[Asia Economy Reporter Bu Aeri] Internet-only banks are competing to lower jeonse loan interest rates. Since June, KakaoBank and K Bank have reduced jeonse loan interest rates from once a month to up to three times a month, lowering them to the lowest levels among commercial banks.

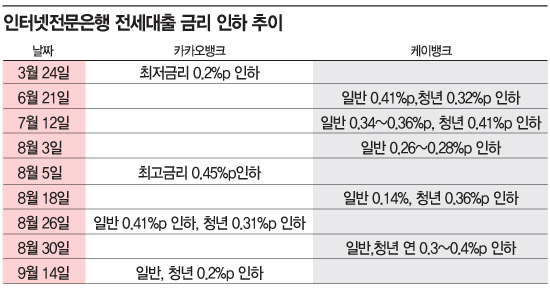

According to the financial sector on the 21st, KakaoBank and K Bank have lowered jeonse loan interest rates nine times this year alone. The two companies are competitively lowering rates alternately. KakaoBank opened the door on March 24 by lowering the minimum interest rate on general monthly jeonse deposit loans by 0.2 percentage points (P). Since then, K Bank officially started the competition by lowering the general jeonse loan interest rate by 0.41%P per annum and the youth jeonse loan interest rate by 0.32%P in June.

K Bank lowered the jeonse loan interest rates by 0.34~0.36%P per annum (youth 0.41%P) in July, and on the 3rd of last month, it further reduced the rates by 0.26~0.28%P. After K Bank lowered rates twice, KakaoBank also lowered the maximum interest rate on monthly jeonse deposit loans by 0.45%P two days later on the 5th of last month. Two weeks later, on the 18th of last month, K Bank lowered the jeonse loan interest rate by 0.14%P (youth 0.36%P), and seeing this, KakaoBank again lowered the monthly jeonse deposit loan interest rate by 0.41%P and the youth monthly jeonse deposit loan interest rate by 0.31%P on the 26th of last month. K Bank lowered the general and youth jeonse loan interest rates by 0.3~0.4%P again on the 30th of last month.

This competitive structure continues through September. KakaoBank announced on the 19th that it would lower the interest rate on monthly jeonse deposit loan products by 0.2%P. As the two banks compete to lower jeonse interest rates, they have dropped to the lowest levels among commercial banks. The upper limit of jeonse loan interest rates at internet-only banks has widened the gap with commercial banks by up to 1.6%P. KakaoBank's monthly jeonse deposit loan interest rates (based on 6-month COFIX) currently range from 3.593% to 4.416%, and K Bank's range is 3.57% to 4.71%. The jeonse loan interest rates of KB Kookmin, Shinhan, Hana, and Woori Banks range from 3.84% to 6.11%.

Internet-only banks are lowering jeonse loan interest rates like this as a strategy to expand their loan portfolios, which have been mainly operated with unsecured loans. In the case of KakaoBank, it has set a goal to raise the proportion of mortgage loans and monthly jeonse deposit secured loans, which currently stand at about 45.6% (as of the end of last month), to over 70% within 3 to 4 years. A representative of an internet-only bank said, "In the case of jeonse loans, the amount is larger than unsecured loans, and since there is collateral, banks have the advantage of being able to manage funds stably."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)