Ministry of Land Housing Statistics... 50,000 Sales Recorded

43.5% Decrease Compared to 5-Year Average

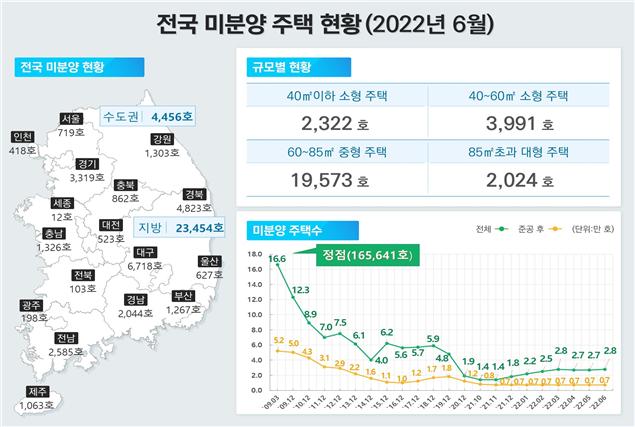

27,910 Unsold Units... Increase from Previous Month

Amid rising interest rates and growing concerns about an economic recession, the housing market is plunging into an unprecedented worst transaction freeze.

According to the Ministry of Land, Infrastructure and Transport on the 29th, the nationwide housing sales volume in June recorded 50,304 cases, the lowest figure since related statistics began in 2006. This represents a 43.4% decrease compared to the same month last year (89,022 cases) and a 20.4% decrease compared to the previous month (63,200 cases). Compared to the 5-year average (89,084 cases), it decreased by 43.5%.

The cumulative housing sales volume for the first half of this year (January to June) also shrank significantly, recording 310,260 cases. This is a 44.5% decrease compared to the same period last year (559,323 cases) and a 35.1% decrease compared to the 5-year average (477,892 cases). The first half transaction volumes over the past five years were approximately 437,000 cases in 2018, 314,000 cases in 2019, 621,000 cases in 2020, and 559,000 cases in 2021, all significantly higher than in 2022.

By type, apartments (28,147 cases) decreased by 24.2% compared to the previous month and by 51.4% compared to the same month last year, showing a larger decline than non-apartments, which decreased by 15% month-on-month and 28.7% year-on-year.

The nationwide monthly rental and lease transaction volume recorded 212,656 cases, a 47.4% decrease compared to the previous month (404,036 cases). This is interpreted as a base effect caused by a surge in May transactions due to the expiration of the grace period for imposing fines on rental contract reporting at the end of May. However, it is a 6% increase compared to the same month last year (200,547 cases), indicating relatively smooth transactions compared to the sharply contracted rental market.

The 'disappearance of Jeonse and its conversion to monthly rent' is also accelerating. Jeonse transactions decreased by 8.4% compared to the same month last year, while monthly rent transactions increased by 25.7%. Compared to the 5-year average, this is a 61.4% increase.

The increase in the proportion of monthly rent is largely attributed to the impact of the two rental laws (right to request contract renewal and rent ceiling system) introduced in July 2020. Since the law's implementation, the number of tenants continuing to live in existing homes by exercising the right to request contract renewal has increased, locking up Jeonse listings. Meanwhile, landlords have tried to raise the deposit by the accumulated increase over four years at once, causing Jeonse prices to rise sharply and intensifying the conversion of Jeonse to monthly rent, according to experts.

As of the end of June, the number of unsold houses nationwide was 27,9105 units, a 2% increase from the previous month. By region, the metropolitan area recorded 4,456 units, a 25.1% (893 units) increase from the previous month (3,563 units), while the provinces recorded 23,454 units, a 1.5% (358 units) decrease from the previous month (23,812 units). The number of 'post-completion unsold' houses, which remain unoccupied even after construction is completed, also increased by 4.4% (300 units) to 7,130 units compared to the previous month.

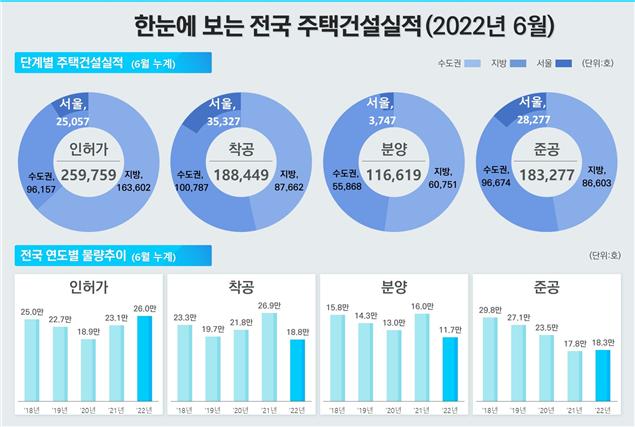

There is a growing gap between the leading indicator of housing permits and the coincident indicator of housing starts in nationwide housing construction performance. The number of housing permits in June was 50,701 units, a 15.2% increase compared to the same month last year (44,018 units).

Housing starts were 39,430 units, a 7.4% decrease compared to the same month last year (42,595 units). Sales (approvals) in June were 20,367 units, a 48.1% decrease compared to the same month last year (39,243 units). The lagging indicator, completions (move-ins), was 30,099 units, an 8.3% decrease compared to the same month last year (33,819 units).

Meanwhile, as the Korea-US base interest rates inverted for the first time in two and a half years, increasing uncertainty in the real estate market, Seoul's weekly apartment prices fell at the largest rate in two years and three months.

According to the Korea Real Estate Board's 'Weekly Apartment Price Trends Nationwide for the Fourth Week of July' released on the 28th, Seoul's sales prices fell by 0.07%, expanding the decline from last week's -0.05%. This is the first time in about two years and three months since the fourth week of April 2020 that Seoul's weekly apartment sales prices have fallen by 0.07%.

The Real Estate Board analyzed, "Although there were some movements to withdraw listings due to the government's announcement of easing the comprehensive real estate tax burden, the downward pressure on prices caused by concerns over further interest rate hikes is significant," adding, "The prolonged buyer wait-and-see stance has expanded the decline in Seoul."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)