Equity Investment in Domestic and International Commerce Platforms

New Growth Engine Amid Commerce Business Slowdown

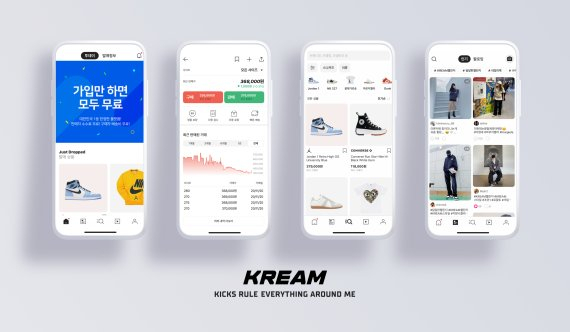

[Asia Economy Reporter Yuri Choi] Naver is investing in domestic and international commerce platforms through Cream, a resale platform that facilitates personal transactions of limited-edition products. This is to expand product categories and enter the Southeast Asian resale market.

According to the IT industry on the 30th, Cream recently invested 2.5 billion KRW in the Thai resale platform operator 'Sasom Company,' acquiring 23,000 shares. Cream had previously invested 1 billion KRW last year. The share ratio increased to 30%. Along with this, Cream also invested 2 billion KRW in the domestic media commerce company 'Blank Corporation,' which sells household goods.

Cream is a Naver subsidiary platform that mediates personal transactions of limited-edition products. It was launched in March 2020 as a subsidiary of Snow and became independent through a physical division in January last year. This year, Cream has been investing in domestic and international commerce platforms about once a month.

Domestically, Cream invested 5.4 billion KRW in 'Craving Collector,' which operates a fashion product platform, and 9.9 billion KRW in 'Segment,' which operates a luxury goods trading platform. It also invested 1.4 billion KRW and 1.9 billion KRW respectively in the used car trading platform 'Cheka' and the e-commerce marketing company 'Culture & Commerce.' The product categories have expanded from limited editions to fashion, luxury goods, used cars, and household miscellaneous goods.

Overseas, investments have been focused on Southeast Asian resale platforms. Cream acquired shares of Singapore's top used home appliance trading platform 'Revello' and Malaysia's top sneaker resale platform 'Shake Hands' for 3.6 billion KRW and 2.2 billion KRW respectively. Last year, Cream also invested 35.5 billion KRW in 'Soda,' a Japanese limited-edition trading platform operator that has expanded into various Asian regions.

Cream's aggressive investment is aimed at building a platform connecting major Asian countries to expand its commerce business. Behind this aggressive investment is Naver. In February, Naver participated in a paid-in capital increase of its subsidiary Snow, contributing 150 billion KRW, and Snow has provided 60 billion KRW in funding to Cream this year. As investments increase, Cream's share of transaction volume in the commerce business is also expanding. The transaction volume was 370 billion KRW in the first quarter and 350 billion KRW in the second quarter, already surpassing last year's transaction scale. At the current pace, it is expected to exceed 1 trillion KRW in transaction volume this year.

Profitability is also becoming visible as transaction fees are officially introduced. Since April, Cream started charging a 1% purchase fee, which was raised to 2% in June. From this month, a 1% sales fee has also been imposed. An industry insider said, "Although Cream's share of Naver Commerce's total transaction volume, which is around 9 to 10 trillion KRW, is still low, once sales become full-fledged, it will contribute to profits," adding, "It appears that they intend to make it a new growth engine in the global market in the mid to long term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)