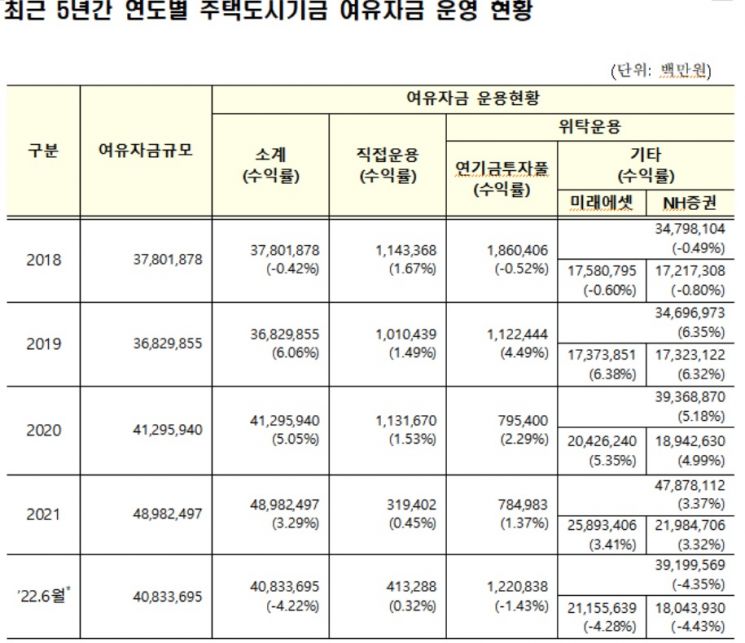

Surplus Fund Yield: 6.06% in 2019 → 5.05% in 2020 → 3.29% in 2021 → -4.22% in June This Year

[Asia Economy Reporter Oh Ju-yeon] The Housing and Urban Fund recorded a 4% loss in operating its surplus funds in the first half of this year. This is the first time since 2018 that the operating yield has been negative in four years.

According to data received on the 15th from the Ministry of Land, Infrastructure and Transport by the office of Kim Byung-wook, a member of the National Assembly Land, Infrastructure and Transport Committee from the Democratic Party of Korea, as of June this year, the Housing and Urban Fund's surplus funds amounted to 40.8337 trillion won, recording a yield of -4.22% during this period.

Source=Office of Kim Byung-wook, Democratic Party of Korea, Ministry of Land, Infrastructure and Transport

Source=Office of Kim Byung-wook, Democratic Party of Korea, Ministry of Land, Infrastructure and Transport

The Housing and Urban Fund raises funds through national housing bonds, subscription savings, loan repayments, and loan interest income, and uses them for purposes such as constructing rental housing and providing loans for home purchase and jeonse deposits. Considering future cash flow situations, surplus funds are managed within a secured range of stability to generate returns. Over the past five years, the surplus funds of the Housing and Urban Fund increased from 37.8019 trillion won in 2018 to 36.83 trillion won in 2019, and 41.2959 trillion won in 2020. By the end of last year, it reached 48.9825 trillion won, nearly a 30% increase compared to 2018. The Housing and Urban Fund manages these surplus funds either directly or through entrusted management. The operating yield recorded 6.06% in 2019, followed by 5.05% in 2020 and 3.29% in 2021, generating profits for three consecutive years. However, this year, the yield turned negative through the first half, raising concerns about losses for the full year.

The Housing and Urban Fund is characterized by prioritizing 'stability' over other funds. Looking at the portfolio, long- to medium-term assets account for more than 95% of the total, with domestic bonds making up over 70% of that. Domestic stocks and foreign stocks are allocated at around 6% and 8%, respectively. The asset management guidelines explicitly state that management is conducted according to the principle of 'stability > liquidity > public interest > profitability.' Thanks to this pursuit of stability, it performed better than the National Pension Service, which has a high proportion of domestic and foreign stocks and recorded a -8.00% yield in the first half of this year, but the Housing and Urban Fund also could not avoid investment losses.

In the first half of this year, about 10% of the Housing and Urban Fund's surplus funds, 413 billion won, were managed directly (yield 0.32%), while the remaining 90% were entrusted to pension funds and dedicated management institutions. The investment losses occurred in these entrusted operations. The 1.22 trillion won entrusted to pension funds recorded a yield of -1.43%, and the 39.2 trillion won entrusted to Mirae Asset Management and NH Investment & Securities recorded losses with yields of -4.28% at Mirae Asset (21.1156 trillion won) and -4.43% at NH Investment & Securities (18.044 trillion won), respectively.

A Ministry of Land, Infrastructure and Transport official explained, "Due to recent domestic and international interest rate hikes and the Ukraine crisis, international political conditions have become unstable, causing most pension fund yields to decline."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)