Regular KOSPI Stock Changes Next Month

Short-Term: Favorable Changes from Large-Cap to Mid-Cap Stocks

Long-Term: Focus on Changes from Mid-Cap to Large-Cap Stocks

.

.

[Asia Economy Reporter Hwang Junho] As the strong dollar sweeps through the stock market, increasing market volatility, attention is focused on the stock reshuffling due to the regular KOSPI component changes next month. Looking at past changes, stocks upgraded to large-cap status showed remarkable performance. There is growing interest in whether this could provide relief to retail investors (individual investors) who have been struggling with recent market volatility.

According to the Korea Exchange on the 24th, the KOSPI opened at 2446.18, up 0.45% from the previous day, alongside a decline in the won-dollar exchange rate. After five consecutive trading days of decline, the market finally showed signs of recovery. Concerns about the end of the 'bear market rally' grew due to uncertainties over U.S. interest rate hikes, the soaring dollar, and fears of a European economic recession caused by the Russia-Ukraine war. However, the recent dollar weakness appears to have positively influenced the domestic stock market.

Amid ongoing uncertainties, the regular KOSPI component changes next month will bring shifts in supply and demand. The securities industry views that changes in inclusion or exclusion among large-cap (ranked 1?100), mid-cap (101?300), and small-cap (below 300) stocks will alter supply and demand dynamics, potentially offering a new breakthrough for retail investors.

Particularly noteworthy are the 'dragon's tail' and the 'snake's head.' In the short term, attention should be paid to the snake's head. Lee Jaerim, a researcher at Shinhan Financial Investment who analyzed the performance by market capitalization over 14 past changes, explained, "From 20 trading days before the rebalancing day until the rebalancing day, the relative performance of large-cap to mid-cap portfolios was superior, whereas after the rebalancing day, the relative performance of mid-cap to large-cap portfolios excelled."

The index effect boosted stock prices. Domestic funds and pension funds use market capitalization-based indices as benchmarks for small and mid-cap stocks. Large-cap stocks moving into the mid-cap category hold a significant weight within the index, attracting index funds. As of last year, the investment scale in small and mid-cap funds managed by the National Pension Service's entrusted funds was about 5.3 trillion KRW. Considering funds investing in small and mid-cap stocks, the total assets under management are even larger. However, most assets benchmarked to small and mid-cap indices are actively managed, making supply and demand unstable, and their scale is smaller than that of large-cap assets, which is a drawback. Shinhan Financial Investment identified stocks expected to move to mid-cap status in this change, including Hanmi Science, GS Construction, KCC, KEPCO Engineering & Construction, and DB HiTek. Among these, GS Construction and DB HiTek showed relatively low institutional net buying strength based on cumulative trading volume as of the 20th.

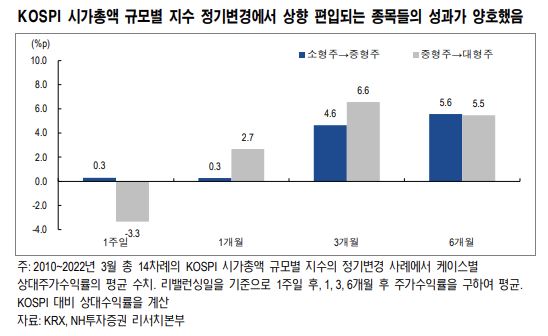

In the long term, investors should target the dragon's tail. Heo Yul, a researcher at NH Investment & Securities who analyzed the average relative stock returns three months after 14 past regular changes, stated, "When stocks are upgraded from mid-cap to large-cap indices, returns averaged 6.6 percentage points, and when upgraded from small-cap to mid-cap indices, returns averaged 4.6 percentage points. Generally, stocks upgraded to higher indices showed superior performance," adding, "This is due to the momentum effect."

NH Investment & Securities expects stocks such as Hyundai Mipo Dockyard, Pan Ocean, BGF Retail, OCI, and Hyundai Marine & Fire Insurance to be included in the large-cap category. Stocks previously in the small-cap index like Samchully, SeAH Steel Holdings, and Korea Carbon are expected to move into the mid-cap category.

Meanwhile, this regular change will take place on the 9th, with index funds tracking the KOSPI conducting rebalancing based on the closing price on the 8th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.