Applied for Small and Medium Fintech Innovative Financial Services but Received Only "Designation Not Possible" Response After 1 Year

"When Will the Financial Services Commission Respond?"... Fintech Companies Submitted Applications Three Times in 2 Years

Yoon Chang-hyun's Office Audit Data

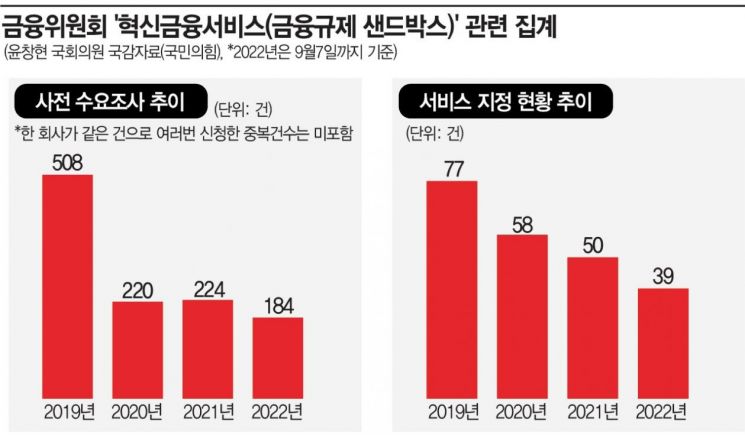

Total 1,136 Cases in 3 Years 9 Months of Preliminary Demand Survey, Only 20% Passed

This Year, Small and Medium Fintechs Wiped Out

Innovative Financial Services Become a "Large Corporation League"

"It took a year after applying for preliminary demand to be designated as an 'Innovative Financial Service (Financial Regulation Sandbox)' to receive the four-word notification 'Designation Not Possible.'"

This is the lament of the CEO of fintech startup Company A, who requested anonymity due to concerns about the Financial Services Commission's attitude. When asked about the reason out of frustration, the Financial Services Commission only gave a brief response of 'lack of innovation.'

The CEO of Company A said, "For startups, quick decisions and execution are crucial, but being told to wait silently for months or even years is like being told not to do business. If only there had been a detailed explanation for the designation denial, it would have been bearable, but there was none, which is heartbreaking." Company B faced a similar situation and ultimately decided to change its business direction. Company C, which submitted revised preliminary demand applications three times in the past two years, also has not received any meaningful response from the Financial Services Commission.

Turned into a League for Large Corporations Only... A Needle's Eye for Small and Medium Fintechs

The Innovative Financial Service initiative by the Financial Services Commission, which started to promote the development of small and medium fintech companies, has become a 'needle's eye' for these small and medium fintech firms. This year, it has completely turned into a 'league for large corporations only.' The number of designations has decreased every year, making the purpose of the system meaningless.

"For us, who must start business only with government approval, designation as an Innovative Financial Service is a matter of life and death. Cases of delayed review without feedback for months have increased, worsening difficulties during the investment winter," say small fintech companies. This was the reason why companies poured requests to "activate the regulatory sandbox" at the meeting between financial authorities and small-to-medium fintech firms held on the 27th.

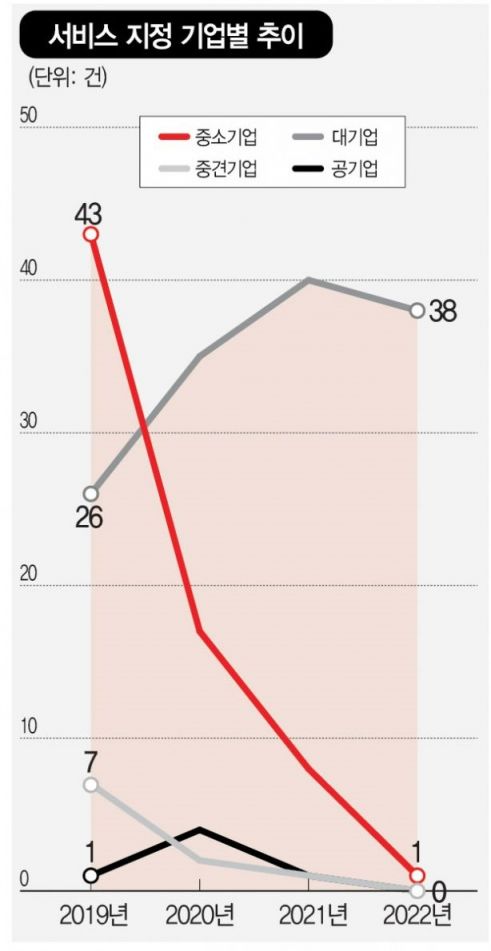

According to National Assembly member Yoon Chang-hyun of the People Power Party, based on data received from the Financial Services Commission for the audit on the 29th, only one small or medium enterprise, Musicow, was designated as an Innovative Financial Service from January this year to September 7. In contrast, large corporations such as Samsung Securities, Mirae Asset Securities, KB Kookmin Card, and Shinhan Card had 38 designations.

