Higher Income Replacement Rate Compared to Low Insurance Premium Rates

Unrealistic Structure from the Start

Focusing Only on Financial Stabilization Worsens Elderly Poverty Issues

[Asia Economy Reporter Naju-seok] The National Pension Service's fund is expected to be completely depleted in about 30 years due to an inherently contradictory structure. Compared to major countries, the contribution rate?the ratio of monthly income to insurance premiums paid by subscribers?is low, but the pension benefits paid during retirement are designed to be generous.

According to a recent report titled "Review and Direction of Pension Reform Discussions" published by the National Assembly Legislative Research Office, "The National Pension Service is facing a crisis that urgently requires preparation for fund depletion due to unprecedented low birth rates and demographic and sociological changes, with the country entering a super-aged society in just three years," adding, "The fundamental reason for the necessity of National Pension reform lies in the system being designed with a low contribution rate but a generous benefit level, creating a low-burden, high-benefit structure."

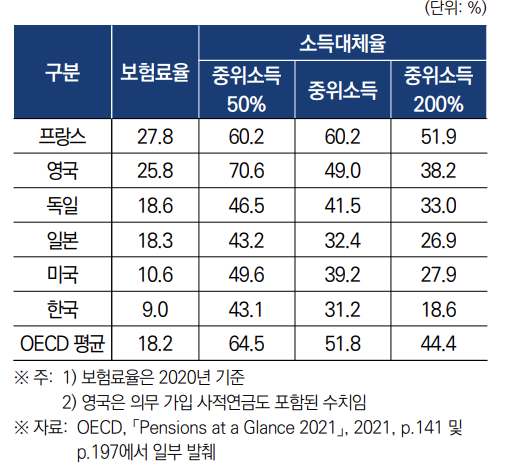

When comparing the 'contribution rates' and the 'income replacement rates'?the ratio of pension benefits to the average income during the subscription period?of major OECD countries, the problem becomes evident. South Korea's contribution rate is 9%, with a median income household replacement rate of 31.2%. In contrast, other countries have higher contribution rates but not necessarily higher replacement rates. For example, France, with a contribution rate three times higher than South Korea's (27.8%), has a median income replacement rate of 60.2%. The UK has a contribution rate of 25.8% and a median income replacement rate of 49.0%, Germany's contribution rate is 18.6% with a replacement rate of 41.5%, and Japan's contribution rate is 18.3% with a replacement rate of 41.5%.

Based on this, the Legislative Research Office explained, "Although South Korea's income replacement rate may appear low at first glance, it is not actually low," adding, "Compared to the OECD member countries' average (contribution rate 18.2%, median income replacement rate 51.8%), South Korea's income replacement rate is relatively high when considering the contribution rate alone." This means that subscribers can receive more money than the premiums they have paid.

However, subscribers may not perceive the income replacement rate as higher than the contribution rate because their subscription periods are short, resulting in lower actual pension receipts. As the number of long-term National Pension subscribers increases, pension benefits will inevitably grow. Moreover, considering the rapid aging caused by declining birth rates, it is a reality that the current National Pension system is difficult to sustain.

Therefore, two main directions are being considered as solutions.

The first is parametric reform. The purpose of parametric reform is to stabilize finances by raising contribution rates or lowering income replacement rates. This means changing the structure to pay more and receive less.

The second is more comprehensive structural reform. The Legislative Research Office explained structural reform as "changing the structure of the pension system and altering its functions and roles," giving examples such as integrating the income redistribution function of the National Pension with the basic pension and converting the National Pension into an income-proportional pension, or merging special occupational pensions, which have characteristics of retirement pensions, with the National Pension.

The reform currently under consideration is primarily parametric reform. However, given the severity of elderly poverty, there is also significant opposition advocating for strengthening retirement security. Therefore, pension reform in the National Assembly is likely to face conflicts between the two policy goals of financial stabilization and retirement income security.

In this regard, the Legislative Research Office advised, "To avoid the risk of pension reform discussions in the government and National Assembly ending in failure after only confirming various differences in positions, it is necessary to minimize unproductive debates without progress. For this, political orientations and ideologies should not dominate, and a clear consensus on the ultimate goal must precede," adding, "For pension reform to progress beyond parametric reform to structural reform, a precise understanding of the actual conditions and status of individual pension systems is required, and a pension reform governance framework that can successfully encompass the entire system must be in place."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.