Falling House Prices Combined with Interest Rate Hikes

More Cautious Waiting Applicants

Intensifying Trends in Screening Subscription Applications

[Asia Economy Reporter Kim Hyemin] As the real estate market downturn accelerates, the subscription market is rapidly freezing. Until last year, large complexes and top-tier brand units that were naturally absorbed in the first-priority subscription market are also struggling. There have even been cases where subscription scores in the 10-point range won in the metropolitan area’s large brand apartments. Expectations for house price increases have disappeared and are instead declining, intensifying the sorting process in the subscription market.

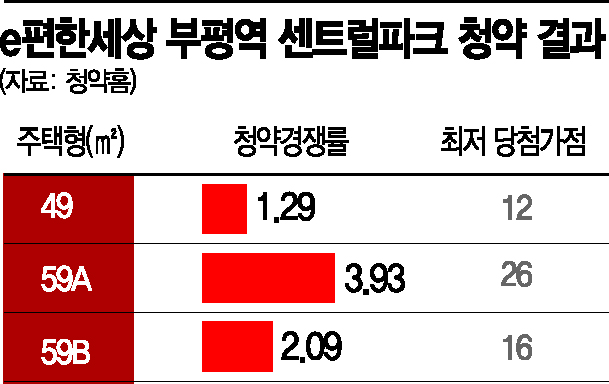

According to Korea Real Estate Agency's Subscription Home on the 22nd, among the three housing types offered at e-Pyeonhansesang Bupyeong Central Park in Bupyeong-gu, Incheon, the lowest winning subscription scores were in the 10-point range for two types. The cutoff score for the 49㎡ exclusive area was 12 points, and for the 59㎡ types, the scores were 16 and 26 points respectively. This means that winning was possible even with subscription scores in the 10s and 20s.

Jointly constructed by DL Construction and DL E&C, this complex supplies 457 households. Despite being a brand apartment built by a major construction company and having a considerable complex size, as well as being close to Bupyeong Station on Subway Line 1 and facing Bupyeong Park, the location has been evaluated as not bad. However, the small unit sizes and the sale prices ultimately became obstacles. The sale price for the 59㎡ unit is up to 563.6 million KRW, but the market price for similar units nearby is formed in the 400 to 500 million KRW range. An industry insider said, "At a time when Incheon house prices have entered a downward trend, the sale price is rather burdensome compared to market prices, so it appears to have been 'cut off'."

The subscription competition rates for large complexes and top-tier brands are also shrinking compared to the past. Two large complex apartments by DL Construction supplied in Pyeongtaek, Gyeonggi Province, recently experienced undersubscription consecutively. e-Pyeonhansesang Pyeongtaek Laciello had only 352 applicants for 953 units, and Highcent had only 385 applicants for 816 units, with both complexes undersubscribed by more than half. Combined, 1,034 units out of 1,769 units, equivalent to 58%, were undersubscribed.

GS Construction’s Bongdam Jaie La Jenne in Hwaseong, Gyeonggi Province, also failed to exceed five times the subscription rate for most housing types in the first-priority subscription, and the 84B㎡ unit was undersubscribed. This contrasts with Bongdam Jaie La Fine, which was supplied in the same location in May last year and attracted 8,592 applicants for 389 units, recording an average subscription competition rate of 22 to 1.

According to Real Estate R114, the average apartment subscription competition rate in the Gyeonggi area has decreased from 28.65 to 1 last year to 8.93 to 1 so far this year. Ye Kyung-hee, senior researcher at Real Estate R114, said, "With house price growth slowing and loan interest rates rising, subscription waiters have no choice but to scrutinize target locations more carefully than before," adding, "Even for large complexes and major brands, if the sale price is not dramatically cheaper than market prices or the location is not good, they can be ignored."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)