Net Interest Income Turns Positive for the First Time

Timely Capital Expansion Essential to Sustain Rapid Growth

[Asia Economy Reporter Minwoo Lee] Toss Bank still recorded a loss in the second quarter of this year, but it turned profitable in the interest segment for the first time. This appears to be due to the steep growth of loan assets and the improvement of net interest margin (NIM) as interest rates rose. While the effect of increased interest income from asset growth could be significant, capital is required for this, so continuous capital increases are also expected to be necessary.

According to the financial sector on the 10th, Toss Bank recorded a net loss of 58.9 billion KRW in the second quarter of this year. Although the deficit narrowed by about 6.5 billion KRW compared to the previous quarter, the pace of loss reduction slowed somewhat. This is interpreted as due to an increase in loan loss provisions in the second quarter. Before provisioning, the loss decreased from 40.1 billion KRW in the first quarter to 16.1 billion KRW in the second quarter.

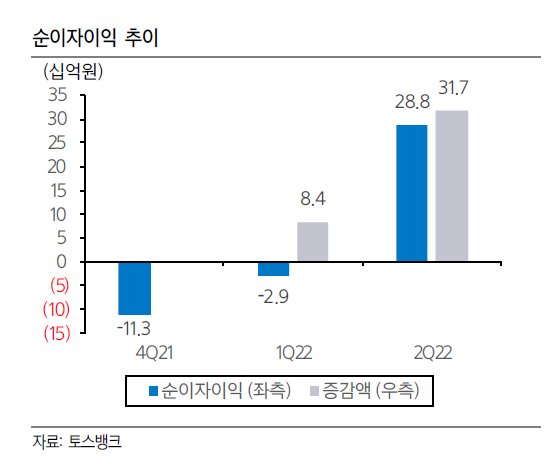

Net interest income recorded 28.8 billion KRW, showing a profit for the first time since its launch. Until now, it had consecutively recorded losses, such as a net interest loss of 11.3 billion KRW at the end of last year and 2.9 billion KRW in the first quarter. Interest expenses on deposits exceeded income from loans, but from the second quarter of this year, it started to generate income.

Therefore, analysts suggest focusing on the fact that net interest income increased by 31.7 billion KRW compared to the previous quarter rather than the superficial decrease in losses. Jaewoo Kim, a researcher at Samsung Securities, forecasted, "Although the loan-to-deposit ratio is still low and economies of scale have not been secured, so losses are likely to continue for the time being, loan assets are growing steeply, and NIM improvement will accelerate earnings growth."

The core of future earnings improvement is expected to be interest income. In particular, the benefits from Korea Citibank's credit loan refinancing program are also worth noting. It is explained that this is a significant advantage not only in terms of scale but also in attracting Citibank's high-quality customers. Additionally, as the demand for refinancing loans centered on credit loans is growing across the market, there is a view that Toss Bank's competitiveness can be demonstrated. The loan-to-deposit ratio is still at 15.1%, so the effect of increased interest income from asset growth can also be significant, which is considered potential.

However, the biggest challenge for Toss Bank's asset growth is the capital ratio. Toss Bank has already consistently conducted paid-in capital increases since its launch. At the end of last month, it carried out a paid-in capital increase of 300 billion KRW, bringing Toss Bank's capital size to about 1.4 trillion KRW. Nevertheless, considering the high asset growth rate and the current loss structure, there is an analysis that paid-in capital increases must continue.

Researcher Kim pointed out, "Assuming a simple leverage ratio of up to 10 times based on current capital, Toss Bank can increase loans up to 9.1 trillion KRW, nearly double the total loans of 4.3 trillion KRW at the end of the first half," adding, "In other words, considering the continued impact of capital reduction due to quarterly losses and the possibility of an increase in loans to medium- and low-credit borrowers and self-employed borrowers with high risk weights when calculating the capital ratio, the current capital ratio is likely to be rapidly depleted." Ultimately, it is analyzed that timely capital confirmation at an appropriate scale is necessary for sustainable solid growth.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.