Announcement of Measures to Promote AI Utilization and Ensure Trust in the Financial Sector

Establishment of Financial AI Data Library

Exception Allowed for Network Separation in AI Development

On the morning of the 4th, Kim So-young, Vice Chairman of the Financial Services Commission, held a meeting on the use of artificial intelligence (AI) in the financial sector with industry professionals and related experts at Park Byung-won Hall, Front1, Mapo-gu, Seoul, and discussed measures to promote AI utilization and secure trust in the financial sector.

On the morning of the 4th, Kim So-young, Vice Chairman of the Financial Services Commission, held a meeting on the use of artificial intelligence (AI) in the financial sector with industry professionals and related experts at Park Byung-won Hall, Front1, Mapo-gu, Seoul, and discussed measures to promote AI utilization and secure trust in the financial sector.

[Asia Economy Reporter Song Hwajeong] Financial authorities have decided to permit the reuse of pseudonymized financial information to accumulate and continuously utilize data sets built by combining such information with other data. Additionally, exceptions to network separation regulations will be allowed so that financial companies and fintech firms can more smoothly conduct MyData businesses, AI development, and reduce costs.

On the 4th, Kim Soyoung, Vice Chairman of the Financial Services Commission (FSC), held a meeting with industry representatives and related experts to discuss measures to activate AI utilization in the financial sector and secure trust.

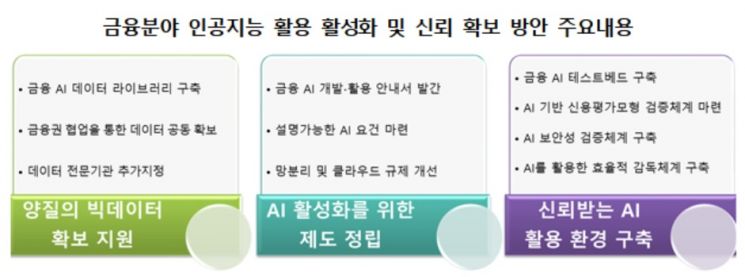

The measures announced by the FSC on the same day to promote AI utilization and secure trust in the financial sector include ▲establishing a 'Financial AI Data Library' that allows reuse of pseudonymized information ▲publishing AI development and utilization guides for five major financial sectors ▲allowing exceptions to network separation for AI development and test servers using pseudonymized information ▲building an AI testbed to support test data and computing resources ▲establishing AI-based credit evaluation models and AI security verification systems.

Since lack of quality data, institutional deficiencies, and lack of trust have been major factors hindering AI activation in the financial sector, the FSC plans to actively address these issues.

Establishing Financial AI Data Library to Secure Quality Big Data

Currently, pseudonymized information must be destroyed after achieving its intended purpose, making it difficult to build and operate large-scale data sets. To enable smooth construction and utilization of large data sets through reuse without infringing on personal information, the FSC plans to establish a 'Financial AI Data Library' that permits data combination and reuse through a regulatory sandbox. The library will be built through a consortium composed of various companies to activate data combination and utilization across different industries. The Korea Credit Information Services (KCIS), which specializes in personal information protection as a comprehensive credit information concentration agency, will lead the consortium launch within the third quarter.

Data stored in the library can be withdrawn and reused by consortium participants as needed. For example, when using data developed for credit evaluation models for industry-specific default rate analysis, credit ratings can be removed before withdrawal and use. In addition, a high-level data protection system will be established through thorough physical network separation and work separation to prevent information leakage.

Furthermore, the financial sector will jointly secure financial big data through collaboration. AI development for chatbots, fraud detection systems (FDS), and others requires large amounts of specialized data, but cost burdens related to data acquisition have made AI development difficult. Therefore, the FSC plans to build AI big data that can be jointly used by the financial sector, centered on associations and financial data infrastructure institutions. The constructed data sets will, in principle, be available for use by participating financial companies, and additional utilization plans will be reviewed through participant consultations if necessary. Additionally, more data specialized institutions will be designated to facilitate easier and smoother data combination.

Improving Network Separation and Cloud Regulations for Smooth AI Development

When developing AI services, it is common to test various AI algorithms to find and apply the algorithm optimized for the service. Therefore, external API and cloud utilization are necessary for smooth AI development and utilization. However, to ensure strict personal information protection, financial companies and fintech firms are required to physically separate their work networks (internal networks) and internet networks (external networks). This network separation regulation inevitably increased development time and costs. Moreover, complex usage procedures such as system importance evaluation and prior reporting to the Financial Supervisory Service hindered smooth cloud usage.

Considering this, the FSC will improve network separation and cloud regulations to maintain the security and stability of electronic finance while facilitating AI development and utilization by financial companies. Exceptions to physical network separation will be allowed through regulatory sandboxes for development and test servers using pseudonymized information to enable smoother use of external APIs. Additionally, cloud usage procedures will be improved by differentiating procedures according to work importance and changing prior reporting to post-reporting when using the cloud.

Moreover, to secure trust in AI utilization, verification data and test environments capable of various financial sector AI tests will be established. The Korea Credit Information Services will build a testbed for credit evaluation AI, the Korea Financial Telecommunications & Clearings Institute for financial fraud prevention AI, and the Financial Security Institute for financial security AI. AI-based credit evaluation model verification systems and AI security verification systems will also be prepared.

The FSC plans to build the AI Data Library by the second quarter of next year and improve network separation and cloud regulations by January next year, pushing forward related tasks swiftly to activate AI in the financial sector.

In his opening remarks, Vice Chairman Kim emphasized the importance of digital financial innovation through big data and AI utilization. He stated, "Digital financial innovation enhances the convenience of financial consumers by providing customized financial services and strengthens financial intermediation functions by supplying sufficient funds where needed. It also refines financial companies' screening and evaluation to improve risk management functions and expands financial accessibility and inclusion for vulnerable groups such as thin-file borrowers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)