Bank of Korea Governor Lee Chang-yong is striking the gavel at the Monetary Policy Committee plenary meeting held at the Bank of Korea in Jung-gu, Seoul on the 13th. Photo by Jinhyung Kang aymsdream@

Bank of Korea Governor Lee Chang-yong is striking the gavel at the Monetary Policy Committee plenary meeting held at the Bank of Korea in Jung-gu, Seoul on the 13th. Photo by Jinhyung Kang aymsdream@

[Asia Economy Reporter Minji Lee] There is an analysis that heavy rain could stimulate agricultural product prices and cause inflation to rise more than expected, potentially prompting the Bank of Korea to raise interest rates further.

On the 13th, KB Securities analyzed that if domestic inflation rises more than expected due to heavy rain and the early Chuseok schedule, or if the peak period is delayed, the Bank of Korea may consider additional base rate hikes, potentially raising the final base rate to 3.00~3.25%.

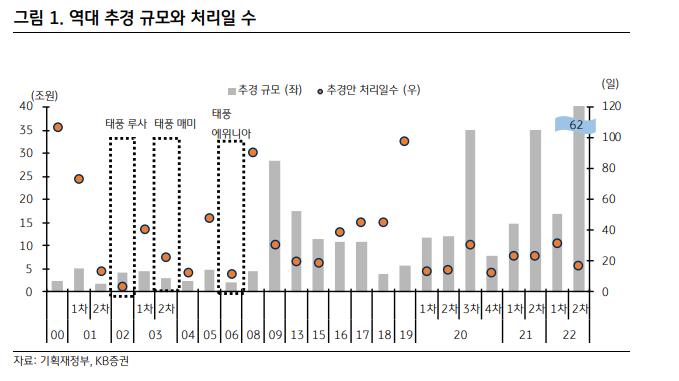

Given the record-breaking heavy rain in 115 years, the possibility of a supplementary budget is also increasing. There have been experiences of implementing supplementary budgets due to natural disasters in 2002, 2003, and 2006. Considering the current economic scale, if a supplementary budget of a similar size to the past is prepared, it is expected to range from at least 4.7 trillion won to nearly 12 trillion won. However, since most of the damage from this heavy rain is concentrated in the Seoul metropolitan area and the damage to crops is not significant, the decision to prepare a supplementary budget remains uncertain. The recent crop flooding damage caused by heavy rain covers 305 hectares, which is significantly less compared to 232,000 hectares in 2002 and 35,000 hectares in 2006.

Hainhwan KB Securities researcher said, “Even if a supplementary budget is mentioned, the time until final approval will be short, so the period during which the bond market is affected will be brief,” adding, “Typhoon Rusa in 2002 took 4 days, and Typhoon Maemi in 2003 took about 23 days.”

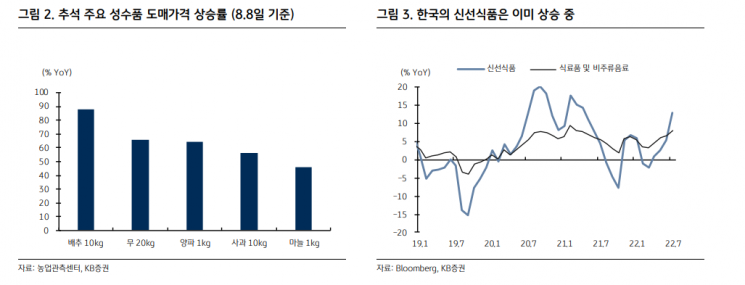

More importantly than the supplementary budget is inflation. Consumer prices in July rose by 6.3%, marking the highest level since the IMF financial crisis, significantly exceeding the Bank of Korea’s inflation target. In this situation, the fresh food price index in July increased by 13% year-on-year. Prices of fresh food could rise further due to heavy rain. Moreover, with rain forecasted until next week and this year’s Chuseok falling relatively early from September 9 to 12, if crop damage expands, agricultural product prices could be further stimulated.

In 2002, a typhoon occurred before Chuseok, causing fresh food prices to rise sharply, and in 2003, a typhoon during Chuseok led to an increase in fresh food prices after Chuseok, pushing inflation higher.

Researcher Hainhwan analyzed, “Most forecasting institutions, including the Bank of Korea, expect Korean inflation to peak in the third quarter. However, if domestic inflation rises more than expected or the peak is delayed due to heavy rain and Chuseok, the Bank of Korea may consider additional base rate hikes.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)