Household Loans Decrease for the First Time in July Due to Interest Burden

Corporate Loans Surge Amid Weak Corporate Bond Issuance

Due to the Bank of Korea's base interest rate hike and other factors, bank household loans turned to a decline last month. This is the first time since statistics began that bank household loans decreased as of July. On the other hand, bank corporate loans increased by more than 12 trillion won, marking the largest increase ever.

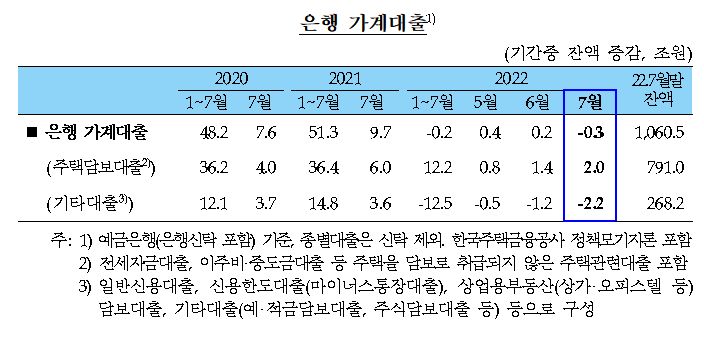

According to the 'Financial Market Trends in July' announced by the Bank of Korea on the 10th, bank household loans (including policy mortgage loans) decreased by 300 billion won compared to the previous month, despite an increase in housing-related loans, as other loans significantly declined last month.

Mortgage loans increased by 2 trillion won as demand for funds related to housing sales slowed, but loans for group and jeonse (long-term lease) funds increased.

However, other loans decreased by 2.2 trillion won, mainly in credit loans, due to rising loan interest rates and continued government loan regulations. This decline is larger than the 1.2 trillion won decrease in the previous month.

This is the first time since January 2004, when related preliminary statistics began to be compiled, that bank household loans have decreased as of July.

Hwang Young-woong, Deputy Head of the Market General Team at the Bank of Korea's Financial Market Department, said, "Since the second half of last year, the Bank of Korea's continued interest rate hike stance appears to have generally influenced the decrease in loans. However, we need to observe a bit more regarding the impact of the big step (a 0.50 percentage point increase in the base interest rate)."

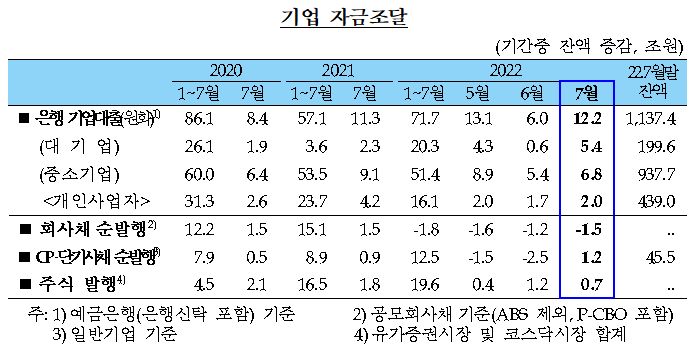

Bank corporate loans increased significantly by 12.2 trillion won last month, supported by COVID-19 financial support, demand for facility funds, banks' efforts to handle corporate loans, and seasonal factors.

This is more than double the increase in June (6 trillion won) and is also the highest ever recorded for July since preliminary statistics began in June 2009.

Loans to large corporations increased sharply from 600 billion won to 5.4 trillion won compared to the previous month, and loans to small and medium-sized enterprises also rose considerably from 5.4 trillion won to 6.8 trillion won.

Deputy Head Hwang explained the background of the increase in large corporate loans, saying, "As global financial market volatility expands, volatility in South Korea is also increasing, and in this process, direct corporate bond issuance is showing sluggishness. In response, companies seem to be increasing their use of the loan market rather than direct financing through corporate bond issuance."

Bank deposits turned to a decrease last month, dropping from 23.3 trillion won in June to -10.3 trillion won.

This was largely due to a sharp decrease in demand deposits (from 15.5 trillion won to -53.3 trillion won) caused by fund shifts to savings deposits following the base interest rate hike, the disappearance of seasonal increase factors, and corporate fund outflows for value-added tax payments.

On the other hand, time deposits (from 9.5 trillion won to 31.7 trillion won) increased significantly due to banks' efforts to attract funds to improve LCR (Liquidity Coverage Ratio) and inflows of household and corporate funds following rising deposit interest rates.

In the case of asset management company deposits, they increased from -7.1 trillion won in June to 14.5 trillion won last month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)