[Asia Economy Reporter Lee Seon-ae] ‘Kurly’ and ‘Golfzon County,’ considered the biggest names in this year’s initial public offering (IPO) market, have both passed the first hurdle of listing on the KOSPI, the preliminary review by the Korea Exchange.

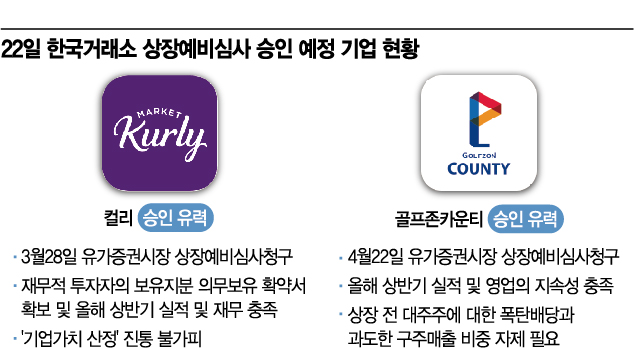

The Korea Exchange announced on the 22nd that it had confirmed the suitability for listing of Kurly and Golfzon County in the preliminary review for the securities market. Established in December 2014, Kurly is the company that officially launched dawn delivery in Korea under the name ‘Saetbyeol Delivery’ through Market Kurly starting in May 2015. Last year, on a separate basis, it recorded sales of 1.558 trillion KRW and an operating loss of 213.9 billion KRW. The net loss amounted to approximately 1.2766 trillion KRW. Kurly filed for preliminary review with the Securities Market Headquarters on March 28, but faced difficulties during the review process due to chronic deficits and unstable shareholding structure issues.

It is reported that Kurly submitted the ‘mandatory holding commitment letter from financial investors (FIs)’ and ‘performance and financial status for the first half of this year’ to the Exchange, which had been obstacles in the review, leading to its approval. The mandatory holding commitment letter is a promise by Kurly’s FIs not to sell shares for a certain period and to exercise voting rights jointly. Considering that Kurly’s founder and CEO Kim Seul-ah holds a low stake of 5.75%, the Exchange required Kurly to obtain agreements from FIs to hold their shares for at least 18 months without selling and to jointly exercise voting rights over more than 20% of shares. This requirement stems from concerns that the low shareholding ratio of Kim, the founder and current CEO, could pose risks to management control after listing.

Golfzon County is a golf course operation company established in January 2018. Last year, on a separate basis, it recorded sales of 191.8 billion KRW and an operating profit of 52.2 billion KRW. It submitted a preliminary review application for listing to the Korea Exchange Securities Market Headquarters on April 22, but the review was delayed as the Exchange decided to assess the sustainability of operations based on the first half’s performance. Golfzon County operates 18 golf courses nationwide. With a total of 387 holes, it holds the number one market share domestically. It is reported that the company’s first half performance was stable, leading to its approval.

However, despite positive expectations for both companies, considerable difficulties are anticipated until the final listing. In Kurly’s case, it seems likely that the company will have to lower its valuation. At the time of pre-IPO investment (equity investment before listing), Kurly was valued at 4 trillion KRW, but the current market value has dropped by more than half. The investment banking industry expects Kurly to significantly reduce its target market capitalization to successfully complete the public offering. This year, due to sluggish stock markets and weakened investor sentiment in the IPO market, companies such as Hyundai Oilbank, SK Shieldus, One Store, and Taelim Paper have canceled their public offerings. Socar, which listed on the same day, proceeded with the listing by lowering its offering price despite failing in demand forecasting and general subscription, but closed the first trading day at a price 6% below the offering price, showing poor performance. Socar’s institutional demand forecast competition rate was only 56.07 to 1 due to controversy over overvaluation of the offering price, leading to the final offering price being set at 28,000 KRW, below the initially hoped range of 34,000 to 45,000 KRW. The general subscription competition rate was also only 14.4 to 1. Based on the closing price that day, Socar’s market capitalization was 860.7 billion KRW, failing to enter the ‘1 trillion club.’

Golfzon County faces criticism that it should refrain from ‘bomb dividends to major shareholders before listing’ and ‘excessive proportion of old share sales.’ Golfzon County’s largest shareholder is Korea Golf Infrastructure Investment, a special purpose company (SPC) established by MBK Partners, and Golfzon Newdin Holdings is the second largest shareholder. Old share sales refer to existing shareholders selling their shares (old shares) to public offering investors at the time of listing, which differs from issuing new shares to public offering investors. MBK plans to monetize part of the shares held by Korea Golf Infrastructure Investment through old share sales upon Golfzon County’s listing.

The Exchange issued listing review guidelines in October last year stating that unlisted companies with private equity funds (PEFs) as major shareholders should not pay excessive dividends before applying for preliminary listing review. This is because excessive dividends immediately before listing can damage the company’s growth potential and negatively affect its sustainability. Accordingly, for unlisted companies with PEFs as major shareholders, the Exchange views paying excessive dividends to existing shareholders before listing, causing cash outflow, and then selling existing shareholder shares to investors after listing as a bad-purpose ‘exit’ (investment recovery) and intends to regulate such actions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.