New Office Supply Focused on CBD from 2024

Mixed Remote and Office Work... "Office Changes Expected"

[Asia Economy Reporter Noh Kyung-jo] The average vacancy rate of Grade A office markets in Seoul's three major business districts has reached its lowest level since the 2008 financial crisis. New office supply is expected to become visible from 2024, further strengthening the landlord-favored market trend until then.

According to the '2022 Seoul Commercial Real Estate Market Mid-Year Review' report recently published by global real estate services firm CBRE Korea on the 27th, the average vacancy rate of Grade A office markets in Seoul's three major business districts in the first half of this year was 2.1%.

The report stated, "Due to the shortage of leasable office space, Seoul's Grade A office market is solidifying as a landlord-favored market," and added, "With no additional supply expected until the end of the year, the vacancy rate forecast for this year has been significantly revised downward from 5.0% in January to 1.5%."

New offices are scheduled to be most concentrated in the central business district (CBD) among the three major districts from 2024 onwards. This is because partial construction has begun on the redevelopment of office and mixed-use facilities in Jung-gu Chodong and Jongno-gu Sewoon Redevelopment Promotion District. The report noted, "The completion timeline has been adjusted, moving the 181,421㎡ scale from 2025 to 2024," and added, "This is expected to partially alleviate the future market supply shortage."

Additionally, new offices are expected to be supplied after 2025 in redevelopment areas such as Jung-gu Bongnae-dong 2-ga and Euljiro 3-ga, as well as in Gangnam (GBC). The Millennium Hilton, northern Seoul Station redevelopment, Lotte Chilsung site, and Seoripul complex are currently in the planning stage, and their future supply will depend on permits and construction commencement.

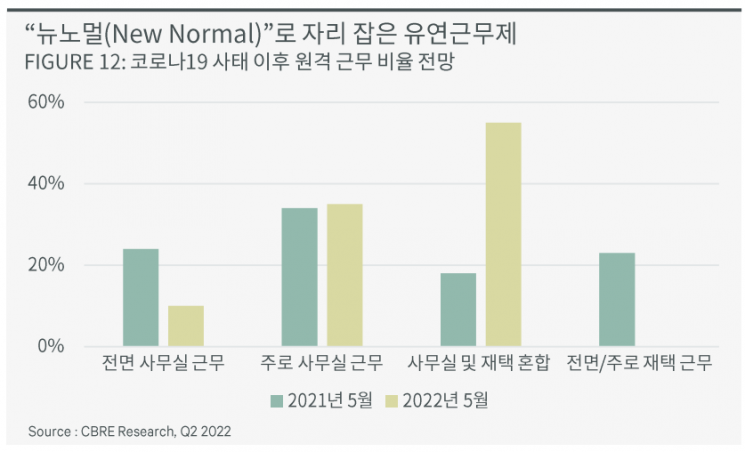

Since COVID-19, flexible work arrangements have become the 'New Normal,' and the role and physical landscape of offices are expected to change. In this year's CBRE office tenant survey, the proportion of companies expecting to continue using flexible work arrangements after COVID-19 rose from 42% last year to 55%.

Companies have introduced and expanded flexible work arrangements over the past two years in line with government policies. The report stated, "Now, as we enter the endemic phase, companies are adjusting the proportion of remote work," and added, "Going forward, offices will gradually transform into active activity-based work environments and spaces specialized for meetings, tailored to employees' work characteristics."

It further noted, "While maintaining the necessity and efficiency of face-to-face work for collaboration, hybrid work environments combining remote work will expand as the new standard."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)