Considering that last year, small and medium enterprises had 8 designations and large corporations had 40, small and medium fintechs are practically wiped out this year. In the first year of the Innovative Financial Service in 2019, small and medium enterprises (43 cases) outnumbered large corporations (26 cases). Compared to then, the gap has widened even more.

The number of Innovative Financial Service designations is also decreasing. From January 2019 to September 2022, a total of 224 cases were recorded. The trend shows 77 cases in 2019 → 58 in 2020 → 50 in 2021 → 39 cases from January to September this year.

Small-Scale Fintechs Blocked at Preliminary Demand Survey Stage... Unable to Even Receive Review

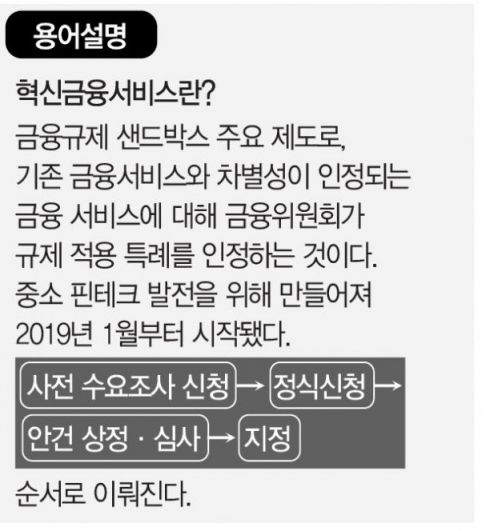

Despite challenging conditions, small fintech companies that apply for Innovative Financial Service are increasingly noticeable for not only failing to be designated but also not even making it to the review table. The Financial Services Commission's Innovative Financial Service designation process consists of four stages ('Demand Survey Application → Formal Application → Agenda Submission & Review → Designation'). These companies fail to progress beyond the first stage, the demand survey application. Most are filtered out at the preliminary demand survey stage with the label 'lack of innovation.'

The Financial Services Commission has received a total of 1,136 preliminary demand survey applications so far (508 in 2019 → 220 in 2020 → 224 in 2021 → 184 from January to September this year). A simple calculation suggests about 20% of these were designated. However, the preliminary demand survey data submitted to the assembly office by the Financial Services Commission did not include multiple applications by the same company over months or years with the same content. The total number of applications is expected to be higher, meaning the designation rate could be even lower.

Attorney Kang Hyun-gu of Law Firm Gwangjang said, "Although the Special Act on Financial Innovation Support does not have a provision for preliminary review, the financial authorities conduct substantive preliminary reviews at the demand survey stage," adding, "In this process, there are cases where individual companies are advised to cancel their applications or, in sensitive matters, review committees are not convened."

Assemblyman Yoon Chang-hyun: 'Fast Track' Should Be Applied to Small and Medium Fintechs

Even among companies designated as Innovative Financial Services, the most common duration from start to designation exceeded four months. Of the 211 cases designated so far (from January 2019 to the end of August this year), 55 cases took more than 120 days, followed by 46 cases taking 31?60 days, and 41 cases taking 61?90 days.

Assemblyman Yoon said, "Both the number of demand survey applications and designations for financial innovation services are decreasing," adding, "The review threshold should be lowered and processed swiftly to support more innovative services entering the market." He continued, "While Innovative Financial Services were mainly operated for small and medium enterprises in the first year of implementation, recently they have become concentrated on large corporations. It is time to consider applying a 'fast track' for fintech to revitalize small and medium enterprises."

Meanwhile, the Financial Services Commission announced last month that it will form an 'Innovative Financial Expert Support Group' to strengthen support for small and prospective fintech companies. A Financial Services Commission official said, "We will enhance expertise and provide data, analytical tools, and mentoring so that anyone can test the business feasibility of their ideas whenever needed," adding, "We will assign a person in charge for each fintech operator to provide close support going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.