Top 500 Large Company CEOs Sold 227 Billion KRW of Their Own Shares This Year... Three Times the Purchase Amount

Highest Purchase: Hanguk BNC... Highest Sale: Korea Center

[Asia Economy Reporter Kim Pyeonghwa] As stock prices have notably declined this year, cases of large corporation CEOs selling their own company shares have continued. The amount sold this year has exceeded three times the amount purchased, reaching 227 billion KRW. This has been criticized as a sign of distancing from responsible management.

CEO Score, a corporate data research institute, announced on the 10th that, based on an investigation of the shareholding status of CEOs of the top 500 companies by market capitalization from January to July, the proportion of shares sold exceeded that of shares purchased. According to the survey, the amount of company shares sold by these CEOs during this period was 227.016 billion KRW. The amount purchased during the same period was 70.9 billion KRW, about one-third of the sales.

Among the top 500 large corporations, the amount sold by owner-CEOs reached 208.018 billion KRW, accounting for 91.6% of the total, representing the majority. The amount sold by professional CEOs was 18.998 billion KRW (8.4%).

Individually, Kim Gi-rok, CEO of Korea Center, sold the largest amount of company shares worth 88.662 billion KRW, accounting for 39.1% of the total sales. In March, Kim sold 8,525,149 shares to Korea E-commerce Holdings (MBK) to raise funds for acquiring Danawa, an online shopping brokerage company.

Following him were ▲ Kim Gi-byeong, CEO of Lotte Tour Development (39.24 billion KRW) ▲ Ham Young-jun, CEO of Ottogi (38.446 billion KRW) ▲ Choi Wan-gyu, CEO of Korea BNC (27.54 billion KRW) ▲ Kim Do-hyung, CEO of Notus (10.578 billion KRW) ▲ Park Sang-woo, CEO of NK Max (9.653 billion KRW), who also sold significant amounts of company shares. Kim Gi-byeong sold shares to fund the Jeju Dream Tower Bogap Resort project, and Ham Young-jun sold shares to fully pay inheritance tax. Park Sang-woo, CEO of NK Max, explained that "a repurchase agreement stock transaction was conducted to raise 5.985 billion KRW in funds."

The total number of shares purchased during the same period was 3,443,520 shares, worth 70.9 billion KRW. Owner-CEOs purchased 3,079,556 shares, accounting for 89.4% of the total. Professional CEOs purchased 363,946 shares, representing 10.6%.

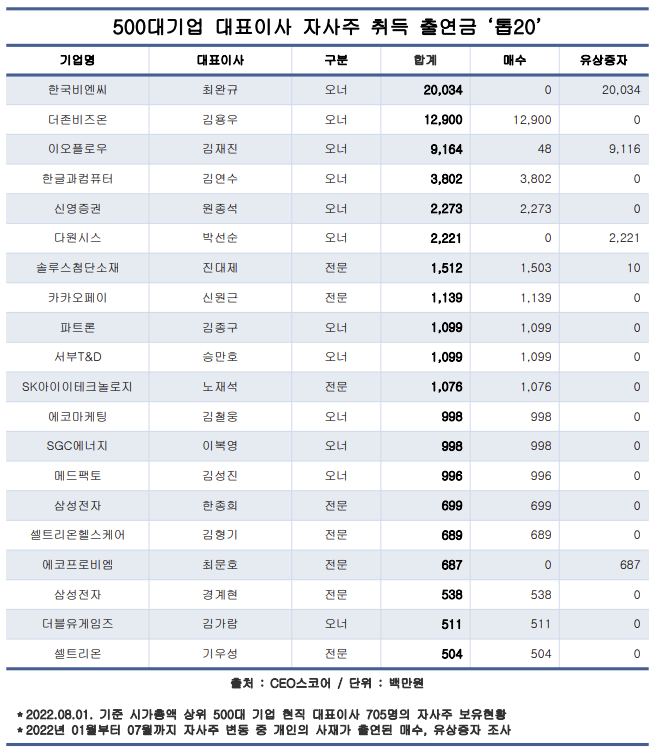

Individually, Choi Wan-gyu, CEO of Korea BNC, recorded the largest purchase amount. In mid-March, Choi participated in a paid-in capital increase and purchased 1,669,492 shares, investing 20.034 billion KRW. This accounted for 28.3% of the total company share purchases.

Following him were ▲ Kim Yong-woo, CEO of Douzone Bizon (12.9 billion KRW) ▲ Kim Jae-jin, CEO of iOFlow (9.164 billion KRW) ▲ Kim Yeon-su, CEO of Hangul and Computer (3.82 billion KRW) ▲ Won Jong-seok, CEO of Shin Young Securities (2.273 billion KRW) ▲ Park Seon-soon, CEO of Dawonsys (2.221 billion KRW) ▲ Jin Dae-je, CEO of Solus Advanced Materials (1.512 billion KRW), who also purchased significant amounts of company shares.

CEO Score commented, "Although large corporation CEOs sold a large volume of company shares worth 230 billion KRW, the scale of share purchases did not even reach 71 billion KRW, about one-third of the sales amount. Many CEOs claimed they would take responsible management by standing by performance despite stock price declines, but it ultimately amounted to lip service."

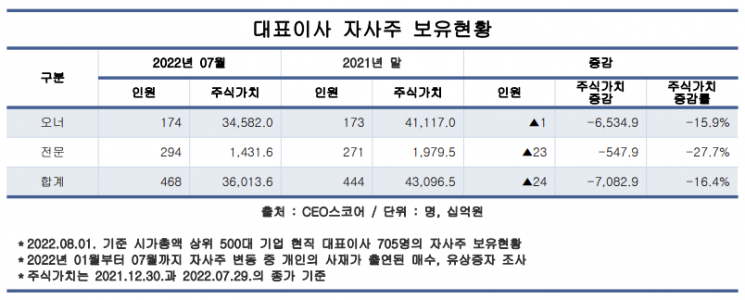

CEO Score also reported that among 705 incumbent CEOs of large corporations holding company shares, 468 held shares, accounting for 66.4%. The number of CEOs holding company shares increased by 24 (5.4%) from 444 at the end of 2021 to 468 this year. However, the value of their holdings decreased by 16.4% (7.829 trillion KRW) from 43.0965 trillion KRW to 36.0136 trillion KRW during the same period. This was due to the KOSPI index plunging 526.15 points (17.7%) from 2,977.65 to 2,451.50 during that period.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.