Samsung Bioepis and Celltrion Battle to Dominate the Biosimilar Market

'9 Consecutive Years as Global Sales Leader'

Annual Sales of 27 Trillion Won for Mega Blockbuster Drugs

Next Year, 8 Biosimilars Expected to Launch Simultaneously in the US Market

Competition to Secure Differentiation with High-Concentration Formulations and Interchangeable Biosimilars

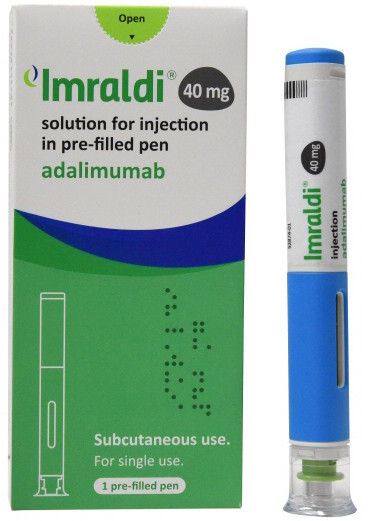

[Asia Economy Reporter Lee Chun-hee] The battle for the $27 trillion Humira (generic name Adalimumab) biosimilar market is intensifying. Various attempts to secure differentiation, such as formulation diversification and interchangeable biosimilars, are ongoing to capture the market.

Samsung Bioepis recently announced on the 18th that it received approval from the U.S. Food and Drug Administration (FDA) for the high-concentration formulation (HCF, 100 mg/mL) of its Humira biosimilar, Hadlima (SB5). This formulation requires a lower drug dosage than the existing low-concentration formulation (50 mg/mL), making it more preferred by patients.

The FDA approval for the high-concentration formulation is known to be the first among biosimilars, excluding the original drug Humira. This has laid the groundwork for securing a foothold in the U.S. market, which opens next year. Accordingly, other biosimilar developers are also working on developing HCF formulations. Sandoz, a subsidiary of Novartis that developed Hyrimoz, applied for FDA approval for HCF last month, and Amgen, which developed Amjevita, is also progressing with development. Celltrion, which has obtained approval for Uplyma (CT-P17) in Europe and other regions and aims for FDA approval within the year, developed HCF as the basic formulation from the start.

Humira, developed by AbbVie, is a treatment for immune-mediated diseases such as rheumatoid arthritis, Crohn's disease, and plaque psoriasis. It was a blockbuster drug ranked number one in global sales for nine consecutive years until 2020. Last year, its sales reached $20.7 billion (approximately 27 trillion KRW), losing the top spot to Pfizer’s COVID-19 vaccine Comirnaty, which earned $36.8 billion (approximately 48 trillion KRW), but it is expected to regain the number one position next year.

Biosimilars have already been launched in Korea, Europe, and other regions, but Humira still dominates the U.S. market. Although the substance patent expired in 2016, AbbVie delayed the launch through patent disputes, and most biosimilars have agreed to launch next year. According to FDA standards, seven products including Amjevita, Cyltezo (Boehringer Ingelheim), Hyrimoz, Hadlima, Abrilada (Pfizer), Hulio (Viatris), and Yusimry (Coherus) have been approved and are preparing for launch next year. Celltrion is also proceeding with approval procedures aiming for a July launch of Uplyma next year. Additionally, LG Chem, which developed Adalimumab BS MA together with its Japanese partner Mochida, is preparing for domestic launch following approval in Japan last year.

Developers are also focusing on approval for interchangeable biosimilars. Due to the nature of biologics, which are difficult to produce identically, biosimilars demonstrate ‘similarity’ rather than equivalence. This is why cross-prescription of biosimilars, unlike generics (synthetic drug copies), is not allowed.

However, if a biosimilar is designated as interchangeable, pharmacists can substitute it, and even if the original developer tries to maintain market share by expanding indications, extrapolation to other indications of the original drug is possible, allowing easier response. However, the FDA has recognized only two interchangeable biosimilars so far: Cyltezo and Semglee (a Lantus biosimilar).

This is also why Celltrion, which has not yet received FDA approval, is actively pursuing interchangeable biosimilar approval. Celltrion recently submitted a global Phase 3 clinical trial plan to the FDA for the interchangeable biosimilar approval of Uplyma. Samsung Bioepis has also started a Phase 4 clinical trial in Europe, including the Czech Republic, to evaluate interchangeability with Humira.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.