CXO Research Institute Analyzes Influence of 4 Major Groups from 2011 to 2020

"Failure in Foundry, Electric Vehicle, and Battery Business Restructuring Poses Risk to Korean Economy"

[Asia Economy Reporter Moon Chaeseok] It has been revealed that the four major conglomerates?Samsung, SK, Hyundai Motor, and LG?accounted for one-fifth of the Korean economy over the past decade. The fluctuation in operating profits was significant due to market conditions such as the memory semiconductor supercycle (boom). This is the result of Korea's failure to establish a structure supported by various venture companies and solid small and medium-sized enterprises (SMEs) and mid-sized companies. Experts evaluate that if these companies fail in business restructuring in foundry (semiconductor contract manufacturing), future cars, and batteries, it will have a major impact on the Korean economy.

On the 9th, Korea CXO Research Institute, a corporate analysis specialist organization, released data titled "Analysis of the Influence of the Four Major Conglomerates from 2011 to 2020." According to the survey, the total corporate sales in Korea increased by 25.2%, from 3,286 trillion won in 2011 to 4,115 trillion won in 2020. The sales of the four major conglomerates rose by 13.7%, from 684 trillion won in 2011 to 778 trillion won in 2020. Although the increase in sales of the four major corporations was smaller than the overall increase, the proportion relative to total corporations changed little. The ratio fell by 1.9 percentage points (P), from 20.8% in 2011 to 18.9% in 2020.

Among the four major conglomerates, Samsung's sales influence was overwhelmingly high. It averaged 8.2% over ten years. It peaked at 9.1% in 2012 (312 trillion won) and 2013 (318 trillion won). Hyundai Motor followed with 4.5%, SK with 4.1%, and LG with 3.2%.

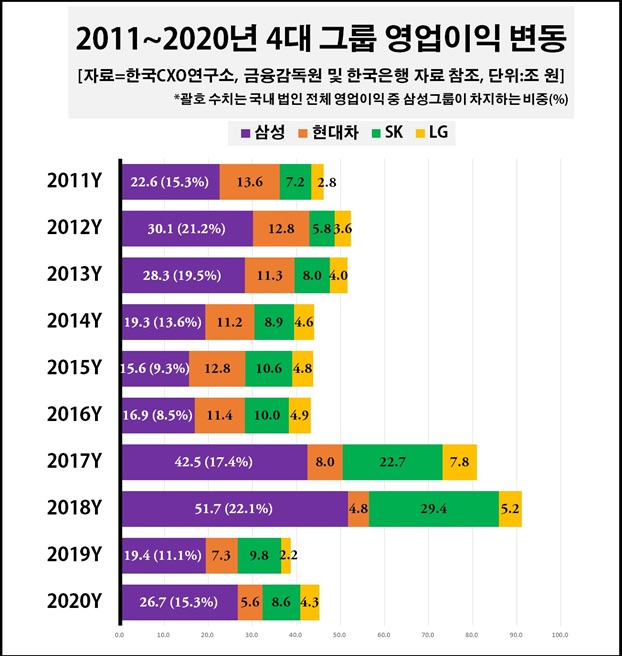

Regarding operating profits, CXO Score explained that Samsung and SK, which operate advanced information technology (IT) businesses such as semiconductors, have more favorable indicators than Hyundai Motor, which is centered on automobiles. The operating profit share of the four major conglomerates averaged 30.4% over ten years and surged to 38.9% in 2018.

It is particularly noteworthy that the shares of Samsung and SK increased in 2017 and 2018. This was during the memory semiconductor supercycle (boom) period. Samsung's share of total corporate operating profits rose from an average of 15.3% over ten years to 19.8% during the two years of 2017?2018, an increase of 4.5 percentage points. SK's share more than doubled from 12.1% to 26.1% in the same period. This also implies that the four major conglomerates or the Korean economy could be shaken by market variables such as the current global decline in memory semiconductor prices.

Oh Ilseon, director of the CXO Research Institute, pointed out, "The fact that the dependence on the four major conglomerates in the Korean economy has been almost maintained over ten years means that strengthening the national economic fundamentals through the growth of solid SMEs and venture companies has not been properly achieved. If the industrial restructuring and management of these companies in foundry, electric vehicles, and batteries are not effectively carried out, risks to the Korean economy, such as a reduction in tax revenue due to decreased corporate taxes, could expand."

The concentration phenomenon was also evident in net profits, which showed an average influence of 40.5% over ten years. However, the recent share of the four major conglomerates decreased from 44.6% in 2011 to 32.1% in 2020. Director Oh said, "For the Korean economy to leap forward, policies supporting the more active nurturing of 'aircraft carrier-like' companies like the four major conglomerates in the future are necessary. It is somewhat regrettable that even though large corporations earn substantial net profits, the profits of other companies have not increased proportionally."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.