[Asia Economy Reporter Seo So-jeong] Thanks to the surge in online shopping and other activities in the first half of this year, the daily transaction amount of electronic payment gateway (PG) services exceeded 1 trillion KRW for the first time. With the activation of non-face-to-face transactions after COVID-19, the daily transaction amount of prepaid electronic payment services also surpassed 800 billion KRW.

According to the "Status of Electronic Payment Service Usage in the First Half of 2022" announced by the Bank of Korea on the 21st, the usage performance of electronic payment gateway services provided by electronic financial companies and financial institutions recorded 23.21 million transactions and 1.0209 trillion KRW, increasing by 3.1% and 8.0% respectively compared to the previous period.

Electronic payment gateway services are services that transmit and receive payment information or mediate and settle payments so that the payment from the buyer in e-commerce can be ultimately paid to the seller.

The Bank of Korea explained, "According to Statistics Korea, the average daily transaction amount of online shopping in the first half of this year increased by 3.8% compared to the previous period. Due to the surge in non-face-to-face transactions caused by COVID-19, online shopping increased, leading to an increase in the usage performance of electronic payment gateway services."

The average daily usage of prepaid electronic payment services also increased by 4.4% and 13.5% compared to the previous period, recording 26.48 million transactions and 801.7 billion KRW. Prepaid electronic payment services are services that issue and manage prepaid funds so that users can pay transportation fees, commercial transaction amounts, or remit money using prepaid funds charged in advance.

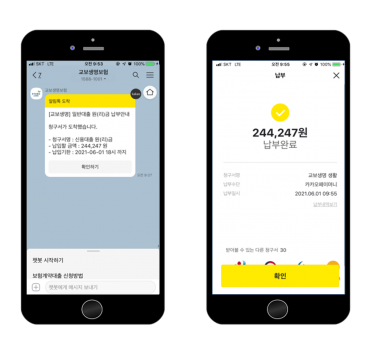

In particular, as financial transactions using mobile devices are preferred, the simple payment and remittance performance of electronic financial companies continued a steady growth trend.

Simple payment services, such as KakaoPay, use simple authentication methods like passwords and fingerprints for payment. The average daily usage in the first half of this year recorded 23.17 million transactions and 723.2 billion KRW, increasing by 8.3% and 10.7% respectively compared to the previous period.

Simple remittance services, such as Toss, recorded 4.91 million transactions and 602.4 billion KRW, increasing by 6.9% and 14.3% respectively compared to the previous period.

The average daily usage of escrow services was 3.19 million transactions and 156.9 billion KRW. While the number of transactions slightly decreased by 1.9% compared to the previous period, the transaction amount remained at a similar level. Escrow services are services that receive payments from buyers in e-commerce, verify whether the transaction was properly conducted through the confirmation process of goods receipt, and then pay the purchase amount to the seller.

The average daily usage of electronic billing and payment services, which issue bills such as apartment management fees and electricity/gas charges electronically via email or apps and directly collect and settle payments, recorded 240,000 transactions and 44.9 billion KRW, increasing by 5.1% and 15.0% respectively compared to the previous period.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.