Shrimp Crackers, the Only Single Item with 100 Billion KRW Sales

Kkobuk Chip, Sales Soar Led by New Products

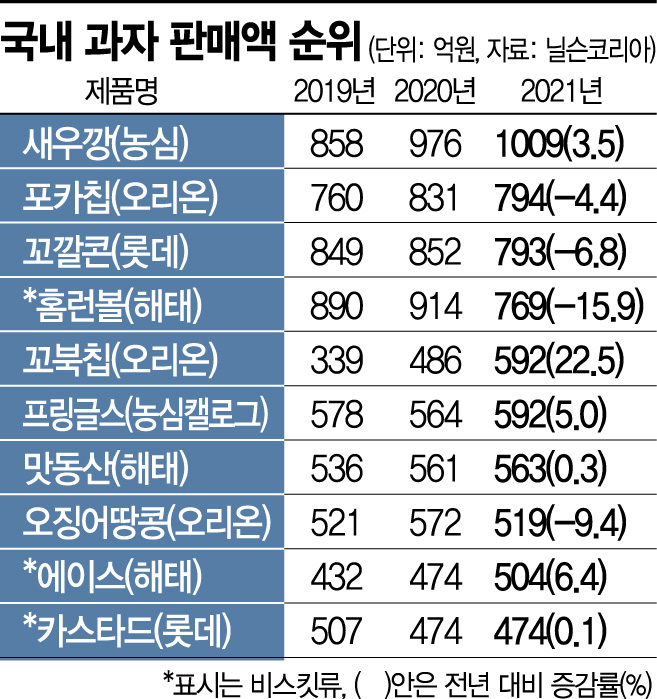

[Asia Economy Reporter Eunmo Koo] Amid the still solid position of traditional brands in the domestic snack market, Nongshim’s ‘Saewookkang’ has firmly maintained its status as the ‘national snack’ by holding the top sales crown for the third consecutive year since 2019, being the only single product to record sales exceeding 100 billion KRW.

According to market research firm Nielsen Korea on the 9th, last year Nongshim Saewookkang sold 100.9 billion KRW worth, a 3.5% increase from the previous year, making it the best-selling product in the domestic snack (snack and biscuit) market. Nongshim explained, "Saewookkang holds symbolic value as the first snack launched in Korea in 1971," adding, "The reason it has been loved for over 50 years is because it enhances flavor by using fresh shrimp and employs a unique method of baking in salt instead of frying, resulting in a crispy and savory taste."

Among the top 10 products, there were seven snack items including Saewookkang, and three biscuit items. Orion’s ‘Pocachip’ and Lotte Confectionery’s ‘Kkokkalcorn’ ranked 2nd and 3rd with sales of 79.4 billion KRW and 79.3 billion KRW respectively, while Haitai Confectionery’s ‘Home Run Ball’ sold 76.9 billion KRW, ranking 4th?the highest among biscuit products. Following these were Orion’s ‘Kkobuk Chip’, Nongshim Kellogg’s ‘Pringles’, Haitai’s ‘Matdongsan’, Orion’s ‘Ojingeo Peanut’, Haitai’s ‘Ace’, and Lotte’s ‘Custard’.

Among individual items, Orion Kkobuk Chip’s growth stood out. Entering the market with sales of 21.6 billion KRW in 2017, Kkobuk Chip continued its momentum with sales of 53.8 billion KRW the following year. Although sales dipped to 33.9 billion KRW in 2019, it successfully rebounded in 2020 with the launch of the ‘Choco Churros’ flavor, and last year set a new annual sales record of 59.2 billion KRW, a 22.5% increase from the previous year. This year, it continues aggressive market expansion by introducing the new ‘Sweet Vanilla’ flavor.

By company, Orion, led by Pocachip and Kkobuk Chip, firmly held the top spot with sales of 619 billion KRW, followed by Lotte Confectionery (393.3 billion KRW) and Haitai Confectionery (378.9 billion KRW). Meanwhile, Nongshim ranked first in the snack market with sales of 367.8 billion KRW but placed fourth in the combined ranking as it does not handle biscuit products.

The domestic snack market has shown steady growth over the past few years. According to market research firm Euromonitor, last year the domestic snack market was valued at 3.6997 trillion KRW, a 16.6% increase over five years compared to 3.1719 trillion KRW in 2016, and is expected to expand to 3.9573 trillion KRW by 2026. By segment, bagged snacks (45.3%) held the largest share, followed by biscuits (32.4%), nut mixes (9.8%), popcorn (3.6%), and snack bars (3.3%).

The industry expects the domestic snack market to continue growing steadily. As more consumers seek low-sugar and low-calorie products for health reasons, interest is rising in products that are baked instead of fried or made with whole grains and other wholesome ingredients. Additionally, the popularity of snacks for home drinking and solo drinking occasions is increasing, reflecting the diversification of consumer demand.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.