American Academy of Ophthalmology Releases SB15 and SB11 Data

SB15: First Interim Results from Phase 3 Clinical Trial

SB11: Follow-up Phase 3 Results Released... Already Launched in the US

Wet Age-related Macular Degeneration, a Major Elderly Disease

Treatment Market Expected to Grow to 27 Trillion KRW by 2028

[Asia Economy Reporter Lee Chun-hee] Samsung Bioepis is accelerating the development of biosimilars (biopharmaceutical generics) to capture the wet age-related macular degeneration market, which is worth 27 trillion KRW. Under the plan to provide various treatment options, the company is leading the development of biosimilars for ophthalmic disease treatments by developing biosimilars for both major existing treatments.

Samsung Bioepis announced on the 28th that it will unveil clinical data for the ophthalmic disease treatment biosimilar 'SB15' (generic name Aflibercept) for the first time at the American Academy of Ophthalmology (AAO) annual meeting held in Chicago, USA, from the 30th of this month to the 3rd of next month (local time). It also plans to disclose two follow-up results from Phase 3 clinical trials of another ophthalmic disease biosimilar, 'SB11' (generic name Ranibizumab, marketed as Amelibu and Byooviz).

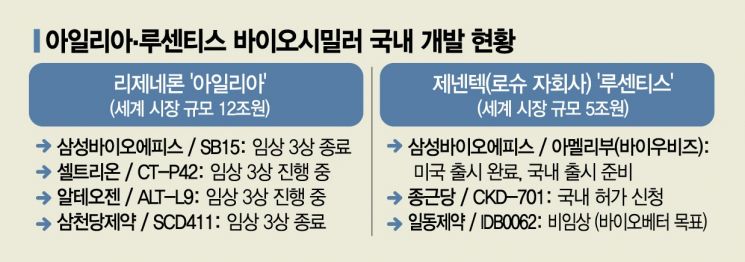

Wet age-related macular degeneration is one of the representative age-related diseases. Macular degeneration occurs when waste accumulates in the macula, the central part of the retina, causing dry macular degeneration, which then worsens into wet macular degeneration due to excessive blood vessel growth. If left untreated, it can lead to blindness, so treatment focuses on inhibiting blood vessel growth to slow disease progression. Antibody drugs such as Regeneron's 'Eylea' or Genentech's (a Roche subsidiary) 'Lucentis' are directly injected into the eye.

There is little difference in efficacy and side effects between the two products. However, unlike Lucentis, which requires monthly injections, Eylea only needs to be administered every two months after the first three months, greatly improving dosing convenience. As a result, Eylea, launched several years later, has rapidly dominated the market. Annual sales as of last year were approximately $9.4 billion (about 13 trillion KRW) for Eylea and $3.6 billion (about 5 trillion KRW) for Lucentis, showing a significant gap. Especially as the global elderly population increases, data analysis firm GlobalData estimates that the market size for wet age-related macular degeneration treatments in nine major countries including the US, Germany, Japan, China, and Australia will reach $18.7 billion (about 27 trillion KRW) by 2028.

The biosimilar SB15 for Eylea, which recently completed Phase 3 clinical trials, will have its related data disclosed for the first time at this AAO meeting. The data to be released is an interim analysis result at 32 weeks out of the total 52-week Phase 3 trial. From June 2020 to March of this year, Samsung Bioepis conducted a global clinical trial involving 449 patients with neovascular age-related macular degeneration (nAMD) across 10 countries including Korea and the US, comparing efficacy, safety, and immunogenicity with Eylea. The primary endpoint was the change in best-corrected visual acuity (BCVA) from baseline at 8 weeks after treatment.

According to the abstract submitted by Samsung Bioepis, the BCVA improvement was 6.7 letters for SB15 and 6.6 letters for the original drug compared to baseline vision. The difference between the two groups met the pre-defined equivalence criteria. Additionally, secondary endpoints including safety, immunogenicity, and pharmacokinetic characteristics were also equivalent between the two treatment groups.

Samsung Bioepis will also disclose two post-hoc analysis results from the Phase 3 clinical trial of the Lucentis biosimilar SB11 at this AAO meeting. This further demonstrates the clinical equivalence between SB11 and Lucentis. SB11 was the first Lucentis biosimilar to receive marketing approval in Europe in August last year, the US in September, and Korea in May this year. Product sales began in June through partner Biogen.

A Samsung Bioepis representative said, “Through the presentation of these research results, we have once again demonstrated our capabilities in biopharmaceutical development. We will continue to expand treatment opportunities with our products and strive to grow as a leading company in the ophthalmic disease treatment biosimilar industry.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)