Hong Kong Investment Firm to Inject 5 Trillion Won Over 2 Years

Goldman Sachs and Others Bid on Building Deals

Ultra-Low Interest Rates and Yen Depreciation

Boost Real Estate Investment Returns

Recently, a large influx of global major investors' funds has been pouring into the Japanese real estate market. This is because the Bank of Japan (BOJ), Japan's central bank, has maintained its ultra-low interest rate policy, making it possible to purchase assets at low prices amid the yen hitting its lowest value in 24 years.

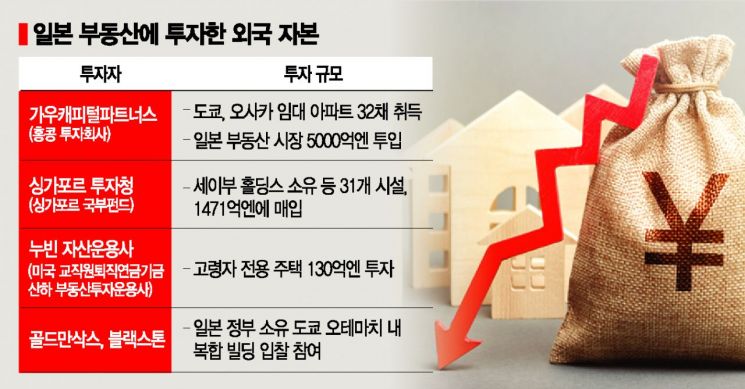

According to the Nihon Keizai (Nikkei) newspaper on the 12th, Hong Kong investment firm Gau Capital Partners plans to inject about 500 billion yen (approximately 4.9113 trillion KRW) into the real estate market over the next two years.

This amount is more than six times the funds Gau Capital Partners invested over the past two years. Having already purchased 32 rental apartments in Tokyo and Osaka all at once earlier this year, Gau Capital Partners plans to expand its investment targets to office buildings and data center facilities.

Singapore's sovereign wealth fund, the Government of Singapore Investment Corporation (GIC), also purchased 31 facilities, including hotels, from Seibu Holdings, the holding company of Japan Railways, for 147.1 billion yen.

Investment funds are also flowing into senior citizen-exclusive housing. Nihon Keizai reported that Nuveen Asset Management, a real estate investment management company under the U.S. Teachers Insurance and Annuity Association (TIAA), expects demand for senior citizen-exclusive housing to increase due to aging and plans to invest 13 billion yen in such housing.

Earlier this year, Goldman Sachs and Blackstone, the largest U.S. private equity firm, participated in a bidding for a government-owned building located in Otemachi, Tokyo. Saburo Nishiura, president of Japanese real estate company Puric, stated, "90% of recent bids have been submitted by foreign companies."

The reason foreign companies have recently been enthusiastic about purchasing Japanese real estate is analyzed to be due to the ultra-low interest rates and the depreciation of the yen, which have increased real estate investment returns.

Despite the interest rate hikes by major countries such as the U.S., the BOJ has maintained its "solo low interest rate" stance. As a result, the interest rate gap between the U.S. and Japan has widened, and with increased raw material imports leading to a larger current account deficit, the yen's value has fallen to the 133 yen per dollar range. Last month, it dropped to 138 yen per dollar, marking the lowest level in 24 years. Overseas investors holding dollars can now purchase real estate at cheaper prices than before.

Katsumi Nakamoto, president of the European real estate investment company Patricia Japan, explained to Nikkei, "With low interest rates, borrowing costs for purchasing real estate are lower, allowing for higher investment returns than before."

The downward trend in Japanese real estate prices due to low interest rates and yen weakness is also reflected in indicators. According to Nikkei, the dollar-denominated real estate price index calculated by Morgan Stanley MUFG Securities based on the Ministry of Land, Infrastructure, Transport and Tourism's commercial real estate price index (2010 average = 100) stood at 104.4 as of the end of March, marking the lowest level since the Lehman Brothers crisis. The estimated figure as of the end of June is 93, approaching the lowest level recorded in 2014 since the survey began.

However, experts have issued warnings that the foreign companies' spree of buying up properties could potentially lead to losses. President Nishiura stated, "Although office building rents in city centers are declining, sales prices are not falling due to the bidding frenzy by foreign companies," adding, "While the investment is based on yen weakness, there are some concerns about a slight bubble."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)