US Strengthens Domestic Bio Production

Korean Companies Accelerate North America Entry

Expecting Spillover Benefits Amid China Containment

Positive Outlook on 'Inflation Reduction Act'

Bio-similar Market Expansion Forecast

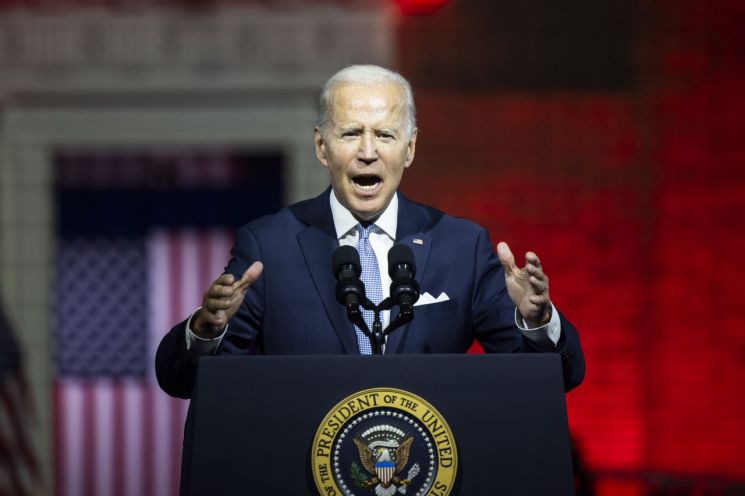

[Asia Economy Reporter Lee Gwanju] Domestic bio industry is also on high alert following U.S. President Joe Biden's signing of the 'National Biotechnology and Biomanufacturing Initiative' executive order on the 12th (local time). As the U.S. emphasizes domestic research and manufacturing in the biotechnology field, including biopharmaceuticals, this could impact Korean bio companies that have strengths in contract manufacturing (CMO) and contract development and manufacturing (CDMO). Conversely, there is also an outlook that faster entry into the U.S., the world's largest bio market, and enhanced drug price competitiveness could be a boon.

Extension of China Containment... The U.S.'s Intentions

The U.S. government's emphasis on domestic research and manufacturing in biotechnology, including biopharmaceuticals, is primarily driven by containment of China. In February this year, the U.S. Department of Commerce imposed sanctions by including Wuxi Biologics, China's largest CDMO company, on the Unverified List (UVL), and the current initiative is interpreted by the domestic industry as a continuation of this stance.

There are reportedly about 100 biopharmaceutical CDMO companies worldwide. Among them, in terms of production capacity, Boehringer Ingelheim (Germany), Samsung Biologics (Korea), Lonza (Switzerland), Wuxi Biologics, and Fujifilm (Japan) rank at the top. According to global market research firm Research and Markets, the global CDMO market is expected to grow from $172.7 billion (approximately 217 trillion KRW) this year to $246.6 billion (approximately 310 trillion KRW) by 2026. In the midst of fierce competition for global CDMO dominance, there is an interpretation that concerns over weakening U.S. competitiveness in this sector due to overseas relocation of production facilities are reflected in this initiative. The White House stated in its explanation of the initiative that it aims to protect the U.S. biotechnology ecosystem and "will develop risk mitigation measures against foreign interference in the biomanufacturing supply chain."

Samsung Biologics booth at the 'Bio International Convention 2022 (BIO USA)' held in San Diego, USA, in June this year.

Samsung Biologics booth at the 'Bio International Convention 2022 (BIO USA)' held in San Diego, USA, in June this year.

Pressure to Enter U.S. Market Likely to Intensify

Although specific implementation plans for this initiative have not been disclosed, the domestic bio industry expects increased pressure to enter the U.S. market in the future. The Biotechnology Policy Research Center forecasts that the U.S. bioindustry market size will reach $430.1 billion (approximately 511 trillion KRW) by 2027. This is about 1.8 times larger than the entire European market ($232.7 billion). With the U.S. Food and Drug Administration (FDA) at its center, the U.S. market possesses global expertise and authority, making it an indispensable market for bio companies.

Many Korean bio companies have already acquired local U.S. firms. SK acquired raw material pharmaceutical producer MPAC in 2018, and GC Cell acquired U.S. cell and gene therapy CDMO company Bioscentric in April this year. Subsequently, Lotte Biologics acquired Bristol-Myers Squibb's (BMS) Syracuse production plant in May, and SD Biosensor signed a contract in July to acquire U.S. in vitro diagnostics company Meridian Bioscience for 2 trillion KRW, the largest deal in the domestic bio industry. An industry insider said, "No company will give up on entering the U.S., the world's largest market. If policies are established that provide benefits only to drugs manufactured in facilities within the U.S., mergers and acquisitions (M&A) for local entry are expected to become more active."

Domestic Bio Industry Should Seize This as an Opportunity

There are also voices urging the domestic bio industry to find breakthroughs by utilizing the U.S. Inflation Reduction Act (IRA). According to the IRA, chemical drugs without generic versions launched for over 9 years or biopharmaceuticals without biosimilars launched for over 13 years must undergo drug price negotiations. Pharmaceutical manufacturers subject to these negotiations must decide whether to include their biopharmaceuticals in the negotiations or change patent strategies to allow biosimilars to enter the market. This could be an opportunity for biosimilars, which have struggled to enter the U.S. market, to expand, and is likely to be a positive factor for the domestic bio industry, where biosimilars constitute a major segment.

There is also analysis that if U.S. containment of China's bio industry intensifies, domestic CDMOs could gain indirect benefits. An industry insider said, "Since the domestic CDMO industry possesses world-class technology, it will not be easy to replace it in the short term," adding, "It seems the time has come to explore various survival strategies such as M&A, securing global networks, and strengthening research and development."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)