[Asia Economy Reporter Minji Lee] Walt Disney has announced earnings that exceeded market expectations, and there are forecasts that the performance improvement trend will continue. Despite a limited operating environment, strong demand is being sustained, leading experts to say that the investment appeal has increased.

On the 14th, Walt Disney's stock price rose 3.3% to $121.57. Over the past week, the stock price surged more than 12%, which is analyzed as an expansion of investor sentiment following the solid earnings announcement.

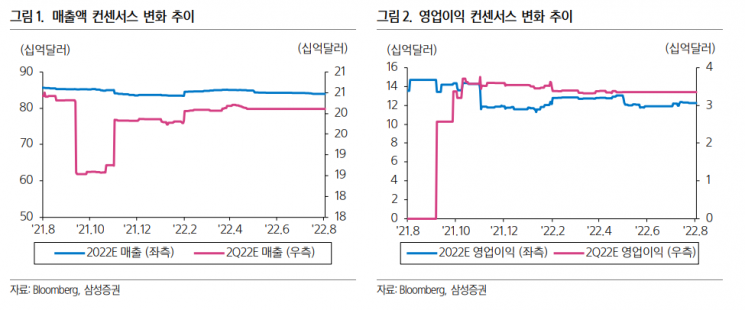

In the third quarter (April to June), Walt Disney's revenue was $21.5 billion, a 26.3% increase compared to the same period last year. Non-GAAP operating income was $3.57 billion, growing 49.7% during the same period. Net income was $1.41 billion, up 53%. Both revenue and net income exceeded market consensus.

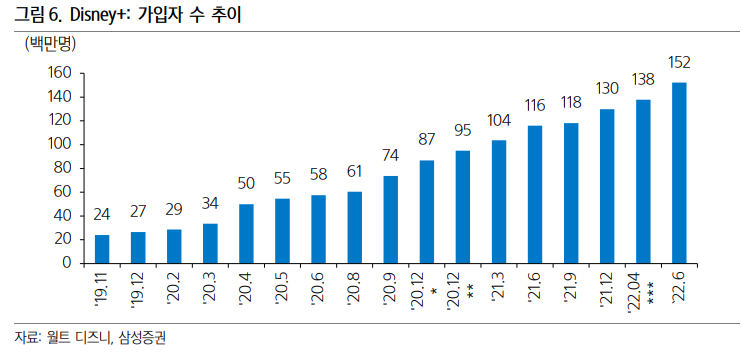

Looking at revenue by business segment, the 'Media & Entertainment' segment recorded $14.11 billion, an 11.3% increase year-over-year. Non-GAAP operating income was $1.38 billion, a 31% decline during the same period. This was due to investments related to the DTC (Disney+, Hulu, ESPN+) business and increased programming and production costs. Disney+ paid subscribers increased by 14.4 million to 152 million, reaching the market expectation level (!148 million), which was better than concerns.

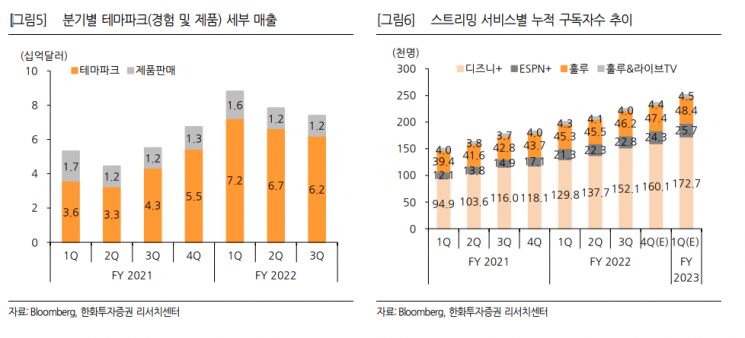

The segment that drove the third-quarter earnings was the 'Disney Parks, Experiences and Products' division, with revenue of $7.39 billion, a 73% increase year-over-year. Non-GAAP operating income surged 514% to $2.19 billion. This was due to strong demand for U.S. theme parks and resorts, mainly from domestic customers. Theme park attendance revenue was $5.42 billion, a 104.3% increase compared to the same period last year. Per capita spending by visitors increased by 10% compared to Q3 2021 and by more than 40% compared to 2019.

Theme park revenue outside the U.S. was $790 million, showing a high growth rate of 49.8% during the same period. Outside the U.S., Shanghai Disneyland was open for only 3 business days due to China's lockdown. The company stated that the revenue increase from Disneyland Paris offset this, and it expects this revenue growth from Disneyland Paris to continue into the fourth quarter.

Customer products revenue was $1.18 billion, a 2.1% increase year-over-year. Jaegoo Kang, a researcher at Hanwha Investment & Securities, explained, “Although it did not show a higher growth rate compared to theme parks, it accounts for about 16% of the segment's revenue this quarter,” adding, “There are still restrictions on the number of visitors due to the lingering effects of COVID-19.”

A notable point is the announced subscription fee increases for streaming services. ESPN+ will raise its monthly fee starting August 23, Hulu on October 10, and Disney+ on December 8. Disney+ will also launch an ad-supported tier with the subscription fee remaining the same as the current price. Eunjeong Park, a researcher at Samsung Securities, said, “Disney appears to be aiming for revenue growth through price increases and securing advertising revenue to improve profitability,” adding, “Disney's content competitiveness is solid, and Disney+ is expanding its subscriber base by increasing the number of service countries, making it highly likely to become the winner in the streaming market.”

However, it is disappointing that the 2024 streaming subscriber guidance was lowered. The forecast was reduced by 15 million from the previous range to 215 million to 245 million, which is presumed to be due to the failure to renew the IPL broadcasting rights contract. The Disney+ guidance of 135 million to 165 million subscribers was maintained. Kihoon Lee, a researcher at Hana Securities, analyzed, “Efforts to strengthen investment in various forms of local originals such as BTS content and bundle-focused growth with ESPN+ will continue,” adding, “The trend toward returning to profitability in 2024 remains valid.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)