Foreign Securities Custody Amount Decreased Compared to Last Year-End

Era of $100 Billion Overseas Investment Ends

Last Month, U.S. Stocks Switched to Net Selling

[Asia Economy Reporter Lee Seon-ae] Not only 'Donghak Ants' but also 'Seohak Ants' are withdrawing from investments. As the global financial market simultaneously experiences a 'cold wave' and volatility increases, investor sentiment has frozen solid. As a result, the amount of foreign currency securities held by domestic investors has shrunk compared to the end of last year. This is due to the decrease in the custody size of U.S. stocks, which account for more than 90% of foreign currency stocks. The 'Overseas Investment $100 Billion Era,' which began in November last year when the custody amount of foreign currency securities surpassed $100 billion for the first time, has also come to an end.

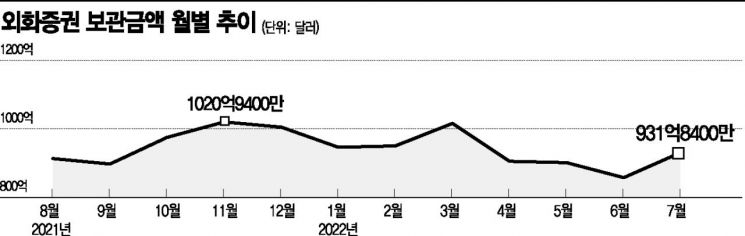

According to the Korea Securities Depository's aggregation of domestic investors' foreign currency securities custody amounts on the 3rd, as of the end of July, the custody amount of foreign currency securities held by domestic investors was $93.184 billion. Compared to $100.59 billion at the end of last year, this is a decrease of $7.46 billion (7.4%). The largest portion, the amount of U.S. stocks held by domestic investors, decreased from $67.778 billion at the end of last year to $62.16 billion at the end of July this year, a drop of $5.672 billion.

The settlement amount (purchase + sale) of foreign currency securities by domestic investors also decreased. The settlement amount through the Depository was $205.85 billion as of the end of July, down $23.66 billion from $229.51 billion in the second half of last year.

This is because Seohak Ants have turned their backs on the U.S. market. Last month, Seohak Ants sold about $36.75 billion worth of U.S. stocks. This is the first monthly net sale since August 2019. Domestic investors had continued a net buying streak until May this year, with monthly amounts ranging from $1.6 billion to $3 billion. However, net buying sharply declined to $407.58 million in June and turned into net selling last month. After the U.S. stock market rebounded, investors realized profits and then withdrew from investment. The top two net sold stocks were Tesla and Apple, which had been favorites among Seohak Ants. In July alone, Seohak Ants sold Tesla ($184.84 million), Apple ($26.65 million), Coupang ($19.85 million), and Amazon ($16.32 million) in that order. Researcher Heo Jae-hwan of Eugene Investment & Securities diagnosed, "Representative growth stocks in the U.S. fell sharply by 20-30% this year, significantly reducing expectations for the global stock market."

If this trend continues, the growth of Seohak Ants' foreign currency securities custody amount is expected to slow down by the end of the year. The custody amount has shown steady growth in recent years: $49.86 billion in the first half of 2020, $72.22 billion in the second half of 2020, $88.92 billion in the first half of 2021, and $100.59 billion in the second half of 2021. In particular, after surpassing $50 billion in May 2020 on a monthly basis, it exceeded $100 billion for the first time in November last year, opening the 'Overseas Investment $100 Billion Era.' It maintained $100 billion in December as well. As the Korean stock market showed a decoupling phenomenon from the U.S. stock market and produced a dull sideways trend, investors flocked to overseas markets, causing the custody balance to surge.

However, this year, the U.S. stock market is also experiencing a downturn and is being neglected by investors. Experts advise that, given the unstable domestic and international environment such as economic recession, a cautious investment strategy is necessary. The Korea Securities Depository warned, "Since rapid changes in the investment environment are underway due to the post-COVID situation, the Russia-Ukraine war, and U.S. interest rate hikes, a cautious approach to foreign currency securities investment is required," adding, "especially when trading and settling foreign currency securities, due to time differences between countries, information asymmetry in overseas markets, and sudden local issues, it may be realistically difficult to respond quickly to sharp stock price drops."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)