Two Domestic Listed REITs with Quarterly Dividends... Legal Restrictions under Commercial Act

Legislative Notice for Amendment to Shorten Dividend Cycle by Board Resolution

[Asia Economy Reporter Noh Kyung-jo] The institutionalization of a 'monthly dividend' system to revitalize public offerings and listings of domestic REITs (Real Estate Investment Trusts) has been set in motion. The aim is to grow the market by enabling investments in REITs like retirement pension products.

According to the National Assembly Legislative Information System on the 13th, Kim Hee-guk of the People Power Party and 10 other members proposed the "Partial Amendment to the Real Estate Investment Company Act" on the 1st, which allows shortening the dividend cycle of REITs through board resolutions. The bill has been open for public comment since the 5th.

The lawmakers explained the reason for the amendment proposal, stating, "In an aging society, income-type investors who prefer periodic cash flow to secure stable retirement funds are increasing, and investments in REITs with relatively high dividend yields are also expanding. However, the current law does not have provisions to shorten the dividend cycle, failing to meet investors' demands for monthly or quarterly dividends from REITs."

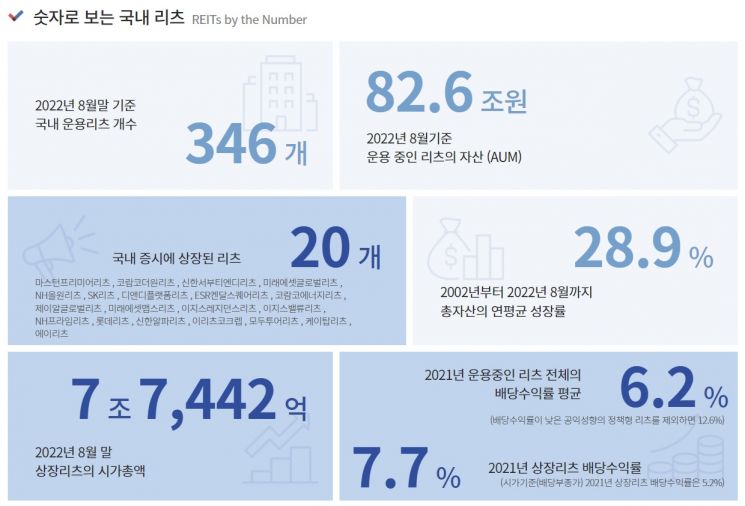

REITs, a type of indirect real estate investment product, collect funds from investors and invest in domestic and overseas real estate, then regularly distribute profits such as rental income or capital gains. According to the Korea REITs Association, as of the end of August, 346 REITs are being operated domestically. Among them, 20 are listed REITs with a market capitalization of 7.7442 trillion KRW.

REITs are considered a stable source of income during stock price downturns due to their relatively low price volatility and high dividend yields. Last year, the average dividend yield of managed REITs was about 6.2% per annum.

However, the number of dividend payments is fewer compared to overseas REITs (such as Realty Income) where monthly dividends are common. Only two REITs, SK REITs and Koramco The One REITs, pay quarterly dividends, while most listed REITs pay dividends once or twice a year (semi-annually).

This is because Article 462-3 of the Commercial Act states, "A company with an annual settlement period may, by resolution of the board of directors, pay interim dividends only once during the business year." To make additional dividend payments, the company must settle accounts and obtain approval at the shareholders' meeting each time, making it difficult to increase the frequency, according to industry insiders.

Accordingly, the amendment introduces provisions allowing the board of directors to determine the number, frequency, and expected amount of interim dividends. It also specifies liability for damages if interim dividends are excessively paid.

The REITs Association expects that through such regulatory improvements, the market capitalization of domestic listed REITs will increase to 46 trillion KRW by 2025 and 150 trillion KRW by 2030. Earlier, at the "2022 Listed REITs Investment Meeting" held in July, the association identified shortening the dividend cycle as one of the institutional improvement measures to revitalize REIT public offerings and listings.

Kim and others said, "If the amendment passes, it will not only redirect investment demand for monthly (quarterly) dividend REITs from overseas back to the domestic market but also stabilize income sources for income-type financial product investors such as the elderly and pensioners."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.