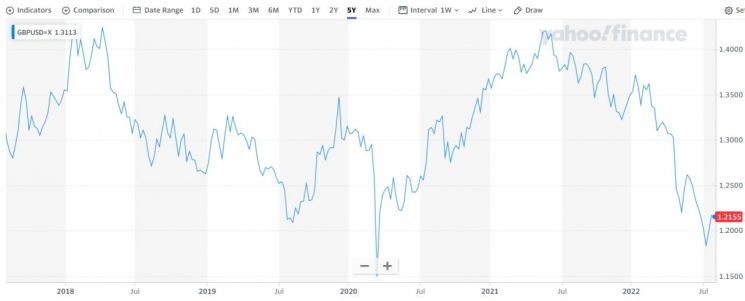

[Asia Economy Reporter Park Byung-hee] Ahead of the Bank of England (BOE), the UK's central bank, making a big step (a 0.5 percentage point increase in the base interest rate) for the first time in 27 years, Swiss investment bank UBS has forecast that the pound sterling will fall to an all-time low.

According to Bloomberg on the 3rd (local time), UBS lowered its forecast for the pound's value in the fourth quarter of this year to $1.15 per pound. This is 8.7% lower than the previous forecast of $1.26 per pound. The pound last fell to $1.15 per pound only once since 1985, which was in March 2020 when the COVID-19 pandemic was declared.

UBS predicted that the UK would face a gas shortage crisis this winter and that a large increase in the BOE's base interest rate would not have a significant positive effect on the pound's value. This is a warning that Russia's reduction in gas supply will push the UK economy into crisis.

On the same day, the UK think tank National Institute of Economic and Social Research (NIESR) diagnosed that the UK economy is already in recession due to the cost-of-living crisis and is heading toward stagflation. NIESR warned that real disposable income will decrease by 2.5% this year and remain 7% lower than pre-COVID-19 levels until 2026. It also predicted that over 5 million households will have no savings capacity until 2024.

The current consumer price inflation rate in the UK is the highest among the Group of Seven (G7) countries. The inflation rate in July recorded 9.4%, breaking the highest level in 40 years for three consecutive months. The BOE expects the inflation rate to exceed 11% by the end of this year.

The BOE is expected to raise the base interest rate by 0.5 percentage points at its monetary policy meeting on the 4th. The last time the BOE decided on a big step was in February 1995, 27 years ago. Although this is a measure to control inflation, concerns are growing that the interest rate hike could plunge the UK economy into a pit.

The BOE has decided to raise the base interest rate five consecutive times since December last year, increasing the rate from 0.1% to 1.25% during this period.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)