[Asia Economy Reporter Changhwan Lee] Although the loss ratio of domestic auto insurance has improved this year compared to last year, the polarization between large and small-to-medium insurers has widened. While large insurers expect a profit in auto insurance for the second consecutive year, small-to-medium insurers continue to incur losses and are reportedly considering whether to continue their business.

According to the insurance industry on the 8th, the auto insurance loss ratios of five major non-life insurers?Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, DB Insurance, KB Insurance, and Meritz Fire & Marine Insurance?were all in the 70% range in the first half of this year.

In the first half of this year, Samsung Fire & Marine Insurance's auto insurance loss ratio was 76.3%, DB Insurance's was 76.5%, Hyundai Marine & Fire Insurance's was 78.0%, Meritz Fire & Marine Insurance's was 74.1%, and KB Insurance's was 75.9%. Due to factors such as high oil prices and COVID-19 reducing vehicle traffic in the first half of this year, all five companies showed improved loss ratios compared to last year.

Insurers believe that if the auto insurance loss ratio is maintained in the low 80% range, profits can be expected. These five companies, which hold an 88% market share in the domestic auto insurance market, are expecting auto insurance profits for the second consecutive year this year following last year.

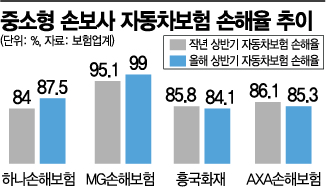

The problem lies with the small-to-medium insurers. Smaller companies have seen their situation worsen compared to last year. Hana Insurance, an affiliate of Hana Financial Group, recorded an auto insurance loss ratio of 87.5% in the first half of this year, worsening by 3.5 percentage points from 84% in the same period last year.

With auto insurance accounting for more than 60% of its total business, Hana Insurance's performance deteriorated as its auto insurance loss ratio increased. Hana Insurance posted a deficit of 21.1 billion KRW in the first half of this year.

To improve its financial structure, Hana Insurance conducted a paid-in capital increase worth 150 billion KRW targeting its parent company, Hana Financial Group, at the end of last month. Through this capital increase, it is expected to expand new businesses such as long-term personal insurance and reduce the proportion of auto insurance.

MG Insurance is in a more serious situation. MG Insurance's auto insurance loss ratio reached 99% in the first half of this year, worsening from 95.1% in the same period last year. The more auto insurance policies it sells, the more losses it incurs. The company is also facing the risk of being designated as a financially distressed institution by financial authorities, threatening the sustainability of its auto insurance business.

Heungkuk Fire & Marine Insurance and AXA Insurance saw slight improvements in their auto insurance loss ratios in the first half of this year, recording 84.1% and 85.3% respectively, compared to last year, but are still estimated to be unable to reach the break-even point.

An industry insider said, "Due to the nature of auto insurance, when the number of policyholders increases and premium income rises, the loss ratio tends to improve. Small-to-medium insurers that cannot increase their customer base may find it difficult to maintain their auto insurance business."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.