KCCI Survey... Expected 2.8% Average Decline Compared to H1

Decreased Demand from China and US, Increased Raw Material Costs... Weakened Price Competitiveness

Policy Tasks: Securing Supply Chains, Diversifying Exports, Strengthening Trade Strategies

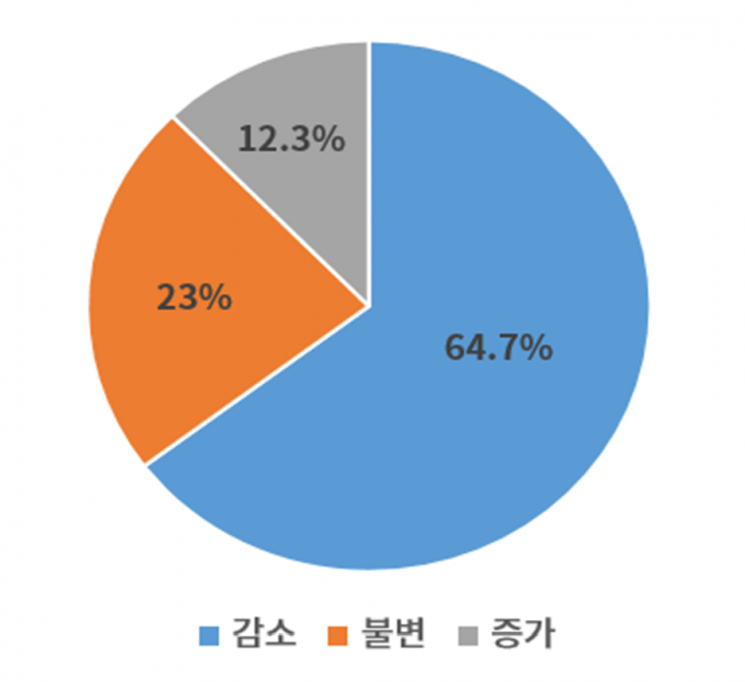

Export outlook for the second half of the year compared to the first half, surveyed by the Korea Chamber of Commerce and Industry among 300 domestic export companies. Data provided by the Korea Chamber of Commerce and Industry

Export outlook for the second half of the year compared to the first half, surveyed by the Korea Chamber of Commerce and Industry among 300 domestic export companies. Data provided by the Korea Chamber of Commerce and Industry

[Asia Economy Reporter Choi Seoyoon] There is a forecast that our exports in the second half of this year will decrease compared to the first half. The decline in demand from China and the United States, as well as the rise in raw material prices, are cited as causes. This means that despite unprecedented export growth, the trade deficit will continue to accumulate.

The Korea Chamber of Commerce and Industry (KCCI) announced on the 17th that in the ‘Export Outlook and Policy Tasks Survey in Response to Changes in the External Environment’ conducted on 300 domestic export companies, 64.7% of respondents answered that ‘exports in the second half of this year will decrease compared to the first half.’ The average forecasted change rate for exports in the second half is expected to decrease by 2.81% compared to the first half.

Among the companies forecasting a decrease in exports, 44.3% cited the ‘China Risk,’ indicating a decline in demand from major target countries such as China, as the reason for the decrease. This was followed by the shock of rising parts and raw material prices (37.6%) and supply chain crises (18.1%).

In fact, a survey of companies operating in China showed that 72.1% expected ‘exports to decrease in the second half.’ The export change forecast also showed an average decrease of 5.32% compared to the first half. This is a larger decline than in other countries and regions. By industry, the home appliances sector (-6.67%) showed the largest decrease, followed by textiles and clothing (-5.86%), steel (-4.32%), shipbuilding and plant (-0.3%), and pharmaceuticals and medicines (-0.67%).

China’s economic growth rate plunged from 4.8% in the first quarter to 0.4% in the second quarter. China’s export growth rate also sharply declined to 14.2% in the first half of this year compared to 38.5% in the same period last year. The Bank of Korea forecasted that “not only is consumption and employment recovery in China slow, but there is also a possibility of long-term export slowdown, making rapid economic recovery difficult.”

Regarding the second cause, parts, the KCCI analyzed that “existing supply chains are blocked, and raw material prices have surged, causing supply instability and cost burden issues.” The ‘CRB’ (Commodity Research Bureau) index, which averages the prices of 19 raw materials, peaked at 351.25 on June 9. This is a 42% increase compared to the beginning of this year.

Although it later showed a downward trend and dropped to the high 200s, as of the 15th, it stood at 309.76, which is 82.17 points higher than the same period last year (227.59). The KCCI forecasted that “the Ukraine crisis has unsettled raw material prices, and abnormal weather events affecting major grain-producing regions worldwide will act as factors of instability for grain and raw material prices.”

The supply chain crisis was also mentioned. Due to the ‘global logistics shortage’ caused by COVID-19 combined with the prolonged Russia-Ukraine war, our companies are facing great difficulties such as raw material supply difficulties, delays in maritime and air logistics, and soaring costs. Maritime freight rates have risen 3.9 times compared to January 2020, and during the same period, air freight rates on the Hong Kong-North America route increased 2.7 times.

The export outlook for next year is also bleak. 66% of survey respondents answered that exports will ‘decrease more than this year,’ while only 15.7% said exports would ‘increase.’ Lee Sungwoo, head of the International Trade Division at KCCI, said, “Our companies are very worried about exports in the second half. Since a decrease in exports will negatively affect our economy, the government should create an environment that can alleviate companies’ concerns even slightly and prepare long-term support measures to boost export vitality.”

The government’s external policies desired by our companies were in the order of ▲strengthening economic security such as securing global supply chains (37.3%) ▲supporting export diversification such as entering new markets (26.1%) ▲strengthening trade strategies such as expanding bilateral and multilateral free trade agreements (25.3%) ▲analyzing trade structures with major export target countries and fostering strategic industries (11.3%).

The number one country to focus cooperation on for supply chain diversification was the United States (47.3%). The KCCI explained, “This is because the U.S. is perceived as a stable supply source possessing resources and advanced technology.” China ranked second (33.7%), followed by Europe (15.3%) and the Middle East and Africa (13.0%).

Companies also showed a positive attitude toward participating in the U.S.-led ‘Chip4 Alliance.’ Only 5.3% responded that ‘they should not participate.’ However, 41.3% of companies said ‘it is better to participate but postpone for now,’ indicating a more cautious approach. The reason for participation was the expectation that they could gain an advantage in the supply chain restructuring process (50.0%), and many companies recognized that semiconductor supply chain cooperation is most important (41.9%).

Woo Taehee, Executive Vice Chairman of KCCI, said, “Our companies agree on the importance of the semiconductor supply chain and support participation in the Chip4 Alliance itself,” but added, “The government should thoroughly survey companies’ opinions and prepare a membership strategy reflecting them to ensure that no disadvantages occur to our companies upon joining.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.