Samsung Electronics Falls 2% Back to 50,000 Won Range, SK Hynix Also in 90,000 Won Range

DXI Index Declines for 7 Consecutive Weeks... Securities Firms Lowering Forecasts One After Another

Global Semiconductor Companies Cut Investments, Equipment Firms Also Affected

[Asia Economy Reporter Minji Lee] As global semiconductor companies have repeatedly warned that the semiconductor market will experience a harsh winter in the second half of the year, investor sentiment toward Samsung Electronics and SK Hynix is rapidly cooling. Due to the economic downturn, front-end demand has sharply decreased, leading to an oversupply of semiconductor inventory. Additionally, participation in the U.S.-led ‘Chip4’ alliance, whose benefits remain unclear, is pushing the situation toward a need to brace for Chinese sanctions. On top of this, global semiconductor companies have mentioned plans to reduce investment due to deteriorating earnings, causing semiconductor equipment companies to also feel uneasy.

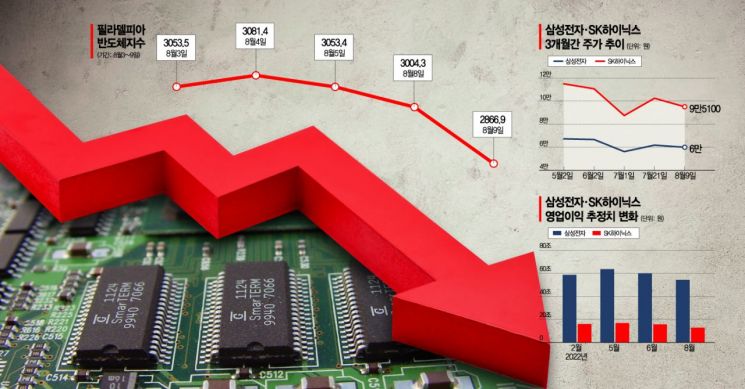

As of 10:30 a.m. on the 10th, Samsung Electronics was trading at 58,800 KRW, down 2% from the previous trading day, and SK Hynix was at 92,300 KRW, down 2.94%. Since foreign investors began buying on the 1st of last month, Samsung Electronics’ stock rose from 56,200 KRW to the 62,000 KRW range, but it has fallen more than 5% in the past week, dropping back to the 50,000 KRW level. SK Hynix also seemed to continue its upward trend after surpassing the 100,000 KRW mark but soon fell back to the low 90,000 KRW range.

The earnings warnings from global semiconductor companies dealt a direct blow. Following guidance revisions by NAND manufacturer Western Digital and the U.S. semiconductor market cap leader Nvidia, Micron, the largest memory semiconductor manufacturer, also significantly lowered its revenue forecast yesterday. Initially, Micron projected Q2 revenue between $6.8 billion and $7.6 billion, but now expects it to be even lower. The main reason is the sharp decline in demand for IT semiconductors used in PCs, smartphones, and other front-end products due to prolonged inflation and a global economic downturn. The market has evaluated this as a shockingly severe adjustment, with the Philadelphia Semiconductor Index, which reflects the stock prices of major semiconductor companies, dropping more than 4% in a single day.

Lee Seung-woo, Research Center Director at Eugene Investment & Securities, explained, "The additional downward revision of guidance indicates that the impact of demand slowdown and inventory adjustments could spread beyond PCs and smartphones to cloud and industrial sectors. Especially, the strong memory demand in the first half of the year was essentially driven by inventory buildup, so memory semiconductor companies will be more heavily affected by the dual challenges of demand slowdown and inventory adjustments."

Key indicators that gauge the semiconductor market sentiment also reflect concerns. The DXI index, which tracks memory semiconductor market conditions and price trends, has been declining for seven consecutive weeks, dropping over 1% in the past week and more than 7% over the past month. DRAM prices for Q3 have already fallen more than 13% compared to the previous quarter. Market research firm TrendForce forecasts next year’s DRAM demand and supply bit growth (shipment growth rate converted to bit units) at 8.3% and 14.1%, respectively, predicting a steeper decline in DRAM prices.

Securities experts have already downgraded earnings forecasts for Samsung Electronics and SK Hynix. Samsung Electronics’ annual operating profit estimate currently stands at 54.2895 trillion KRW, down 15% from 63.695 trillion KRW three months ago. SK Hynix’s forecast dropped 24%, from 16.8276 trillion KRW to 12.8179 trillion KRW. However, considering the elevated inventory levels (Samsung Electronics 11 weeks, SK Hynix 10 weeks) compared to healthy inventory days (4 weeks) and demand slowdown, further adjustments seem inevitable.

Participation in ‘Chip4’ is also viewed negatively. Chip4 is an alliance led by the U.S. aiming to exclude China from the semiconductor supply chain and has become a flashpoint in U.S.-China tensions. Although China, which imports most of its memory semiconductors, cannot immediately impose direct regulations on domestic companies (which account for 45% of the market share), indirect regulations on factories within China could increase companies’ cost burdens. Moreover, since Chip4 focuses on strengthening the production and technological capabilities of U.S. companies like Micron and Intel, it is unlikely to bring significant benefits to domestic companies. Do Hyun-woo, a researcher at NH Investment & Securities, explained, "Regardless of whether Korea participates in the U.S.-conceived Chip4, it will negatively affect domestic semiconductor companies’ stock prices. The benefits of Chip4 will concentrate on U.S. companies. China is the largest market, accounting for 74.8% of Korean memory semiconductor exports, so concerns about retaliation are high."

As global semiconductor companies continue to reduce investments, semiconductor equipment companies’ earnings are expected to shrink. Samsung Electronics and SK Hynix are also reportedly considering postponing, adjusting the timing, or scaling down their original plans. However, from a long-term perspective, since the U.S. has expressed intentions to concentrate semiconductor capabilities domestically, equipment companies capable of local production systems may benefit. Kim Jang-yeol, Research Center Director at Sangsangin Securities, advised, "For companies with diverse customers and production capacity that can expand investment plans with Micron and Intel, mid- to long-term bottom-fishing could be effective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman Who Jumps Holding a Stolen Dior Bag... The Mind-Shaking, Bizarre Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)