'Avoiding Excessive Drinking' Social Atmosphere Highlights Non-Alcoholic Drinks

Drinking Culture Changes Centered on MZ Generation

Rapid Growth of Non-Alcoholic Beer Market

Industry Continues to Launch Non-Alcoholic Products

[Asia Economy Reporter Song Seung-yoon] "Who drinks until they get drunk these days?"

Choi Jung-mi (26), an office worker living in Goyang-si, Gyeonggi Province, is a ‘mood seeker’ who enjoys the atmosphere more than drinking at gatherings. A few years ago, if she asked for a low-alcohol drink at a drinking party, her friends would tease her as an ‘Alssu’ (Alcohol + Trash, meaning someone who cannot drink well), but things are different now. It is natural to start the drinking party with a highball each and then order their favorite drinks regardless of alcohol content. No one looks strangely even if someone drinks non-alcoholic beverages throughout the gathering. Choi said, "These days, forcing someone to drink or drinking until you lose control is considered strange," adding, "I want to drink, but sometimes my body feels weak or I just want to match the mood, so I often choose non-alcoholic drinks."

Non-alcoholic beverages are gaining popularity, especially among the MZ generation (Millennials + Generation Z). As the culture of heavy drinking disappears among young people, a culture of enjoying the drinking party and atmosphere rather than drinking until intoxicated is spreading. This trend accelerated with the rise of ‘home drinking’ and ‘solo drinking’ during the COVID-19 pandemic. The liquor industry is also launching non-alcoholic alcoholic beverages accordingly.

According to market research firm Nielsen Korea and others on the 1st, the domestic non-alcoholic beverage market grew by 250% last year compared to the previous year. Among non-alcoholic beverages, beer accounts for the largest share. The domestic non-alcoholic beer market grew significantly from 8.1 billion KRW in 2014 to 15 billion KRW in 2020, and 20 billion KRW last year. The industry expects the market size to grow to around 200 billion KRW by 2025.

The major reason is the significant change in drinking culture, especially among young people. Another factor contributing to market expansion is that non-alcoholic and low-alcohol beverages are not classified as alcoholic beverages, allowing online sales. Under Korean liquor tax law, products with less than 1% alcohol content are classified as beverages, not alcoholic drinks. Products with no alcohol are called non-alcoholic, and those with less than 1% alcohol are called low-alcohol or non-alcoholic.

This is a global trend. In Japan, this atmosphere spread even faster than in Korea. Major liquor companies such as Asahi, Kirin, Suntory, and Sapporo have launched non-alcoholic beverages one after another, and the non-alcoholic market size in Japan has grown by more than 15 billion yen in five years to reach 80 billion yen (about 753.8 billion KRW). Similar to Korea, drinking culture among young people has changed significantly, and the trend accelerated during the COVID-19 pandemic. Emergency declarations requesting the closure of restaurants serving alcoholic beverages were issued in some areas to prevent the spread of infection, leading many in the food service industry to stock non-alcoholic beverages to avoid closure. In Japan, various RTD (Ready to Drink) products based on beer, low-alcohol wine, chuhai, and canned highballs have been steadily released and gained popularity.

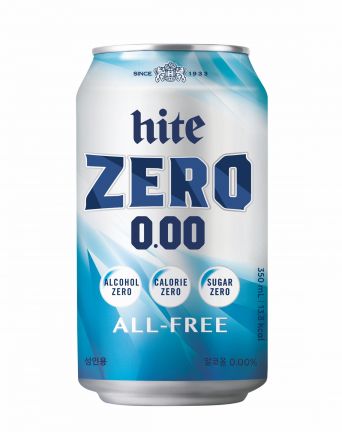

Domestic companies are also rushing to launch related products or expand their product lines. Competition is especially fierce in the beer industry. HiteJinro’s ‘Hite Zero 0.00’ surpassed 100 million cans in cumulative sales, the first in Korea, since its launch in November 2012 until last month. Hite Zero 0.00’s market share in the non-alcoholic beer market is estimated to be around 50%. OB Beer’s ‘Cass 0.0’ sold 6 million cans cumulatively online, including Coupang, by the end of May. Online sales account for about 20-30% of Cass 0.0’s total sales. Lotte Chilsung Beverage renewed ‘Cloud Clear Zero’ last year and plans to launch an additional low-alcohol beer in the second half of this year.

In addition, Tsingtao released a new 500ml can product following its 330ml can and bottle of the non-alcoholic beer ‘Tsingtao Non-Alcoholic.’ OB Beer also introduced non-alcoholic products of overseas brand beers such as ‘Budweiser Zero,’ ‘Hoegaarden Zero,’ and ‘Hoegaarden Fruit Brew.’ Jeju Beer launched ‘Jeju Nuvo,’ a non-alcoholic beer made using original craft beer brewing methods.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.