SK Hynix to Break Ground Next Month on Cheongju M15X... 15 Trillion Won Investment Over 5 Years

Global Semiconductor Company's Bold Preemptive Investment Move

[Asia Economy Reporter Han Ye-ju] SK Hynix is investing 15 trillion won to build a new semiconductor production plant in Cheongju, Chungcheongbuk-do. Industry analysts say this bold decision by SK Group Chairman Chey Tae-won aims to secure new growth engines for the next decade despite forecasts of a 'semiconductor winter' due to falling semiconductor prices and declining demand. Global semiconductor companies, including Samsung Electronics, are also expanding their factories and announcing construction plans, engaging in a race to increase their scale. This is interpreted as a strategic move to prepare for the anticipated 'spring of semiconductors' after 2025 through proactive investment amid fierce semiconductor dominance competition.

◆ "Shaking off the perpetual second place" ? Gambler Chey Tae-won's 'Bet' = According to industry sources on the 7th, SK Hynix will begin construction of 'M15X (eXtension)' next month on approximately 60,000㎡ of land within the Cheongju Technopolis Industrial Complex. It is an expansion fab of the existing M15 plant, and thanks to having already secured the site, the groundbreaking schedule could be advanced. Since it is composed of multiple floors, its scale is similar to the combined size of Cheongju’s M11 and M12 plants.

This new plant construction is separate from the 'M17 Cheongju Plant Expansion' agenda, which SK Hynix’s board postponed on June 29. SK Hynix stated that regarding M17 construction, "the start date will be decided considering the semiconductor market conditions and management environment."

SK Hynix’s move to build a new semiconductor plant comes 4 years and 2 months after the Icheon M16 plant in July 2018. Instead of M17, whose construction timing is uncertain due to incomplete conditions, SK Hynix decided to first build M15X, which can be expanded immediately next to the existing plant.

This is seen as another demonstration of Chairman Chey Tae-won’s gambler spirit, who believes "investment should increase during downturns." It also reflects the determination to shed the label of 'perpetual second place' in both the DRAM and NAND flash markets. From a long-term perspective, it is a move to secure market responsiveness. Although the semiconductor market is currently frozen due to consumption contraction, the judgment is that investing now will enable increased semiconductor supply when the market recovers in a few years.

SK Hynix has a history of achieving results through bold investments during downturns. After being acquired by SK Group in 2012, it increased investments by more than 10% compared to usual, rising to become a global semiconductor leader. At that time, Chairman Chey also made a bold decision. Despite the uncertain future of the semiconductor market, he pledged to "mobilize the group’s capabilities and personal networks to develop Hynix into a top-tier semiconductor company."

M15X is targeted to begin operations in 2025. The main products to be produced will likely be decided considering the ongoing construction status of the Yongin semiconductor cluster that SK Hynix is promoting.

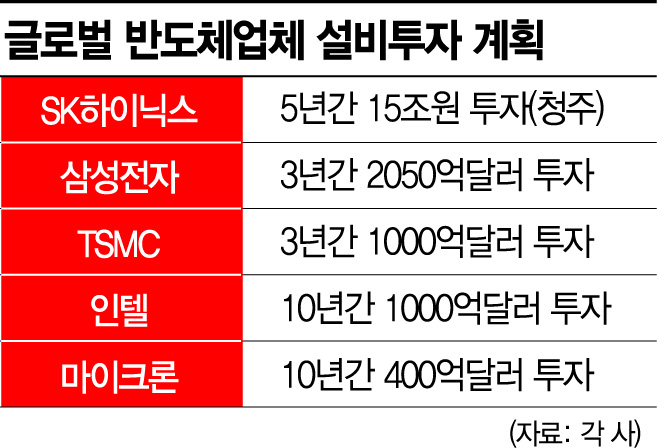

◆ Fierce competition in production facility investment as a 'primer' = SK Hynix plans to invest 15 trillion won over five years starting this year to build a new semiconductor plant. This is a proactive measure to respond to the expected 'market rebound' in 2025. The strategy is to make bold future investments to act as a primer when the memory semiconductor boom arrives.

In fact, the memory semiconductor market has recently entered a crisis phase. According to a survey by the Korea Chamber of Commerce and Industry of experts on the domestic semiconductor industry outlook, 76.7% of respondents diagnosed that the domestic semiconductor industry is currently in crisis. Prices of memory semiconductors, including DRAM, which are the mainstay of the domestic semiconductor industry, have also been declining for several months.

This explains the competition among Samsung Electronics and global semiconductor companies in investing in production facilities. The strategy is to turn 'crisis into opportunity.' Samsung Electronics announced it will invest $205 billion (approximately 283.638 trillion won) over three years for large-scale facility expansion. It is currently investing $17 billion (about 22.7936 trillion won) to build a factory in Taylor, Texas, USA, and plans to operate six production lines by constructing three more semiconductor plants in Pyeongtaek, Gyeonggi Province. Recently, plans to establish a semiconductor back-end (packaging) complex in Cheonan, Chungnam Province, have also been concretized.

TSMC, the world’s largest foundry company based in Taiwan, announced plans last year to invest $100 billion (about 138.36 trillion won) over the next three years to expand production. It is investing $12 billion (about 16.0896 trillion won) to build a new plant in Phoenix, Arizona, USA, scheduled for completion next year. In Japan, TSMC is jointly investing 1 trillion yen (about 9.7994 trillion won) with Sony to build a plant in Kumamoto Prefecture, aiming for mass production by the end of 2024. TSMC plans to spend $44 billion (about 60 trillion won) on foundry facility investments this year.

Intel is partnering with global asset management firms to invest $30 billion (about 40.224 trillion won) to build a semiconductor plant in Arizona, USA. Earlier in January, Intel announced plans to build a semiconductor plant in Columbus, Ohio, USA, and indicated that investments could reach $100 billion over the next decade. It has also announced plans for a $100 billion scale investment in Germany.

Recently, Micron Technology in the USA declared it will invest $15 billion (about 20.763 trillion won) to build a new memory semiconductor plant in Idaho, where its headquarters is located. Last month, Micron announced it will invest $40 billion (about 55.36 trillion won) in US memory semiconductor production facilities and create 40,000 new jobs by 2030.

An industry official explained, "Although semiconductor demand is declining due to recent global economic recession and supply chain instability, the semiconductor market cycle is becoming shorter than in the past. If investment speed slows too much in this uncertain downturn, it may be difficult to keep up with the market when it turns to a boom."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)