The Bank of Korea "Inflation to continue high rise at 5-6% range for considerable period"

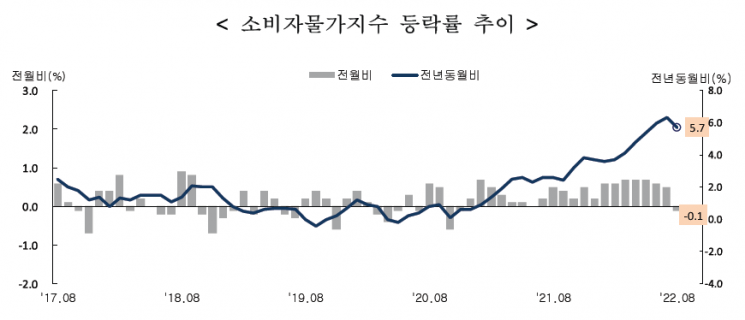

[Asia Economy Sejong=Reporters Son Seon-hee and Seo So-jung] Last month, the consumer price index (CPI) inflation rate fell to the 5% range, breaking the upward trend for the first time in seven months. The recent decline in international oil prices is analyzed to have had a decisive impact on the slowdown in consumer price inflation. However, agricultural products and personal services still show an upward trend, and due to significant external volatility, there is caution regarding the theory that inflation has peaked.

According to the 'August Consumer Price Trends' released by Statistics Korea on the 2nd, the consumer price index last month was 108.62 (based on 2020=100), up 5.7% compared to the same month last year. This is 0.6 percentage points lower than the inflation rate in July (6.3%). It is the first time since January that the month-on-month inflation rate has slowed.

Eo Un-seon, Director of Economic Trend Statistics at Statistics Korea, explained, "Prices of industrial products such as petroleum and processed foods, personal services, and agricultural, livestock, and fishery products continued to rise," adding, "However, the overall inflation rate fell by 0.6 percentage points mainly due to the slowdown in petroleum price increases."

Although the government announced earlier-than-usual price stabilization measures at the beginning of last month ahead of the Chuseok holiday, unfavorable weather conditions such as heavy rains caused vegetable prices to surge by 27.9% compared to the same month last year. Ahead of the kimchi-making season, cabbage prices soared by 78%, and prices of pumpkin (83.2%) and cucumber (69.2%) also rose significantly.

The prices of livestock products, including imported beef subject to a 0% tariff quota applied since the end of July, maintained an increase of 3.7%. Accordingly, the overall prices of agricultural, livestock, and fishery products rose by 7.0%.

Petroleum prices rose by 19.7%, but compared to the previous surge to the 30% range, this shows a relative slowdown.

Thanks to the decline in international oil prices, supply-side factors have somewhat eased, while demand-side factors such as personal services still maintained a high inflation rate. Last month, personal service prices rose by 6.1%, with the dining-out price index jumping 8.8%, marking the highest increase in about 30 years since October 1992 (8.8%).

The living cost index, which reflects perceived inflation, rose by 6.8%, and the core inflation rate (excluding agricultural products and petroleum) that shows the underlying trend of prices increased by 4.4%.

Since price fluctuations largely depend on external variables such as international oil prices, it is difficult to easily determine whether inflation has peaked. The Ministry of Economy and Finance stated, "There are ongoing inflationary risks such as increased demand during the holiday season and expanded volatility in international raw material prices," adding, "We will not lower our guard and will continue all policy efforts."

The Bank of Korea also expects consumer prices to maintain a high inflation rate of 5-6% for a considerable period. Lee Hwan-seok, Deputy Governor, said at the 'Price Situation Review Meeting' on the morning of the same day, "Core inflation rose slightly from 3.9% in July to 4.0% in August as demand-side inflationary pressures continued, particularly expanding in personal services such as dining out," adding, "Given the high uncertainty related to the developments in the Ukraine crisis, international oil price trends, and weather conditions, consumer prices are expected to maintain a high inflation rate of 5-6% for a considerable period."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)