Basel Banking Supervision Committee Announces New Regulatory Proposal... Final Implementation Expected by Year-End

Restrictions Anticipated on Digital Asset Derivatives, Management, Custody, and Lending Operations

[Asia Economy Reporter Minwoo Lee] The Basel Committee on Banking Supervision, which sets various regulatory standards for banks worldwide, has tightened regulations applied when banks handle digital assets such as cryptocurrencies. It also judged that the risks of assets like 'stablecoins,' which are considered relatively safe due to their price linkage with fiat currencies, are higher and set limits on holdings.

On the 5th, the Korea Institute of Finance analyzed this in its report titled "Regulatory Measures and Impact of Digital Asset-related Capital Requirements for Banks."

According to the report, the Basel Committee recently announced the "Second Consultation Paper on Capital Requirements for Banks Holding Digital Assets" and plans to finalize the regulations by the end of the year. The consultation paper further subdivided classifications based on price volatility risks, even for stablecoins backed by collateral assets. Previously, digital assets were categorized as ▲tokenized digital bonds or digital stocks (Group 1a), ▲those backed by fiat currencies, gold, crude oil, or other commodities (Group 1b), and ▲stablecoins and altcoins created by independent algorithms without collateral assets (Group 2).

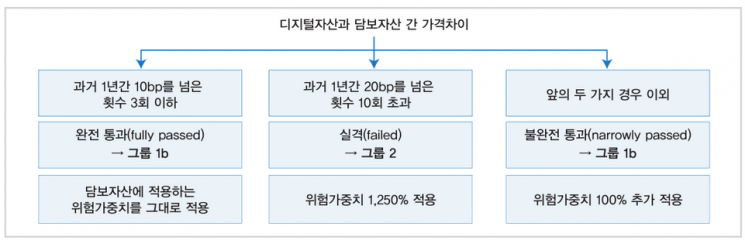

However, now ▲cases where the price deviation from the collateral asset exceeded 10 basis points (bp; 1bp=0.01%) no more than three times in the past year are classified as 'Group 1b' and assigned the same risk weight as the collateral asset. ▲If the price deviation exceeded 20bp more than ten times in a year, the asset is classified as the lowest grade 'Group 2' with a risk weight of 1250%. Additionally, ▲cases where the annual price deviation exceeded 10bp more than three times but less than ten times over 20bp are also classified as 'Group 1b' but with an additional 100% risk weight applied.

Further subdivisions were proposed within this framework. Even within Group 2, assets would be divided into Group 2a and Group 2b based on whether the digital asset has a risk-hedging effect. The report explained, "To be included in Group 2a, hedging must be done using derivatives approved by financial authorities," and "criteria such as a one-year average market capitalization of the underlying digital asset of at least $10 billion (approximately 13.625 trillion KRW) and a daily average trading volume of at least $50 million must also be met." This appears to reflect incidents involving stablecoins like 'Lunacoin,' which failed to maintain collateral asset value and shook the global cryptocurrency market.

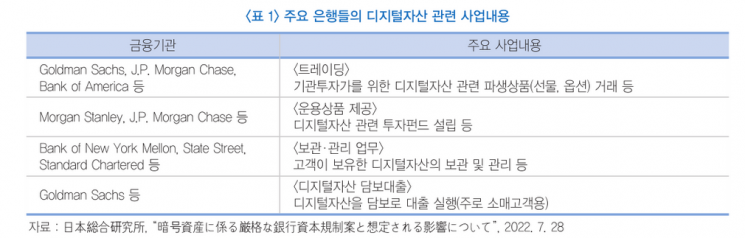

Accordingly, there is analysis that related businesses of major overseas banks may slow down. Major U.S. banks such as Goldman Sachs, JP Morgan Chase, Bank of America, and Morgan Stanley already provide ▲derivatives trading such as futures and options related to digital assets for institutional investors, ▲establishment of investment funds related to digital assets, ▲custody services including safekeeping and management, and ▲collateral loans.

Seonho Kwak, Deputy Director at the Korea Institute of Finance, explained, "If a high capital requirement regulation with a risk weight of 1250% is imposed on Group 2, which has high price volatility risk, it is highly likely that banks will limit direct holdings of such assets and related businesses to restricted areas such as custody and management services." He added, "Significant additional costs will be incurred for establishing dedicated organizations or systems to regularly monitor these risks and price deviations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)