Portfolio Rebalancing This Year... Reducing Securities Stocks and Increasing Food & Beverage

Focusing on Ultra-Safe Assets with Guaranteed Minimum Returns

[Asia Economy Reporters Seon-ae Lee and Soyeon Park] The National Pension Service (NPS), a major player in the domestic stock market, is being evaluated as successfully defending its returns by significantly adjusting its portfolio to cope with inflation. This includes adjusting its stock portfolio by reducing securities stocks and increasing food and beverage stocks, as well as substantially increasing investments in ‘Super-Core’ assets, which guarantee minimum returns, starting a year ago to prepare for inflation.

Holding Up Returns with Inflation-Defensive Stocks

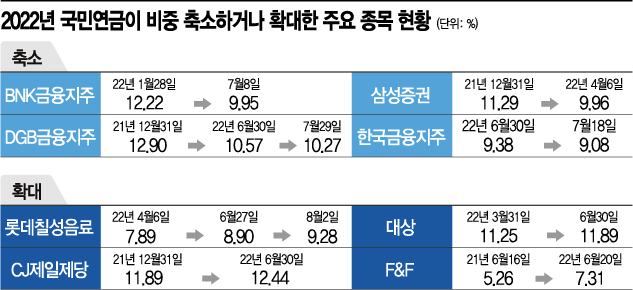

According to the Financial Supervisory Service’s electronic disclosure system on the 11th, the NPS has significantly increased its holdings in the food and beverage sector and consumer goods such as fashion this year. The stake in CJ CheilJedang, a leading food and beverage company, expanded from 11.89% at the beginning of the year to 12.44% as of the end of June. The stake in Lotte Chilsung Beverage also increased from 7.89% in April to 9.28% in August. The NPS also increased its holdings in fashion companies such as F&F, which owns brands like Hyundai Department Store, MLB, and Discovery, as well as in Daesang.

On the other hand, securities and financial stocks were continuously reduced. DGB Financial Group’s stake decreased from 12.90% at the start of the year to 10.27% by July. BNK Financial Group also reduced its stake from 12.22% in January to 9.95% in July. The shareholding ratios of Korea Financial Group and Samsung Securities were also cut by 1 to 2 percentage points. An industry insider said, "Although the NPS’s domestic stock investment return rate was -7.7% through May this year, considering the market downturn, it can be seen as a relatively good performance. Reducing the proportion of securities stocks, which are expected to see overall performance declines this year, and expanding defensive stocks amid growing recession concerns is a sufficiently rational investment decision, actively responding to changes in the market environment."

Predicting Inflation a Year Ago, Increasing ’Super-Core‘ Assets by 3 Trillion Won

Additionally, the NPS predicted inflation conditions starting last year and significantly expanded its ’Super-Core‘ assets. Super-Core assets are ultra-safe assets guaranteed to provide minimum returns through government guarantees from various countries.

As of the end of 2021, the NPS invested 6.9158 trillion won in core assets. This accounts for 24.8% of the NPS’s total infrastructure asset investments. At the end of 2020, the NPS’s core asset investments were 4.1332 trillion won (16.6%), meaning approximately 3 trillion won was additionally invested within one year. The proportion of core assets in total infrastructure investments increased by 8.2 percentage points. A representative example of core infrastructure asset investment is the investment in Portugal’s largest highway operator, jointly executed by the Dutch pension fund APG and the NPS. Concerns about inflation have been steadily raised for over a year, and the Fund Management Headquarters reorganized internal investment processes to facilitate core asset investments in preparation for such conditions.

Since last year, the NPS has expanded asset investments focusing on regulated assets located in advanced countries, which are subject to government regulations or long-term contracts with high-quality counterparties that allow defense against demand and price volatility risks and inflation. These assets include social essential service infrastructures such as roads, transportation, and ports, where governments grant operating licenses or guarantee a certain level of revenue and usage fees to investors, providing stable returns.

An NPS official stated, "We will continue to strive to secure investment opportunities in high-quality assets expected to provide long-term stable returns, such as commitments and co-investments in core funds launched by leading global asset managers in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.