Investor Deposits Decrease to 51 Trillion Won on the 13th

Lowest Level Since September 2020

Sharp Decline Continues This Month, Possible Drop Below 50 Trillion Won

Trading Volume and Market Capitalization Turnover Also Significantly Decrease

[Asia Economy Reporter Ji Yeon-jin] Investor deposits have fallen to the 50 trillion won level. Investor deposits refer to the funds that investors have placed in securities firms' accounts, and this is the lowest level since the Donghak Ant Movement ignited on September 3, 2020.

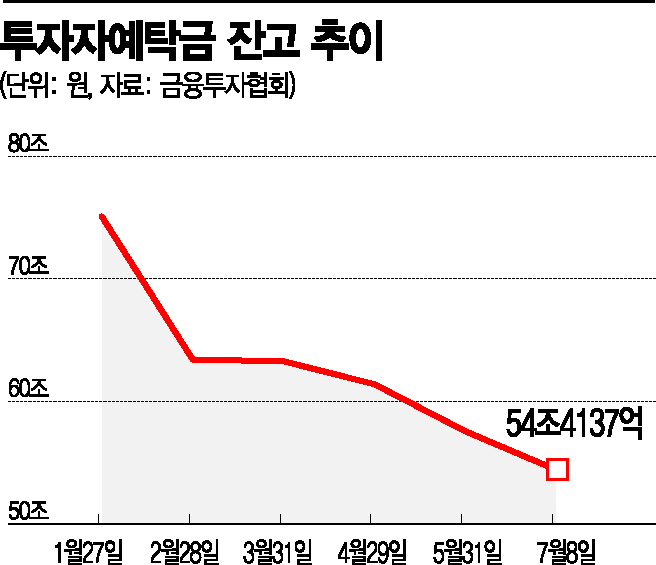

According to the Korea Financial Investment Association on the 15th, investor deposits have continued to decline this month, shrinking to 51.3434 trillion won as of the 13th. Deposits, which exceeded 71 trillion won at the first trading day of this year, have decreased by about 20 trillion won.

Investor deposits, which hovered around 30 trillion won until early 2020 before the COVID-19 pandemic, increased significantly after the market crash in March of the same year, fueled by the Donghak Ant Movement. After the KOSPI index surpassed 3,000 and headed toward its peak (3,305.21 on July 6, 2021), deposits swelled to 77.9018 trillion won on May 3 last year. However, with the U.S. tightening monetary policy in full swing this year, deposits have been rapidly decreasing. The decline in deposits has accelerated this month amid the sharp rise in the won-dollar exchange rate, raising the possibility that deposits could fall below 50 trillion won if this trend continues.

U.S. inflation, which has pressured the stock market since the beginning of the year, remains ongoing. Additionally, Russia, engaged in war with Ukraine, has cut gas supplies to Europe, causing an energy crisis and increasing concerns about a global economic recession, which may lead investors to shift funds to safe assets. According to SK Securities, the average daily trading volume in the stock market this month has been about 15.4 trillion won, the lowest since January 2020, just before the COVID-19 outbreak. Stock market trading volume surged sharply after the COVID-19 pandemic began, reaching an average daily 47.8 trillion won in January 2021, but has been on a continuous decline since then.

Market capitalization turnover has also plummeted. Market capitalization turnover is calculated by dividing the trading volume during a period by the average market capitalization. A lower turnover rate indicates less active trading. The turnover rate averaged 286% last year but dropped to 164% this month. This figure is even below the 20-year average (195%). This suggests that investors who suffered losses have exited the stock market.

The KOSPI index has fallen about 20% so far this year until the day before yesterday. The index plunged to the 2,200 level in early July but managed to rebound; however, volatility has increased again this month. This is due to the U.S. August Consumer Price Index (CPI) exceeding expectations, raising the possibility that the Federal Reserve (Fed) might implement an 'ultra step' by raising the benchmark interest rate by 1 percentage point this month.

However, the sharp decline in deposits this month also appears to reflect individual investors buying at low prices. Individual investors have net purchased about 3.3858 trillion won in the domestic stock market from the beginning of this month through the 13th. Lee Kyung-soo, head of the investment strategy team at Daishin Securities, explained, "There are various reasons for the decrease in customer deposits, but the main factors are the poor stock index performance, rising interest rates, and increased attractiveness of overseas markets. Simply put, individual investors who were 'stuck' at high prices have cut losses and gradually exited the stock market, or they are depleting deposits by buying at low prices (averaging down)."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.