which bet twice against the index, also boasted returns in the 16% range. Five products that inversely track the KOSPI 200 futures index at twice the rate consecutively ranked first through fifth in price gains during the same period.

As market volatility increased, trading volumes for these ‘inverse betting’ products also rose. It is presumed that investors chose these products as a risk-hedging tool amid the falling market. Reviewing domestic ETF trading volume trends during this period, four out of the top ten traded items were inverse ETFs. However, due to the nature of leveraged products with high volatility, the increase in trading volume may also be attributed to short-term trading demand. Among domestically listed ETNs, two products tracking the VIX futures index ranked 18th and 40th in trading volume, respectively.

However, experts advise that to profit in a declining market, it is better to use covered call products rather than inverse or VIX ETFs. This is because these products track futures indices, which can incur rollover costs during long-term investment. Rollover refers to the cost of selling the near-month futures contract at expiration and reinvesting in the next near-month contract, causing a divergence from the spot price.

Kim Hae-in, a researcher at Daishin Securities, said, “Inverse or VIX ETFs are more suitable for short-term use when a market crash is expected or hedging is necessary,” adding, “For those who want to prepare for a downturn that could come at any time, a covered call ETF that combines stock purchases with call option sales can be a better alternative.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.