Bank of Korea Financial Stability Report

Household and Corporate Debt at End of Q2 Hits Record High of 2.2 Times GDP

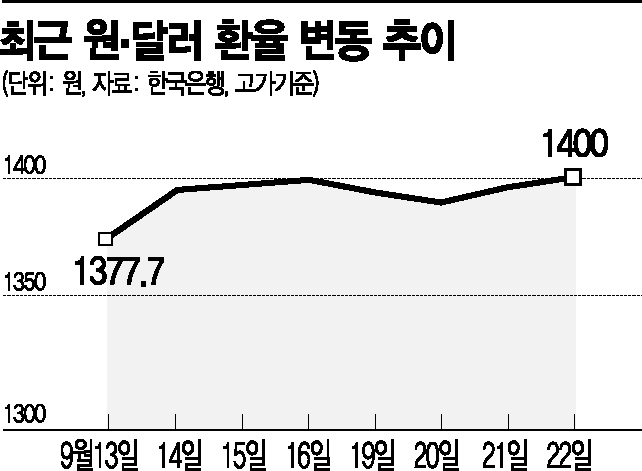

On the 22nd, when the won-dollar exchange rate surpassed 1,400 won for the first time in 13 years and 6 months, dealers were working in the dealing room of Hana Bank in Euljiro, Seoul. Photo by Mun Ho-nam munonam@

On the 22nd, when the won-dollar exchange rate surpassed 1,400 won for the first time in 13 years and 6 months, dealers were working in the dealing room of Hana Bank in Euljiro, Seoul. Photo by Mun Ho-nam munonam@

[Asia Economy Reporter Seo So-jeong] As uncertainties both domestically and internationally increase due to the strengthening trend of interest rate hikes by major countries, South Korea's Financial Stress Index (FSI) is on the verge of entering the 'crisis' stage.

According to the "Financial Stability Report" released by the Bank of Korea on the 22nd, the FSI, a composite index calculated by standardizing 20 monthly indicators related to real and financial sectors of financial stability, stood at 17.6 last month, gradually approaching the crisis stage (22 or above).

The FSI has remained in the 'caution' stage (8 or above but below 22) for six consecutive months?recording 8.8 in March this year, then 10.8 in April, 13.3 in May, 15.9 in June, 18.8 in July, and 17.6 in August?showing an overall upward trend.

However, the domestic financial system has maintained a sound condition based on reduced financial imbalance risks and the resilience of financial institutions, with the Financial Vulnerability Index (FVI) recording 48.3 in the second quarter, down from 52.3 in the first quarter. Nevertheless, this still exceeds the long-term average (average from Q4 1994 to Q2 2022) of 40.

The Bank of Korea evaluated, "The recent contrasting movements in financial stability indicators reflect that as the accumulated financial imbalances are reduced due to rising interest rates, volatility in financial markets is temporarily increasing."

Additionally, with the slowdown in private credit growth, the ratio of private credit (sum of household and corporate debt in the flow of funds statistics) to nominal Gross Domestic Product (GDP) at the end of the second quarter rose by 0.3 percentage points from 220.9% in the first quarter to 221.2%, setting a new record high.

The household credit ratio to GDP in the second quarter was 104.6%, down from 105.5% in the first quarter, but the corporate credit ratio increased to 116.6% from 115.3% in the first quarter. The corporate loan growth rate also rose to 15.5% in the second quarter from 14.7% in the first quarter.

The Bank of Korea explained, "Corporate loans increased due to demand for facility and working capital loans from companies and financial institutions' efforts to handle corporate loans."

Furthermore, the Bank of Korea identified high domestic and international inflationary pressures, the policy rate hike trend in major countries such as the United States, and related domestic and international uncertainties as major risks to financial safety. Rising raw material prices, worsening of the Ukraine crisis, economic slowdown in China, and the end of COVID-19-related financial support measures could trigger financial system instability.

The Bank of Korea stated in the report, "In a situation where private debt levels are high, inflationary pressures and the resulting interest rate increases burden borrowers' debt repayment capacity and may also increase financial market volatility. Considering that overseas alternative investments have expanded mainly among non-bank financial institutions and the proportion of short-term foreign currency borrowings has increased, the impact of external shocks such as changes in major countries' monetary policies on South Korea's financial system has become even greater."

It added, "In the ongoing process of policy efforts to curb private credit growth and stabilize asset prices, qualitative structural improvements in household debt should be pursued alongside selective support for vulnerable groups. Strengthening and reorganizing financial institutions' response capabilities related to high-yield, high-risk asset investments are also necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)