Lululemon Stock Rises Over 9% in One Month

[Asia Economy Reporter Minji Lee] Despite weakened investor sentiment, analysis suggests that Lululemon Athletica will continue to show significant performance improvements in the second half of the year.

On the 10th, Lululemon's stock price was $348.65, up 0.83% from the previous trading day. Over the past month, it has risen more than 9%. Although macroeconomic uncertainties and lowered expectations for sportswear persist, solid earnings are believed to have driven the stock price increase.

For the fiscal year 2023 Q2, revenue reached $1.9 billion and operating profit was $400 million, marking growth of 28.8% and 30.7% respectively compared to the same period last year. EPS stood at $2.20. Each figure exceeded market expectations by 5.3%, 20%, and 19.8%, respectively.

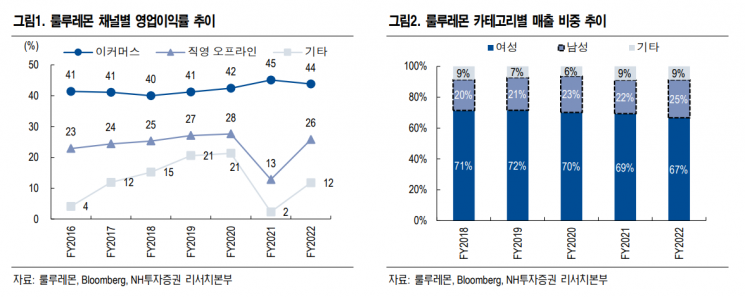

Gross profit decreased by 1.6%, reflecting increased air freight costs due to global supply chain disruptions and unfavorable exchange rates. However, operating profit margin rose by 1.4%. Jiyoon Jung, a researcher at NH Investment & Securities, stated, “This is attributed to the leverage effect from growth in high-margin direct-operated offline malls and e-commerce sales, as well as adherence to a full-price sales strategy.”

In fact, Q2 showed high growth across all channels and regions. Offline store sales reached $900 million, growing 29.9% year-over-year. The number of stores expanded from 579 at the beginning of the quarter to 600, with 12 new stores opened in Asia, 7 in North America, and 2 in Europe. Digital sales increased 29.8% year-over-year to $700 million. Both online and offline channels demonstrated balanced high growth. Other sales (outlets, temporary stores, Mirror, licenses) rose 20% year-over-year to $200 million.

By region, sales in North America, outside North America, and Canada increased 28.3%, 35.1%, and 24.1% respectively compared to the same period last year. Notably, performance improvements in China stood out. Revenue increased by more than 30% year-over-year, with a three-year average annual growth rate of about 70%. Lululemon opened 8 new stores in China alone and currently operates 40 stores in first-tier cities, 25 in second-tier cities, and 14 in third-tier cities. The proportion of China’s sales in Lululemon’s consolidated revenue rose from about 2-3% in 2019 to around 5% last year.

Jaegu Kang, a researcher at Hanwha Investment & Securities, said, “Growth was slow early in the year due to COVID-19 lockdowns, but there has been a sharp rebound recently. The DTC strategy is also being strengthened, with the launch of a digital flagship store on JD.COM and community building efforts to enhance brand power.”

The proper activation of China’s sports industry is positive for future stock performance. In August 2019, the Chinese State Council issued a notice on building a strong sports nation, aiming to cultivate about 45% of the total population as sports participants by 2035. Accordingly, the proportion of sportswear in China’s apparel market has been steadily increasing since 2013. The yoga industry, which Lululemon focuses on, has also grown. As of 2020, China’s yoga industry was worth about 46.8 billion yuan, up 18.7% year-over-year. The number of yoga studios in China increased nearly threefold from 14,146 in 2016 to 42,350 in 2021. China’s luxury goods market also grew 30% year-over-year in 2020.

Researcher Jaegu Kang explained, “With ongoing trends in luxury goods in China, it is expected to hold the largest share of the global luxury market by 2025. China’s consumption trends will be a growth driver for Lululemon, which has established itself as a premium sports brand.”

Meanwhile, Lululemon is expected to maintain solid performance in the second half of the year. The company’s annual revenue forecast is $7.9 billion, and EPS is projected at $9.82, representing growth of 5.5% and 26.1% respectively compared to the previous year. The number of new stores for the year is expected to be 75, five more than previously anticipated.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)