August Nationwide Index 69.6... Up 1.3 Points from Previous Month

"Supply Measures Expected to Contribute to Housing Stabilization"

July Occupancy Rate 79.6%, Down 2.7% from June

Top Reason for Non-Occupancy: 'Delay in Selling Existing Homes'

[Asia Economy Reporter Hwang Seoyul] Expectations that the government’s supply measures announced the previous day will help stabilize the housing market have led to a slight improvement in the apartment move-in outlook for August. However, buying sentiment remains subdued, with 'delays in selling existing homes' identified as the top reason for non-occupancy last month.

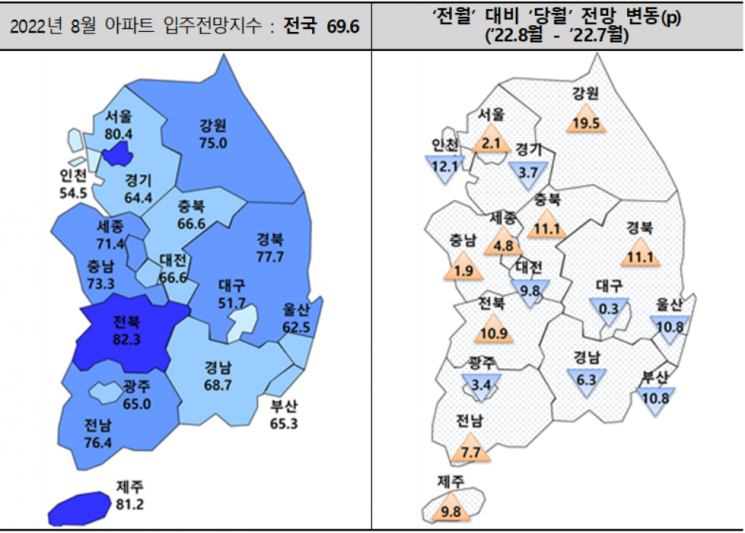

According to the Korea Housing Institute (KHI) on the 17th, the nationwide apartment move-in outlook index for August is expected to improve by 1.3 points to 69.6 compared to last month’s 68.3. The Seoul metropolitan area is expected to worsen by 4.6 points (71.0→66.4), metropolitan cities by 5.1 points (68.8→63.7), while other provinces are expected to improve by 8.3 points (66.9→75.2).

The apartment move-in outlook index was developed to proactively respond to changes in the housing supply market and is surveyed among members of the Korea Housing Association and the Korea Housing Builders Association.

KHI analyzed that although "concerns over economic recession due to interest rate hikes and increased loan costs have dampened homebuyers’ sentiment, causing the nationwide move-in outlook index to fall below the 70-point mark," the slight improvement reflects "expectations that the 'National Housing Stability Plan,' which includes a five-year supply plan of 2.7 million homes, will contribute to stabilizing the housing market."

Despite the partial lifting of adjustment target areas and speculative overheated districts, Daegu (52.0→51.7), Daejeon (76.4→66.6), and Gyeongnam (75.0→68.7) are expected to see further deterioration in move-in outlook. Meanwhile, Jeonnam (68.7→76.4) and Gyeongbuk (66.6→77.7) are expected to improve.

The occupancy rate in July was 79.6%, down 2.7% from the previous month. Reasons for non-occupancy were delays in selling existing homes (40.0%), failure to secure final payment loans (28.0%), and failure to secure tenants (26.0%). KHI stated that "to prevent a decline in occupancy rates, measures such as revitalizing housing transactions, strengthening loan support for the housing non-owners, and easing the Debt Service Ratio (DSR) regulations are necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.